SoftBank’s Shares Hit a Record in Win for Masayoshi Son

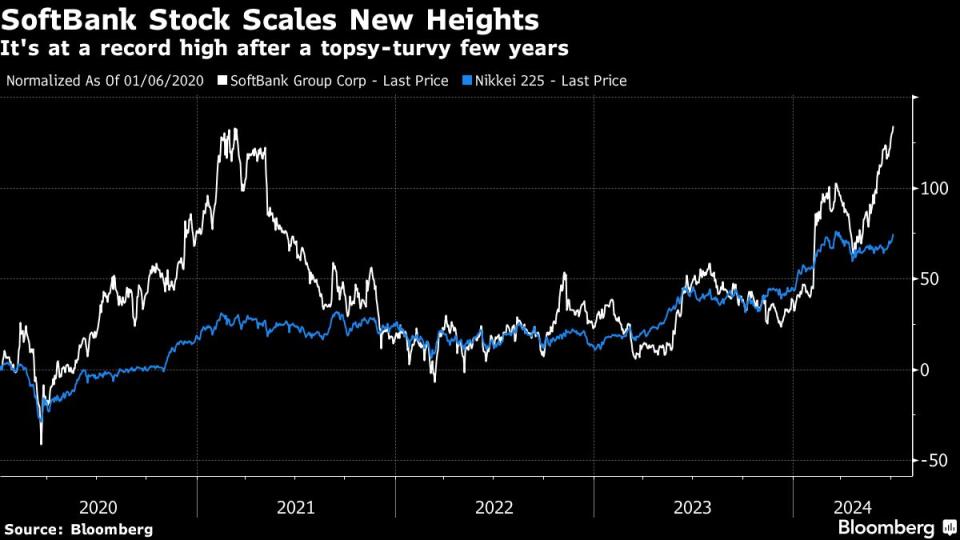

(Bloomberg) -- SoftBank Group Corp.’s stock rose 1.5% to a new lifetime high on Wednesday, a vote of confidence in Masayoshi Son’s ambitions to ramp up investments in AI and semiconductors.

Most Read from Bloomberg

China Can End Russia’s War in Ukraine With One Phone Call, Finland Says

Biden Faces Mounting Pressure as Report Says He Is Weighing Exit

The Japanese tech investor is gaining investor attention as its telecom arm moves aggressively to invest in generative AI, tying up with Microsoft Corp. and startup Perplexity AI Inc. and building data centers stocked with Nvidia Corp. accelerators. Its chip unit Arm Holdings Plc is also trying to position its architecture as a means to conserve energy in devices running artificial intelligence.

The rally is a vindication for SoftBank founder Son, whose reputation has been tarnished by big startup bets that cost the company billions of dollars in recent years. SoftBank’s close ties with Nvidia and OpenAI have strengthened the company’s position amid a global race to build AI-related infrastructure.

Shares of SoftBank got a lift in part because the benchmark Nikkei 225’s recovery is expected to help the investment firm’s earnings, according to Tomoaki Kawasaki, a senior analyst at Iwaicosmo Securities. “It’s getting another boost as more investors see it as a semiconductor-related stock,” he said.

A darling of retail investors, SoftBank shares remain volatile. During the dot-com boom and bust, the company lost 99% of its market capitalization, erasing $70 billion of Son’s wealth. Its stock regained ground through two decades of effort rolling out broadband networks in Japan, selling the country’s first Apple Inc. iPhones and investments in some of the world’s biggest startups.

But its shares plunged again in 2021 in the wake of Beijing’s crackdown on tech firms and a flurry of missteps including investments in startups such as WeWork, Katerra Inc., OneWeb Ltd. and Zume Pizza Inc.

The share rise has also lifted Son’s rhetoric, with the billionaire making more grandiose pronouncements about the future of AI. Recently, he told shareholders he was preparing to swing for the fences, in a move that will make his previous bets seem like “warmups.”

--With assistance from Natsuko Katsuki.

(Updates with shares and analyst’s commentary from the first paragraph)

Most Read from Bloomberg Businessweek

China’s Investment Bankers Join the Communist Party as Morale (and Paychecks) Shrink

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

Dragons and Sex Are Now a $610 Million Business Sweeping Publishing

For Tesla, a Smaller Drop in Sales Is Something to Celebrate

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance