Steer Clear Of {avoid_company} Dividend With {hold_companies_count} Better Dividend Stock Alternatives

Investing in dividend stocks is often pursued for the potential of steady income. However, the reliability of these dividends is crucial; a company that has previously cut its dividends, such as OKE Precision Cutting Tools, might indicate underlying financial instability. Such fluctuations can significantly impact the attractiveness of a stock as a long-term investment option.

Top 10 Dividend Stocks

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.74% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 6.97% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.56% | ★★★★★★ |

Globeride (TSE:7990) | 3.78% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.38% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 6.61% | ★★★★★★ |

Kwong Lung Enterprise (TPEX:8916) | 5.79% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.05% | ★★★★★★ |

DoshishaLtd (TSE:7483) | 3.47% | ★★★★★★ |

Innotech (TSE:9880) | 3.93% | ★★★★★★ |

Click here to see the full list of 1965 stocks from our Top Dividend Stocks screener.

Here's a peek at one of the choices from the screener and one that may be safer to dodge.

Top Pick

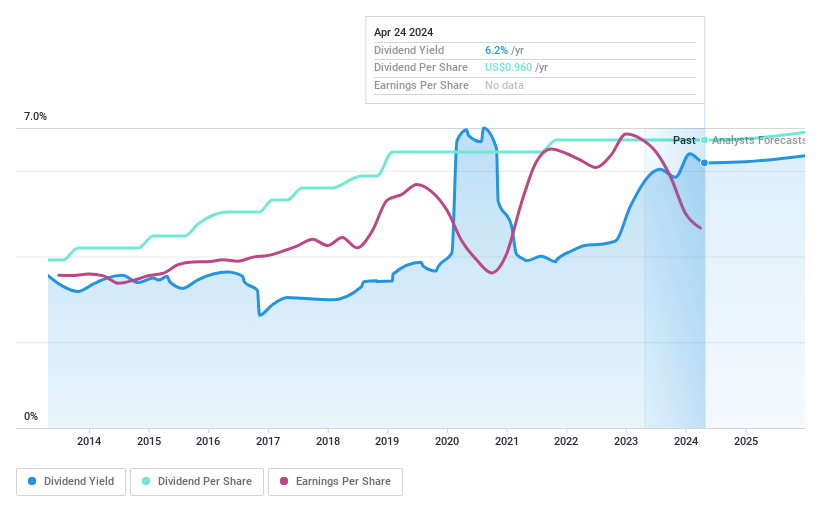

Provident Financial Services

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Provident Financial Services, Inc., serving as the bank holding company for Provident Bank, offers a range of banking products and services to individuals, families, and businesses in the United States, with a market capitalization of approximately $1.09 billion.

Operations: The company generates its revenue primarily from traditional banking and other financial services, totaling approximately $441.20 million.

Dividend Yield: 6.6%

Provident Financial Services offers a compelling dividend yield of 6.6%, well above the US market average, supported by a stable payout ratio of 60%. Over the past decade, its dividends have shown consistent growth with minimal volatility, underscoring reliability in payouts. Recent corporate actions include a $40.78 million Shelf Registration and significant board changes post-merger, enhancing governance structures. However, recent earnings have dipped, with net interest income and net income declining from the previous year's figures.

One To Reconsider

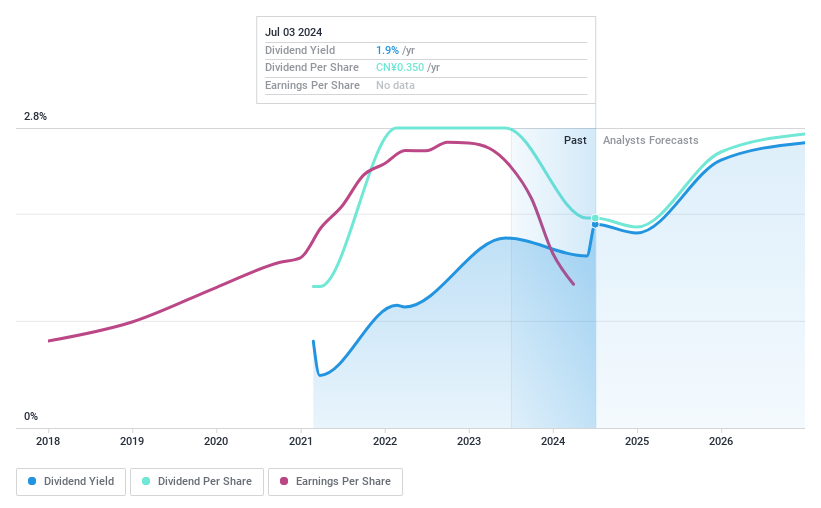

OKE Precision Cutting Tools

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: OKE Precision Cutting Tools Co., Ltd. specializes in the research, development, production, and sale of cemented carbide and CNC cutting tool products, with a market capitalization of approximately CN¥2.95 billion.

Operations: The company generates CN¥1.01 billion from its metal processors and fabrication segment.

Dividend Yield: 1.9%

OKE Precision Cutting Tools has demonstrated unstable dividend payments with a significant drop in the past, making it a less reliable choice for dividend-seeking investors. Despite having a low payout ratio of 40.6%, its dividends are not well-supported by free cash flows, and the recent exclusion from the S&P Global BMI Index may concern potential investors. Additionally, its profit margins have decreased from last year, further signaling potential risks in sustaining dividends.

Summing It All Up

Delve into our full catalog of 1965 Top Dividend Stocks here.

Are any of these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NYSE:PFS and SHSE:688308.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance