Steer Clear Of Guangdong Champion Asia ElectronicsLtd And Explore One Better Dividend Stock Option

Dividend-paying stocks are often sought after for their potential to provide a reliable income stream. However, a declining dividend, such as that seen with Guangdong Champion Asia ElectronicsLtd, can raise red flags about the sustainability and health of the company's financials. Investors looking into dividend stocks in China should consider both the yield and the growth history of these dividends to ensure they are investing in a company with strong financial fundamentals.

Top 10 Dividend Stocks In China

Name | Dividend Yield | Dividend Rating |

Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.74% | ★★★★★★ |

Midea Group (SZSE:000333) | 4.76% | ★★★★★★ |

Changhong Meiling (SZSE:000521) | 4.05% | ★★★★★★ |

Wuliangye YibinLtd (SZSE:000858) | 3.56% | ★★★★★★ |

Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.65% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 6.97% | ★★★★★★ |

Huangshan NovelLtd (SZSE:002014) | 5.61% | ★★★★★★ |

China South Publishing & Media Group (SHSE:601098) | 4.33% | ★★★★★★ |

Chacha Food Company (SZSE:002557) | 3.53% | ★★★★★★ |

Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.64% | ★★★★★★ |

Click here to see the full list of 235 stocks from our Top Dividend Stocks screener.

Below we spotlight one of our favorites from our exclusive screener and one you might the flick.

Top Pick

Xinjiang Xuefeng Sci-Tech(Group)Co.Ltd

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinjiang Xuefeng Sci-Tech (Group) Co., Ltd focuses on the research, development, production, and sale of civil explosives, with a market capitalization of approximately CN¥7.31 billion.

Operations: The company generates its revenue primarily from the research, development, production, and sales of civil explosives.

Dividend Yield: 3.7%

Xinjiang Xuefeng Sci-Tech(Group)Co.,Ltd, despite a recent dip in quarterly revenue and net income as of March 2024, maintains a robust dividend profile. The company's dividend yield of 3.67% ranks in the top 25% within its market, supported by a sustainable payout ratio of 35.7% from earnings and an even lower cash payout ratio at 27.9%. However, it's notable that Xinjiang Xuefeng has experienced volatility in its dividend payments over the past eight years, reflecting some inconsistency in its ability to increase dividends steadily. This contrasts with firms showing declining dividends, highlighting Xinjiang’s relative resilience and potential appeal to dividend-focused investors despite some fluctuations.

One To Reconsider

Guangdong Champion Asia ElectronicsLtd

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Guangdong Champion Asia Electronics Co., Ltd. operates in the electronics sector with a market capitalization of approximately CN¥3.67 billion.

Operations: The company generates its revenue from various electronics sector activities.

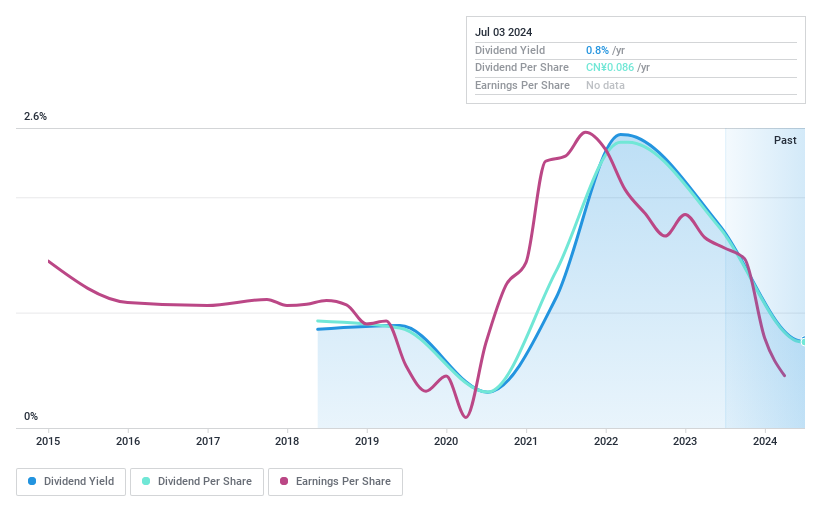

Dividend Yield: 0.8%

Guangdong Champion Asia Electronics has displayed a troubling trend in its dividend payments, which have decreased over the past six years. The company's current dividend yield of 0.77% is significantly lower than the market's top quartile at 2.52%. Additionally, recent financial reports reveal a shift from net income to a net loss, further complicating its ability to sustain dividends. Despite reasonable coverage by earnings and cash flows, the volatile share price and poor interest coverage raise concerns about its overall financial health and reliability as a dividend stock.

Make It Happen

Gain an insight into the universe of 235 Top Dividend Stocks by clicking here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:603227 and SHSE:603386.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance