Rush Street Interactive (NYSE:RSI): Strongest Q1 Results from the Gaming Solutions Group

Let's dig into the relative performance of Rush Street Interactive (NYSE:RSI) and its peers as we unravel the now-completed Q1 gaming solutions earnings season.

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

The 8 gaming solutions stocks we track reported a decent Q1; on average, revenues beat analyst consensus estimates by 3.3%. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and gaming solutions stocks have held roughly steady amidst all this, with share prices up 2.6% on average since the previous earnings results.

Best Q1: Rush Street Interactive (NYSE:RSI)

Specializing in online casino gaming and sports betting, Rush Street Interactive (NYSE:RSI) is an operator of digital gaming platforms.

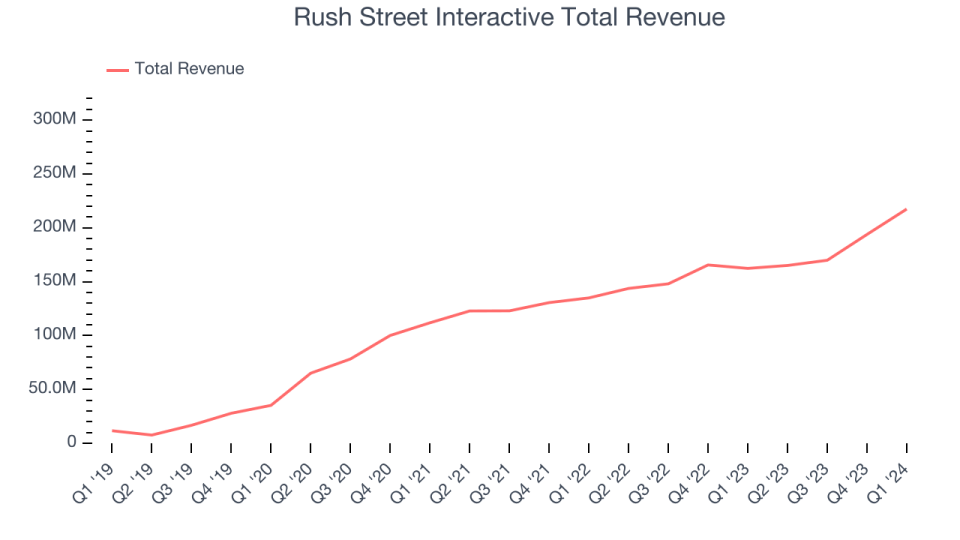

Rush Street Interactive reported revenues of $217.4 million, up 33.9% year on year, topping analysts' expectations by 9.8%. It was an incredible quarter for the company, with an impressive beat of analysts' earnings estimates and full-year revenue guidance exceeding analysts' expectations.

Richard Schwartz, Chief Executive Officer of RSI, said, “We are extremely pleased with our record first quarter results achieving company quarterly record Revenues and Adjusted EBITDA of $217 million and $17 million, respectively. This was accomplished by growing both our iCasino and Online Sports businesses by over 35% year-over-year, in large part by acquiring new players more efficiently while simultaneously increasing the number and value of our users. Our team is proud to have achieved these results, which stemmed from our long-standing, unwavering commitment to prioritize the quality of our product and customer experience.”

Rush Street Interactive scored the biggest analyst estimates beat and highest full-year guidance raise of the whole group. The stock is up 42.7% since the results and currently trades at $9.13.

Is now the time to buy Rush Street Interactive? Access our full analysis of the earnings results here, it's free.

Light & Wonder (NASDAQ:LNW)

With names as crazy as Ultimate Fire Link Power 4 for its products, Light & Wonder (NASDAQ:LNW) is a gaming company supplying the casino industry with slot machines, table games, and digital games.

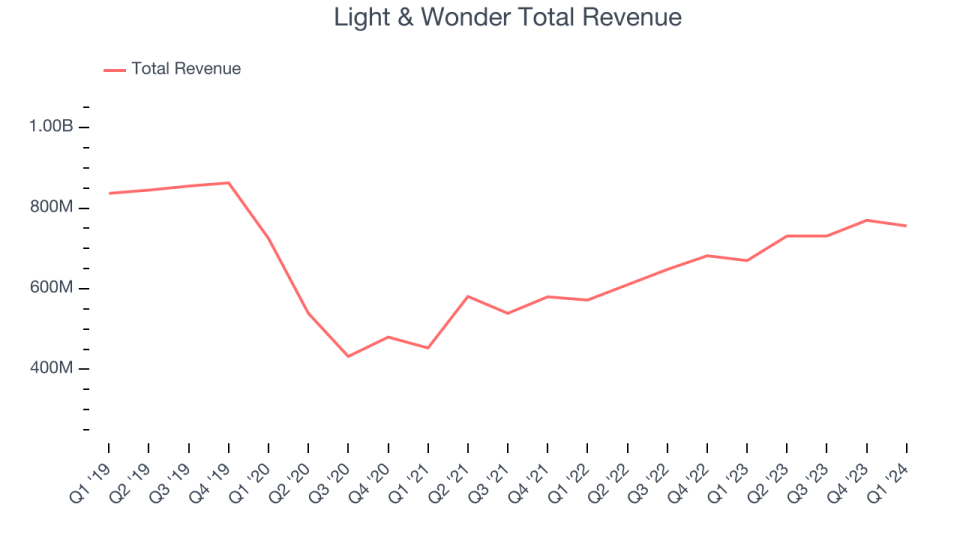

Light & Wonder reported revenues of $756 million, up 12.8% year on year, outperforming analysts' expectations by 5.4%. It was a very strong quarter for the company, with a decent beat of analysts' earnings estimates and a narrow beat of analysts' Gaming revenue estimates.

The stock is up 7.9% since the results and currently trades at $104.14.

Is now the time to buy Light & Wonder? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Inspired (NASDAQ:INSE)

Specializing in digital casino gaming, Inspired (NASDAQ:INSE) is a provider of gaming hardware, virtual sports platforms, and server-based gaming systems.

Inspired reported revenues of $63.1 million, down 2.8% year on year, falling short of analysts' expectations by 2.8%. It was a weak quarter for the company, with a miss of analysts' earnings estimates and a miss of analysts' Leisure revenue estimates.

Inspired had the weakest performance against analyst estimates in the group. The stock is down 4.1% since the results and currently trades at $9.06.

Read our full analysis of Inspired's results here.

PlayStudios (NASDAQ:MYPS)

Founded by a team of former gaming industry executives, PlayStudios (NASDAQ:MYPS) offers free-to-play digital casino games.

PlayStudios reported revenues of $77.83 million, down 2.9% year on year, surpassing analysts' expectations by 2.5%. It was a mixed quarter for the company, with a miss of analysts' earnings estimates.

PlayStudios had the weakest full-year guidance update among its peers. The company reported 14.75 million monthly active users, up 12.8% year on year. The stock is down 13.7% since the results and currently trades at $2.01.

Read our full, actionable report on PlayStudios here, it's free.

DraftKings (NASDAQ:DKNG)

Getting its start in daily fantasy sports, DraftKings (NASDAQ:DKNG) is a digital sports entertainment and gaming company.

DraftKings reported revenues of $1.17 billion, up 52.7% year on year, surpassing analysts' expectations by 4.6%. It was a decent quarter for the company, with full-year revenue guidance exceeding analysts' expectations but a miss of analysts' earnings estimates.

DraftKings pulled off the fastest revenue growth among its peers. The stock is down 13% since the results and currently trades at $37.41.

Read our full, actionable report on DraftKings here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance