Steer Clear Of Accelleron Industries And Explore One Better Dividend Stock Option

In the search for reliable dividend stocks within Switzerland, where the average yield hovers around 3.0%, it's crucial to scrutinize companies offering higher dividends. A high payout ratio can either signal a robust income stream or raise red flags about the sustainability of these dividends. This article examines such scenarios, highlighting one company, Accelleron Industries, whose elevated payout ratio could indicate financial challenges ahead.

Top 10 Dividend Stocks In Switzerland

Name | Dividend Yield | Dividend Rating |

Vontobel Holding (SWX:VONN) | 5.57% | ★★★★★★ |

Cembra Money Bank (SWX:CMBN) | 5.19% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.54% | ★★★★★★ |

St. Galler Kantonalbank (SWX:SGKN) | 4.43% | ★★★★★★ |

Novartis (SWX:NOVN) | 3.36% | ★★★★★☆ |

Roche Holding (SWX:ROG) | 3.86% | ★★★★★☆ |

Julius Bär Gruppe (SWX:BAER) | 5.08% | ★★★★★☆ |

Holcim (SWX:HOLN) | 3.57% | ★★★★★☆ |

Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.74% | ★★★★★☆ |

Helvetia Holding (SWX:HELN) | 5.18% | ★★★★★☆ |

Click here to see the full list of 26 stocks from our Top Dividend Stocks screener.

Let's dive into one of the prime choices out of the screener and one to possibly skip over.

Top Pick

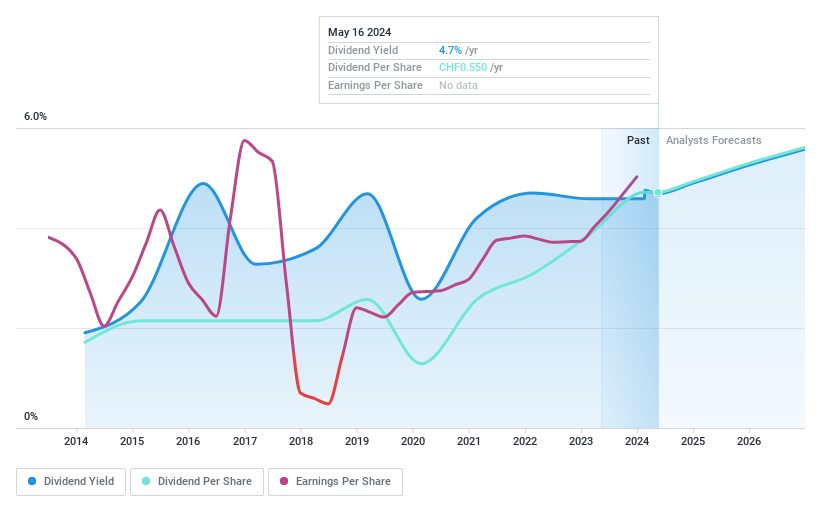

EFG International

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EFG International AG operates in private banking, wealth management, and asset management, with a market capitalization of approximately CHF 4.06 billion.

Operations: EFG International's revenue is generated from several geographic and functional segments, including CHF 450.20 million from Switzerland & Italy, CHF 249.70 million from Continental Europe & Middle East, CHF 177.40 million from the United Kingdom, CHF 165.30 million from Asia Pacific, CHF 133.20 million from the Americas, CHF 122.40 million from Investment and Wealth Solutions, and CHF 83 million from Global Markets & Treasury.

Dividend Yield: 4.1%

EFG International maintains a sustainable dividend with a current payout ratio of 58.5%, suggesting dividends are well-covered by earnings, contrasting sharply with some peers struggling with high payout ratios. However, its dividend yield at 4.06% is slightly below the top Swiss payers' average of 4.22%. Despite this, EFG has shown earnings growth of 56.6% over the past year and recently extended its buyback plan, indicating confidence in ongoing financial health and shareholder value support.

One To Reconsider

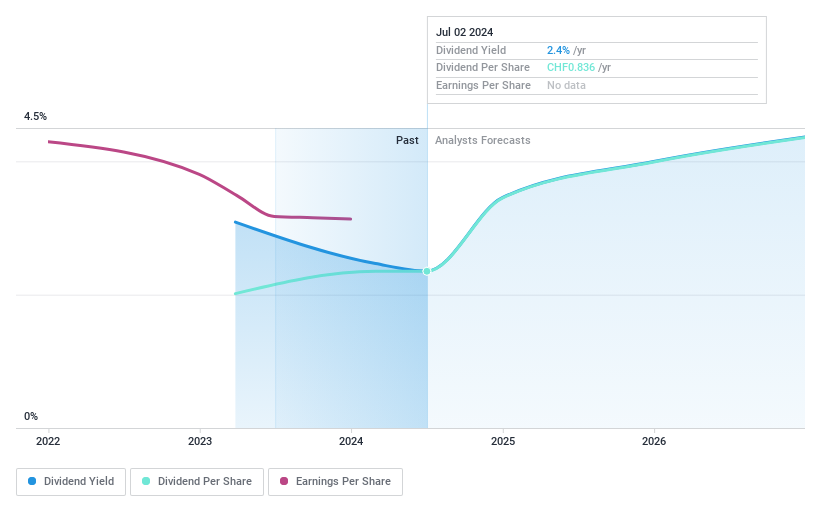

Accelleron Industries

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Accelleron Industries AG specializes in developing, manufacturing, selling, and servicing turbochargers and digital solutions globally, with a market capitalization of CHF 3.30 billion.

Operations: The company generates revenue primarily through two segments: High Speed, which brought in $249.94 million, and Medium & Low Speed, contributing $664.92 million.

Dividend Yield: 2.4%

Accelleron Industries AG faces challenges with its dividend sustainability, marked by a high payout ratio of 93.5%, indicating that earnings do not adequately cover the dividend payments. Despite a recent increase in dividends to CHF 0.85 per share, the company's dividend yield remains low at 2.35%, underperforming against the top Swiss dividend payers' average of 4.22%. Additionally, large one-off items have distorted financial results, raising concerns about the quality of earnings and long-term viability of payouts.

Taking Advantage

Explore the 26 names from our Top Dividend Stocks screener here.

Hold shares in some of these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:EFGN and SWX:ACLN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance