Reasons to Retain Fresenius Medical (FMS) in Your Portfolio Now

Fresenius Medical Care AG & Co. KGaA FMS is well-poised for growth on the back of a broad range of dialysis products and services, and a solid global foothold. However, stiff competition remains a concern.

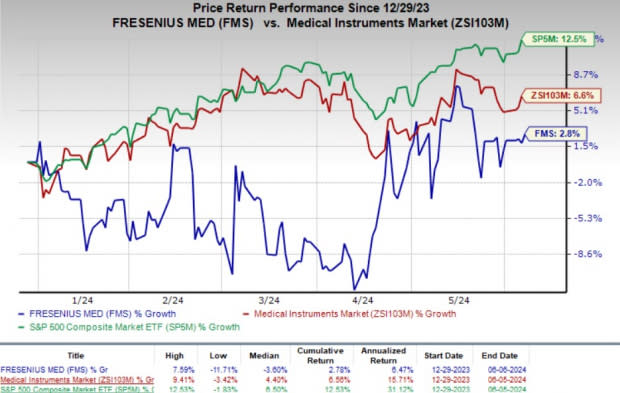

Shares of this Zacks Rank #3 (Hold) company have risen 2.8% year to date compared with the industry’s growth of 6.6%. The S&P 500 Index has increased 12.5% in the same time frame.

The company, with a market capitalization of $12.45 billion, is one of the largest integrated providers of products and services for individuals undergoing dialysis following chronic kidney failure. Its bottom line is anticipated to improve 12.5% over the next five years. FMS’ earnings beat estimates in three of the trailing four quarters and missed the same once, delivering an average surprise of 21.53%.

Image Source: Zacks Investment Research

Key Catalysts

Fresenius Medical provides a wide range of dialysis products in its dialysis and third-party clinics. These include modular machine components, dialyzers, bloodline systems, HD (hemodialysis) solutions, concentrates and water treatment systems.

The company offers an extensive array of Hemodyalisis, Peritoneal dialysis and Acute Dialysis products. It is focused on further expanding its home dialysis offerings in order to boost the quality of life for patients and increase their choice of available treatments.

In March, FMS introduced an innovative Augmented Reality (AR) program, Ready4 multiFiltratePRO AR, which will likely revolutionize training for medical staff in Intensive Care Units (ICU). This groundbreaking development combines digital learning elements with hands-on training on the Fresenius Medical Continuous Kidney Replacement Therapy system, thereby enhancing the skills of ICU nursing staff.

In February, the company announced the receipt of FDA 510(k) clearance for its 5008X Hemodialysis System. The new system is aimed at providing an improved standard of care in dialysis therapy to patients suffering from kidney diseases in the United States.

Fresenius Medical has a solid market hold in the regions of North America, Europe (EMEA), the Asia Pacific and Latin America. To strengthen its market position, the company is resorting to various approaches like enhancing its organic growth and making strategic and suitable acquisitions. FMS also aims to align its business activities through public-private partnerships in the dialysis business. This way, it can tap into new markets in the coming quarters.

The company is also realigning its portfolio to concentrate on businesses and markets with an optimal strategic fit, substantial scale and potential for sustainable growth. It has also successfully executed several divestments in 2023, as part of its ongoing Portfolio Optimization Program. It did so by divesting its non-core and dilutive assets. In March, FMS announced the sale of its dialysis clinic networks in Brazil, Colombia, Chile and Ecuador to DaVita.

Fresenius Medical exited the first quarter on a strong note, with its results reflecting strong organic growth on the back of value-based care business growth and reimbursement rate increases in the United States. Continued improvement in these two key factors should be beneficial for the company in 2024. Overall price improvements also supported growth in the Care Enablement segment in the first quarter. Meanwhile, FMS’ newly implemented operating model continued to lead to operational improvements during the same period.

The company expects its 2024 revenues to grow at a low-to-mid single-digit percentage rate. The operating income is estimated to grow at a mid to high-teens percentage rate.

What’s Hurting the Stock?

Fresenius Medical has numerous competitors in the fields of healthcare services and dialysis products. Intense competition in the niche markets is likely to hamper the company’s sales opportunities, which, in turn, may lead to a loss of market share.

Last year, positive data from a late-stage study evaluating Novo Nordisk’s new diabetes drug, Ozempic, raised concerns about a potential rise in competitionfor Fresenius Medical. Clinical data suggests that the adoption of Ozempic may have an adverse impact on the dialysis of patients — a major source of FMS’ revenues — going forward. A lower volume of dialysis, led by a potential delay in chronic kidney disease (due to the use of Ozempic), can be detrimental to Fresenius Medical’s top line.

The company’s U.S. revenues continued to be hurt by the FX impact during the quarter. Moreover, the bottom line was hurt by inflationary cost increases in energy, material and personnel. However, FMS’ cost-saving initiatives have helped cushion the decline in operating margin. Planned divestitures, as part of the company’s transformational plan, are likely to lead to a loss of revenues going forward.

Estimate Trend

The Zacks Consensus Estimate for 2024 revenues is pegged at $21.17 billion, indicating growth of 0.6% from the previous year’s reported number. The consensus mark for earnings is pinned at $1.51 per share, implying growth of 10.1% from the year-ago level.

Fresenius Medical Care AG & Co. KGaA Price

Fresenius Medical Care AG & Co. KGaA price | Fresenius Medical Care AG & Co. KGaA Quote

Stocks to Consider

Some better-ranked stocks in the broader medical space that have announced quarterly results are Align Technology, Inc. ALGN, Ecolab ECL and Boston Scientific Corporation BSX.

Align Technology, currently carrying a Zacks Rank of 2 (Buy), reported first-quarter 2024 adjusted earnings per share (EPS) of $2.14, which beat the Zacks Consensus Estimate by 8.1%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Revenues of $997.4 million outpaced the consensus mark by 2.6%. Align Technology’s shares have lost 9.2% year to date against the industry’s 1.4% growth.

Align Technology has a long-term growth rate of 6.9%. ALGN’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, the average surprise being 5.92%.

Ecolab, carrying a Zacks Rank of 2 at present, reported first-quarter 2024 adjusted EPS of $1.34, which beat the Zacks Consensus Estimate by 0.75%. Ecolab’s shares have risen 18.7% year to date against the industry’s 20.1% decline.

Ecolab has a long-term growth rate of 14.3%. ECL’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 1.30%.

Boston Scientific reported first-quarter 2024 adjusted EPS of 56 cents, which beat the Zacks Consensus Estimate by 9.8%. Revenues of $3.86 billion surpassed the Zacks Consensus Estimate by 4.9%. The company currently carries a Zacks Rank #2. Boston Scientific’s shares have risen 31.4% year to date compared with the industry’s 3% growth.

Boston Scientific has a long-term growth rate of 12.5%. BSX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 1.30%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Fresenius Medical Care AG & Co. KGaA (FMS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance