Smith & Wesson (NASDAQ:SWBI) Beats Q1 Sales Targets, Stock Soars

American firearms manufacturer Smith & Wesson (NASDAQ:SWBI) reported Q1 CY2024 results exceeding Wall Street analysts' expectations , with revenue up 9.9% year on year to $159.1 million. It made a GAAP profit of $0.57 per share, improving from its profit of $0.28 per share in the same quarter last year.

Is now the time to buy Smith & Wesson? Find out in our full research report.

Smith & Wesson (SWBI) Q1 CY2024 Highlights:

Revenue: $159.1 million vs analyst estimates of $156.8 million (1.5% beat)

Adjusted EBITDA: $36.0 million vs analyst estimates of $32.7 million (10.1% beat)

EPS: $0.57 vs analyst estimates of $0.34 (67.6% beat)

Gross Margin (GAAP): 35.5%, down from 36.5% in the same quarter last year

Free Cash Flow of $38.05 million, up from $7.16 million in the previous quarter

Market Capitalization: $743.7 million

Mark Smith, President and Chief Executive Officer, commented, "We delivered yet another strong quarter to close out fiscal 2024. I am very proud of the team's continuing discipline and execution against our strategic initiatives of strong brand messaging and marketing, best-in-class innovation, operational excellence, and business process efficiencies. Our results in fiscal 2024 again demonstrate that our relentless focus on these long-term strategies consistently reinforces our position as a market leader and delivers solid stockholder returns. While the summer months will be highly competitive as we navigate the traditionally slower season for firearms, we continue to expect healthy demand overall for firearms in fiscal 2025, and Smith & Wesson is well positioned to deliver another solid year of growth. With our deep pipeline of new products, leading brand, new state of the art facility now fully operational, strong balance sheet, and, most importantly, world-class dedicated employees, we are excited to continue delivering value for our stockholders."

With a history dating back to 1852, Smith & Wesson (NASDAQ:SWBI) is a firearms manufacturer known for its handguns and rifles.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Sales Growth

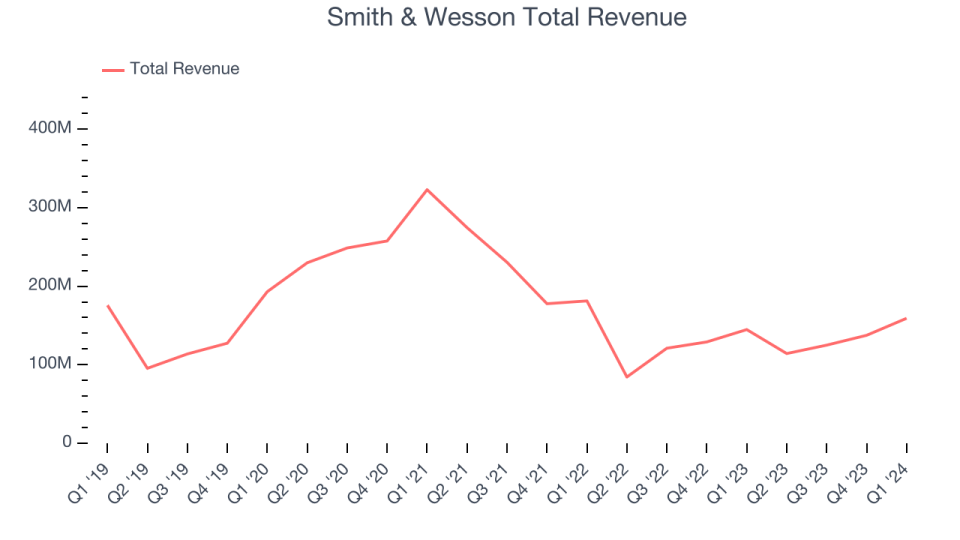

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one tends to sustain growth for years. Smith & Wesson had weak demand over the last five years as its sales fell by 3.3% annually, a rough starting point in our assessment of quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. Smith & Wesson's recent history shows its demand has stayed suppressed as its revenue has declined by 21.3% annually over the last two years.

This quarter, Smith & Wesson reported solid year-on-year revenue growth of 9.9%, and its $159.1 million of revenue outperformed Wall Street's estimates by 1.5%. Looking ahead, Wall Street expects sales to grow 7.9% over the next 12 months, a deceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

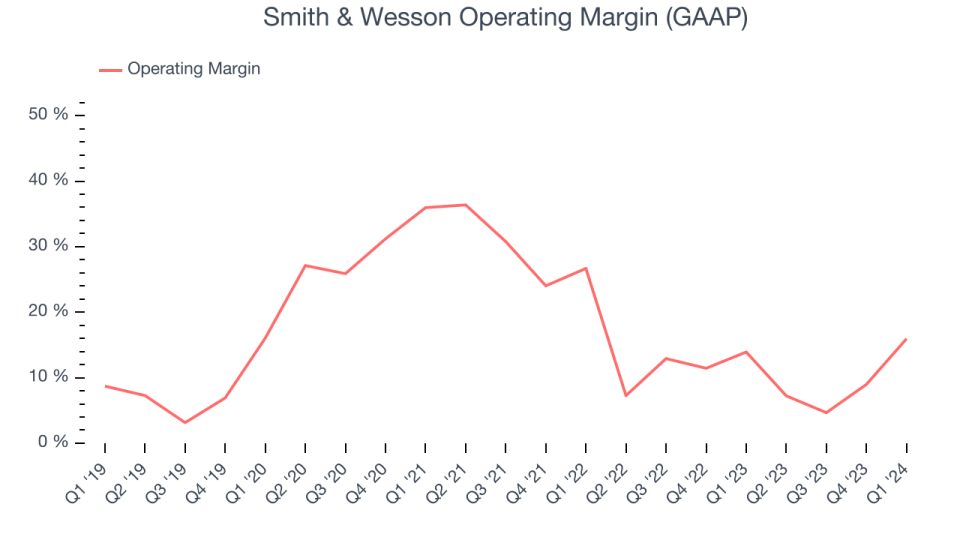

Smith & Wesson has done a decent job managing its expenses over the last two years. The company has produced an average operating margin of 10.7%, higher than the broader consumer discretionary sector.

In Q1, Smith & Wesson generated an operating profit margin of 15.9%, up 2 percentage points year on year. Looking ahead, Wall Street expects Smith & Wesson to become more profitable. Analysts are expecting the company’s trailing 12 month operating margin of 9.7% to rise to 12.6% in the coming year.

Key Takeaways from Smith & Wesson's Q1 Results

We were impressed by how significantly Smith & Wesson blew past analysts' EPS expectations this quarter. We were also excited its operating margin outperformed Wall Street's estimates. Zooming out, we think this was an impressive quarter that should delight shareholders. The stock is up 7.3% after reporting and currently trades at $17.60 per share.

Smith & Wesson may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance