Will Solid Total Payment Volume Aid PayPal's (PYPL) Q3 Earnings?

PayPal’s PYPL third-quarter 2023 earnings, set to be released on Nov 1, are expected to have benefited from an improving Total Payment Volume (TPV). The metric is expected to have benefited from a strong relationship between the company and its merchants, as well as consumers.

PayPal’s two-sided platform helps develop direct financial relationships with customers and merchants. In second-quarter 2023, TPV improved 11% year over year on a spot rate, as well as on a currency-neutral basis, to $376.54 billion.

Our model estimate for TPV is pegged at $394.094 billion, indicating 17% year-over-year growth.

Click here to know how PayPal’s overall third-quarter performance is likely to be.

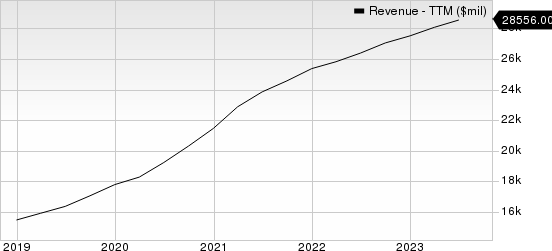

PayPal Holdings, Inc. Revenue (TTM)

PayPal Holdings, Inc. revenue-ttm | PayPal Holdings, Inc. Quote

Strong Product Portfolio: Key to PayPal’s Prospects

PayPal is riding on an expanding clientele, thanks to a strong product portfolio. Strong monetization efforts of Venmo are likely to have aided its adoption rate in the to-be-reported quarter.

The growing momentum of the company’s buy now pay later solution is anticipated to have contributed well. Advancing PayPal’s Checkout experiences are expected to have sustained its momentum in the to-be-reported quarter.

PayPal’s initiative to introduce of Tap to Pay on Android for Venmo and Zettle users, which empowered small businesses with seamless payment options, is expected to have benefited top-line growth.

For the third quarter, our model estimates for Active Customer Accounts are pegged at 457 million, indicating 5.8% year-over-year growth.

These factors are expected to have boosted PayPal’s prospects, which currently carries a Zacks Rank #3 (Hold).

Upcoming Earnings to Watch Out

Investors are eagerly waiting for the earnings releases of GoDaddy GDDY, eGain EGAN and Fastly FSLY in the broader Zacks Computer & Technology sector, to which PayPal belongs. Each stock sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

GoDaddy is scheduled to release third-quarter 2023 results on Nov 2. The Zacks Consensus Estimate for GDDY’s earnings is pegged at 71 cents per share, suggesting a 12.7% jump from the prior-year levels.

eGain is set to report first-quarter fiscal 2024 results on Nov 2. The consensus mark for earnings has been steady at 7 cents per share over the past 30 days.

Fastly is set to report third-quarter 2023 results on Nov 1. The Zacks Consensus Estimate is pegged at a loss of 7 cents per share, indicating a 50% rise from a year ago.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

eGain Corporation (EGAN) : Free Stock Analysis Report

GoDaddy Inc. (GDDY) : Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL) : Free Stock Analysis Report

Fastly, Inc. (FSLY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance