Reasons to Add Leonardo DRS (DRS) Stock to Your Portfolio Now

Leonardo DRS, Inc. DRS, with a strong backlog and rising earnings estimates, offers a great investment opportunity in the Zacks aerospace sector.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) company a strong investment pick at the moment.

Growth Projections & Surprise History

The Zacks Consensus Estimate for DRS’ 2024 earnings per share (EPS) has increased 1.3% to 81 cents in the past 60 days. The Zacks Consensus Estimate for Leonardo DRS’ total revenues for 2024 stands at $3.02 billion, which indicates year-over-year growth of 6.8%.

The company’s (three to five years) earnings growth is pegged at 16.4%. It delivered an average earnings surprise of 25.07% in the last four quarters.

Debt Position

Leonardo DRS’ times interest earned ratio (TIE) at the end of the first quarter of 2024 was 7.5. The strong TIE ratio indicates that the company will be able to meet its interest payment obligations in the near term without any problems.

Currently, Leonardo DRS’ total debt to capital is 14.08%, much better than the industry’s average of 53.52%.

Liquidity

DRS’ current ratio at the end of the first quarter of 2024 was 1.96, higher than the industry’s average of 1.55. The ratio, being greater than one, indicates Leonardo DRS’ ability to meet its future short-term liabilities without difficulties.

Rising Backlog

DRS’ total backlog as of Mar 31, 2024 increased by $3.57 billion to $7.85 billion from the year-ago quarter’s reported figure of $4.27 billion. The acceptance of a multi-boat contract to assist electric propulsion activities on the Columbia Class submarine program with the U.S. Navy was the primary driver of the backlog rise.

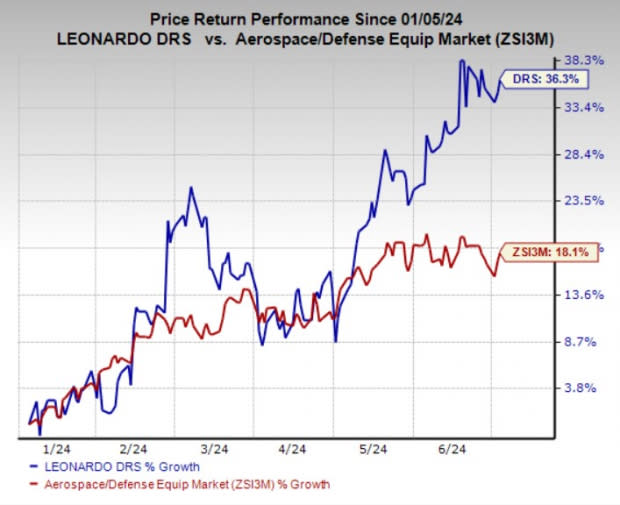

Price Performance

In the past six months, DRS’ shares have rallied 36.3% compared with the industry’s growth of 18.1%.

Image Source: Zacks Investment Research

Other Stocks to Consider

A few other top-ranked stocks from the same sector are Leidos Holdings, Inc. LDOS, HEICO Corporation HEI and AAR Corp. AIR, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Leidos’ long-term (three to five years) earnings growth rate is pegged at 11.1%. The Zacks Consensus Estimate for LDOS’ 2024 sales is pegged at $16.12 billion, which indicates an improvement of 4.4% from the 2023 reported sales figure.

HEICO’s long-term earnings growth rate is pegged at 19.1%. The Zacks Consensus Estimate for HEI’s fiscal 2024 sales is pegged at $3.87 billion, which implies an improvement of 30.3% from the fiscal 2023 reported sales figure.

AAR delivered an average earnings surprise of 3.96% in the last four quarters. The Zacks Consensus Estimate for AIR’s fiscal 2024 revenues is pegged at $2.32 billion, which calls for a rise of 16.7% from the fiscal 2023 expected sales figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AAR Corp. (AIR) : Free Stock Analysis Report

Heico Corporation (HEI) : Free Stock Analysis Report

Leidos Holdings, Inc. (LDOS) : Free Stock Analysis Report

Leonardo DRS, Inc. (DRS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance