How we're all shopping at Aldi and Lidl more and more

Aldi and Lidl are Britain’s fastest-growing supermarkets as shoppers’ love affair with discount chains shows no sign of cooling.

While Tesco and Morrisons were neck and neck as the fastest growing of the big four – both clocking in sales growth of 2.7%, the cut-price challenge of their smaller rivals continues to eat into the dominance of the traditional favourite grocers.

Sales growth at Aldi and Lidl once again far outstripped anything the long established chains could produce.

According to retail analysts Kantar Worldpanel, Aldi saw sales grow by 13.9% while Lidl posted a 13.3% rise, dwarfing the growth performance of their bigger rivals.

Kantar said: “With both discounters working hard to expand their store portfolio, Aldi and Lidl also benefited from increased shopper numbers as well as growth in basket size.”

Kantar figures show that, in January 2000, Aldi and Lidl had just a 1.2% share of the UK’s supermarket sector.

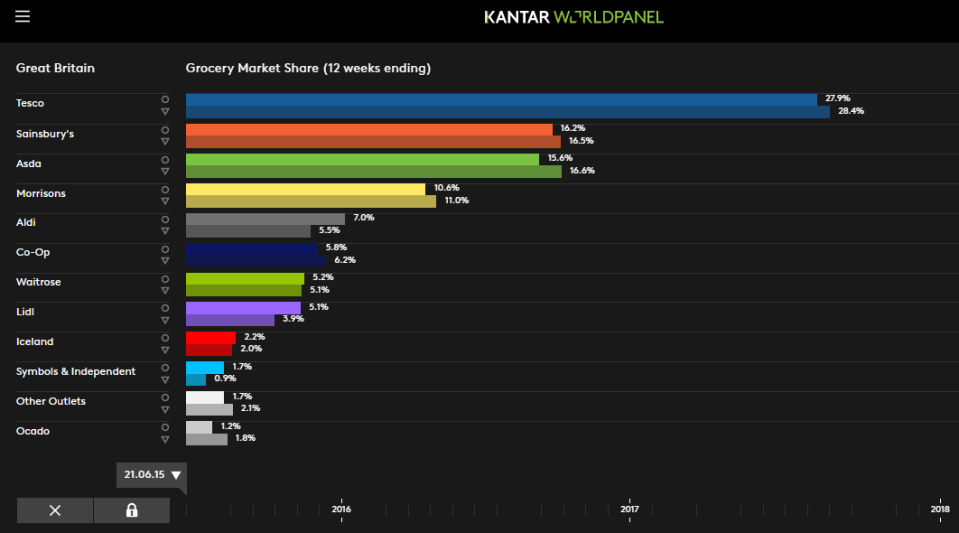

By January 2010, that had risen to 2% and 2.3%, respectively – and the most recent figures for the end of February this year, that share had soared to 7% for Aldi and 5.1% for Lidl.

MORE: Boots joins major UK supermarkets in ban on energy drinks sales to under 16s

The continued rise in market share demonstrates the very real challenge the likes of Tesco – still the UK’s favourite supermarket – Sainsbury’s, Asda and Morrisons face in maintaining their appeal among savvy shoppers.

The ‘Big 4’ still retain a 70% combined share of the UK grocery market but that is being squeezed.

Fraser McKevitt, head of retail and consumer insight at Kantar Worldpanel, said, overall, the grocery market, was in good health.

He added: “Tesco continues to perform well – more positive news following approval of its Booker acquisition last week.

“Despite a slight fall in market share of 0.1 percentage points, Tesco experienced particularly strong growth from its Extra superstores.

“The varied selection of groceries on offer at these larger stores has encouraged customers to return to fuller trolley shops, with average baskets worth £31.09 – currently, the highest value in the bricks and mortar market.”

MORE: Supermarkets admit to milk and bread shortages as ‘Beast from the East’ leaves shelves bare

For Sainsbury’s, he indicated that its stubborn position on not discounting could be chipping away at its competitiveness.

“Only 34.5% of sales at Sainsbury’s were on promotion during the past 12 weeks, in stark comparison to 41.9% for the rest of the big four,” McKevitt noted.

Yahoo Finance

Yahoo Finance