Polar Capital Holdings Leads Three Undervalued Small Caps With Insider Actions In The United Kingdom

As the United Kingdom braces for a pivotal general election, market sentiment remains cautiously optimistic, evidenced by a modest uptick in the FTSE 100. In this climate of political and economic transition, identifying undervalued small-cap stocks with potential for growth becomes particularly compelling.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Stelrad Group | 9.2x | 0.5x | 45.06% | ★★★★★★ |

Ultimate Products | 10.1x | 0.8x | 14.50% | ★★★★★☆ |

Norcros | 7.7x | 0.5x | 43.98% | ★★★★★☆ |

THG | NA | 0.4x | 42.82% | ★★★★★☆ |

Bytes Technology Group | 28.5x | 6.4x | 16.65% | ★★★★☆☆ |

CVS Group | 21.2x | 1.2x | 41.34% | ★★★★☆☆ |

Savills | 37.1x | 0.7x | 27.85% | ★★★☆☆☆ |

Robert Walters | 20.3x | 0.3x | 39.01% | ★★★☆☆☆ |

J D Wetherspoon | 21.9x | 0.5x | -60.01% | ★★★☆☆☆ |

Hochschild Mining | NA | 1.8x | 37.99% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

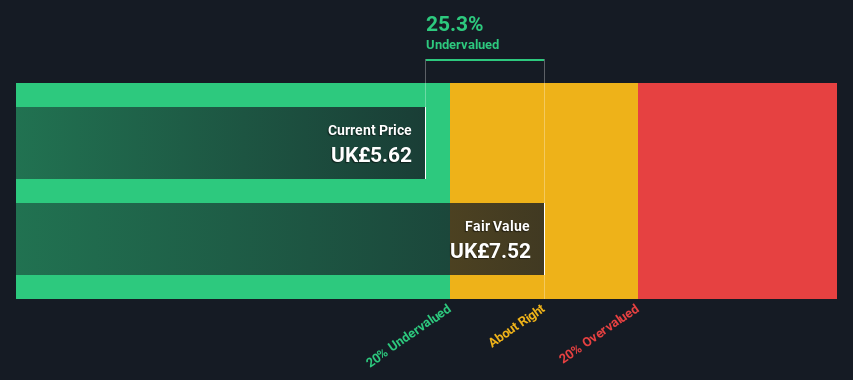

Polar Capital Holdings

Simply Wall St Value Rating: ★★★★★☆

Overview: Polar Capital Holdings is a specialist, investment-led asset manager with a market capitalization of approximately £0.53 billion.

Operations: The Investment Management Business generates revenue primarily through management fees, evidenced by a consistent gross profit margin of approximately 88.53% over recent periods. This segment has shown a net income margin increase from 19.87% to 20.65% in the latest recorded period, reflecting efficient operational management despite fluctuating operating expenses and non-operating costs.

PE: 14.0x

Polar Capital Holdings, reflecting a solid financial trajectory, reported an increase in annual revenues to £197.59 million and net income to £40.79 million, up from the previous year. Insider confidence is evident as they maintained their dividend at 46 pence per share, underscoring stability in shareholder returns despite no recent insider purchases. With earnings per share also rising from last year and a forecasted annual earnings growth of 11.89%, the firm exemplifies potential amidst its peers in the investment sector.

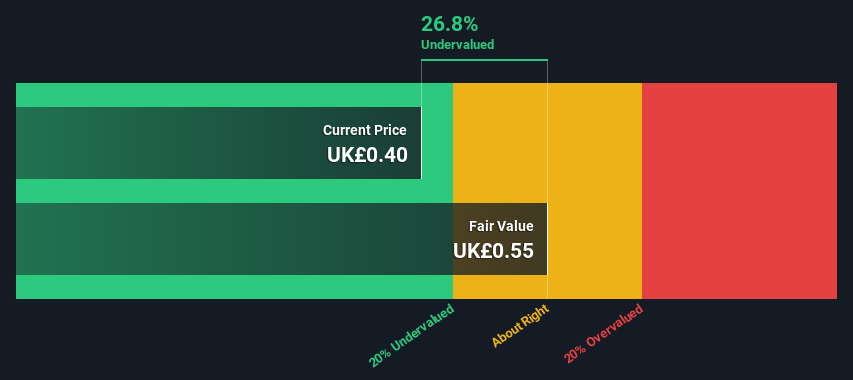

Assura

Simply Wall St Value Rating: ★★★★☆☆

Overview: Assura is a healthcare real estate investment trust (REIT) that specializes in the ownership, management, and development of primary care facilities across the UK, with a market capitalization of approximately £1.76 billion.

Operations: The core segment generated £157.80 million, with a notable gross profit margin of 90.81% as of the latest reporting period. This financial performance is underpinned by a cost of goods sold at £14.50 million and operational expenses amounting to £14.00 million, reflecting the company's streamlined operations despite significant non-operating expenses.

PE: -42.9x

Recently, Assura has demonstrated a commitment to growth and financial prudence, notably through a strategic £250 million joint venture aimed at enhancing NHS infrastructure. This move not only diversifies their investment portfolio but also strengthens their balance sheet by recycling £85 million into broader healthcare opportunities. Despite challenges with debt coverage by operating cash flow, insider confidence is evident as they recently purchased shares, signaling belief in the company's prospects. Additionally, Assura's earnings have shown improvement with a significant reduction in net loss year-over-year and an optimistic forecast of 40.26% annual earnings growth.

Unlock comprehensive insights into our analysis of Assura stock in this valuation report.

Evaluate Assura's historical performance by accessing our past performance report.

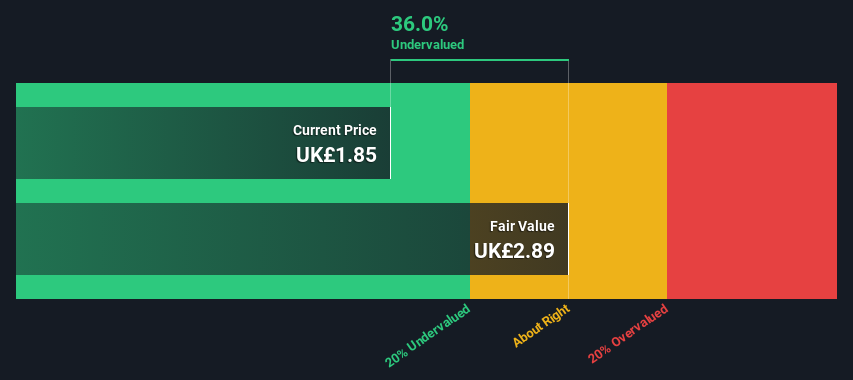

Hochschild Mining

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hochschild Mining is a precious metals company focused on the exploration, mining, and processing of silver and gold, primarily operating through its key assets in Inmaculada, San Jose, and Pallancata.

Operations: San Jose, Inmaculada, and Pallancata are the primary revenue contributors for the entity, generating $242.46 million, $396.64 million, and $54.05 million respectively. The company's gross profit margin has fluctuated over recent periods, with a notable value of 26.46% as of the latest reporting date.

PE: -22.2x

Recently, Eduardo Navarro, CEO of Hochschild Mining, demonstrated insider confidence by acquiring 148,000 shares for £235,320. This move underscores a strong belief in the firm's prospects amid its production growth with a notable increase in gold output and stable silver production as reported in the first quarter of 2024. With earnings expected to climb significantly and the company's strategic focus on enhancing its mining outputs for 2024, these elements collectively suggest that Hochschild Mining may be positioned favorably within the undervalued segments of UK-based companies.

Make It Happen

Unlock our comprehensive list of 36 Undervalued Small Caps With Insider Buying by clicking here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:POLR LSE:AGR and LSE:HOC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance