SEHK Growth Companies With As Much As 33% Insider Ownership

As global markets navigate through varying economic signals, the Hong Kong market has shown resilience with the Hang Seng Index posting gains amidst mixed data. In such a market environment, growth companies with high insider ownership in Hong Kong can offer unique investment appeal due to the alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

Fenbi (SEHK:2469) | 32.5% | 43% |

Meituan (SEHK:3690) | 11.4% | 31.5% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 79.3% |

Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

Tian Tu Capital (SEHK:1973) | 33.9% | 70.5% |

DPC Dash (SEHK:1405) | 38.2% | 89.7% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 76.5% |

Beijing Airdoc Technology (SEHK:2251) | 28.2% | 83.9% |

Underneath we present a selection of stocks filtered out by our screen.

Kuaishou Technology

Simply Wall St Growth Rating: ★★★★★☆

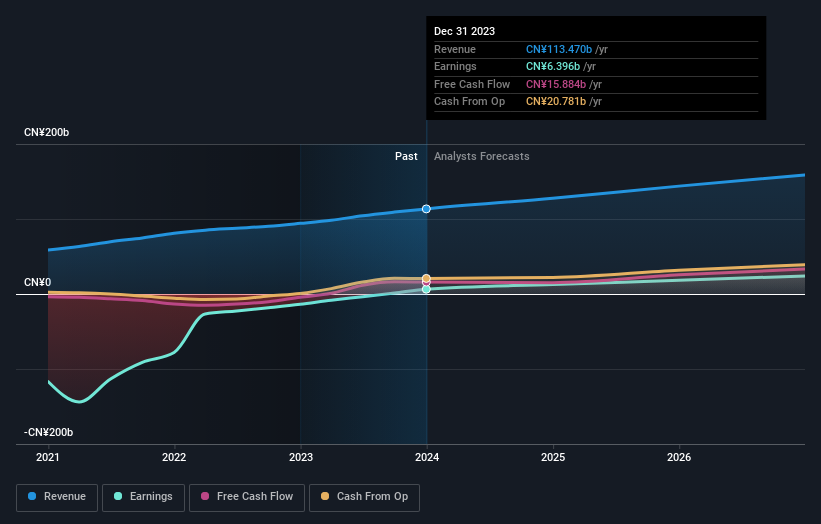

Overview: Kuaishou Technology operates as an investment holding company in the People's Republic of China, offering services such as live streaming and online marketing, with a market capitalization of approximately HK$213.84 billion.

Operations: The company generates its revenue primarily from domestic operations, which accounted for CN¥114.72 billion, and a smaller portion from overseas activities totaling CN¥2.94 billion.

Insider Ownership: 19.3%

Kuaishou Technology, a growth-oriented firm with high insider ownership in Hong Kong, has recently shown promising financial improvements. In Q1 2024, the company reported significant earnings of CNY 4.12 billion, a sharp reversal from the previous year's loss. Analysts expect both revenue and earnings to grow robustly over the next few years, outpacing market averages significantly. Additionally, Kuaishou has demonstrated confidence in its prospects through a substantial share repurchase program valued at HK$16 billion. These strategic moves underscore its commitment to enhancing shareholder value amidst operational expansions and market competition.

Tian Tu Capital

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tian Tu Capital Co., Ltd. is a private equity and venture capital firm focusing on investments in small and medium-sized companies at various stages including early-stage, mature, and Pre-IPO, with a market cap of approximately HK$2.08 billion.

Operations: The company's revenue from asset management is approximately CN¥-0.74 billion.

Insider Ownership: 33.9%

Tian Tu Capital, despite experiencing a highly volatile share price, is positioned for significant growth with projected revenue increases of 62.7% per year and earnings growth of 70.47% annually. Trading at 75.2% below its estimated fair value, it faces challenges with less than US$1m in revenue and a recent shift in executive roles impacting stability. However, the forecasted profitability within three years and above-market profit growth signal potential upside amidst these transitions.

Dive into the specifics of Tian Tu Capital here with our thorough growth forecast report.

Our valuation report here indicates Tian Tu Capital may be undervalued.

MGM China Holdings

Simply Wall St Growth Rating: ★★★★☆☆

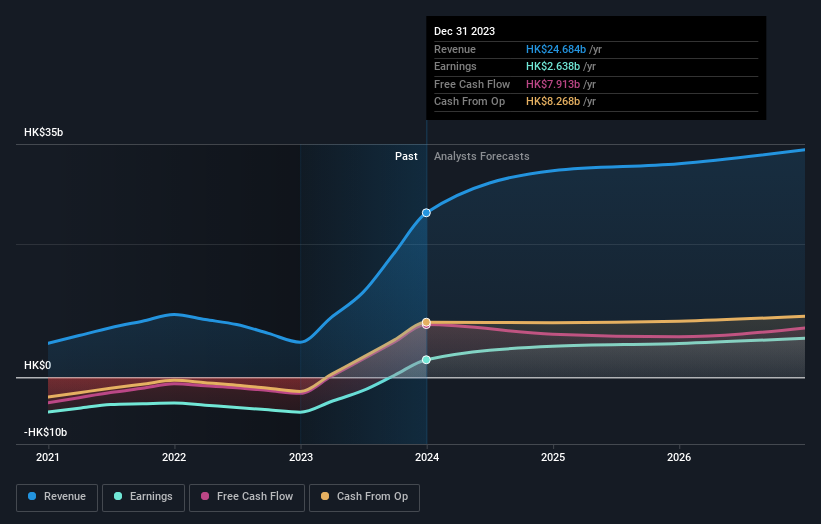

Overview: MGM China Holdings Limited is an investment holding company that develops, owns, and operates gaming and lodging resorts in the Greater China region, with a market capitalization of approximately HK$49.55 billion.

Operations: The company generates revenue primarily from its casinos and resorts segment, totaling HK$24.68 billion.

Insider Ownership: 10%

MGM China Holdings, while not leading in high insider ownership growth companies in Hong Kong, has taken steps indicating potential for value enhancement. Recently, it initiated a substantial share repurchase and secured significant debt financing to optimize its capital structure. Analysts project an 18% annual earnings growth and a very high return on equity forecast within three years. However, concerns exist as its interest payments are not well covered by earnings, reflecting some financial strain.

Seize The Opportunity

Explore the 52 names from our Fast Growing SEHK Companies With High Insider Ownership screener here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1024 SEHK:1973 and SEHK:2282.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance