Roblox (NYSE:RBLX) Misses Q1 Revenue Estimates, Stock Drops 29.3%

Gaming metaverse operator Roblox (NYSE:RBLX) missed analysts' expectations in Q1 CY2024, with revenue up 22.3% year on year to $801.3 million. Next quarter's revenue guidance of $867.5 million also underwhelmed, coming in 7.6% below analysts' estimates. It made a GAAP loss of $0.43 per share, improving from its loss of $0.44 per share in the same quarter last year.

Is now the time to buy Roblox? Find out in our full research report.

Roblox (RBLX) Q1 CY2024 Highlights:

Revenue: $801.3 million vs analyst estimates of $806.2 million (slight miss)

EPS: -$0.43 vs analyst estimates of -$0.53 (19.1% beat)

Bookings Guidance for Q2 CY2024 is $885 million at the midpoint, below analyst estimates of $938.6 million

Bookings Guidance for the full-year 2024 is $4,050 million at the midpoint, below analyst estimates of $4,225 million

Gross Margin (GAAP): 24.1%, up from 16.8% in the same quarter last year

Free Cash Flow of $191.1 million, up 145% from the previous quarter

Daily Active Users: 77.7 million

Market Capitalization: $24.97 billion

“Our teams have been hard at work identifying opportunities to drive DAUs, Hours, and bookings growth rates back to 20% year-over-year. We began experimenting with changes in our AI-driven discovery algorithm and the positioning of various content types on the Homepage. We reintroduced platform-wide events like The Hunt: First Edition. And, we continued to improve the quality and performance of our app and experiences. Based on results since the middle of April, we believe that these steps are yielding positive results,” said David Baszucki, founder and CEO of Roblox.

Best known for its wide assortment of user-generated content, Roblox (NYSE:RBLX) is an online gaming platform and game creation system.

Video Gaming

Since videogames were invented in the 1970s, they have gradually taken more share of entertainment time. Ubiquitous mobile devices have powered a surge in “snackable” games that can be played on the go. Over time, games have developed more social engagement features where friends can play games together over the internet. The business models of games publishers have become less volatile due to digitization of distribution, in game monetization, and like Hollywood, an increasing dependence on surefire hit franchises. Covid driven lockdowns accelerated adoption and usage of videogames – a trend that has not slowed.

Sales Growth

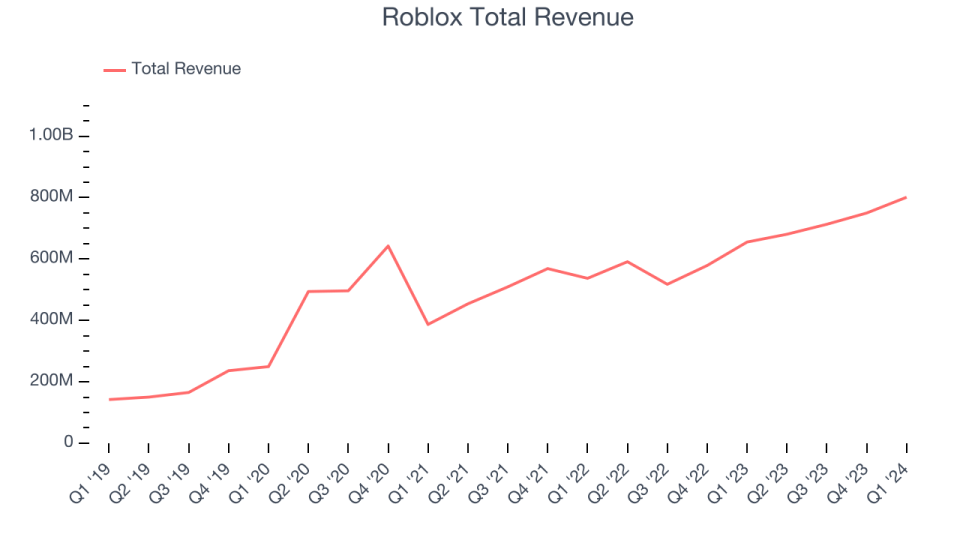

Roblox's revenue growth over the last three years has been mediocre, averaging 15.2% annually. This quarter, Roblox reported decent 22.3% year-on-year revenue growth, falling short of analysts' expectations.

Guidance for the next quarter indicates Roblox is expecting revenue to grow 27.4% year on year to $867.5 million, improving from the 15.1% year-on-year increase it recorded in the comparable quarter last year. Ahead of the earnings results, analysts were projecting sales to grow 49.5% over the next 12 months.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Key Takeaways from Roblox's Q1 Results

We struggled to find many strong positives in these results. Its full-year bookings guidance of 15% year-on-year growth missed analysts' expectations, and investors are punishing the stock because management said it would grow at 20%+ annually for the next few years at its November 2023 Investor Day. On top of that, the company announced it would start calculating adjusted EBITDA differently, raising some questions. Overall, the results could have been better. The company is down 29.3% on the results and currently trades at $27.6 per share.

Roblox may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance