Stocks Face Meager Upside After 2024 Gains, Survey Shows

(Bloomberg) -- The S&P 500 Index has likely logged most of the gains it will see this year as investors are growing increasingly nervous about the stock market’s rich valuations, according to the latest Bloomberg Markets Live Pulse survey.

Most Read from Bloomberg

How Long Can High Rates Last? Bond Markets Say Maybe Forever

Jain Raises $5.3 Billion in Biggest Hedge Fund Debut Since 2018

Russia Is Storing Up a Crime Wave When Its War on Ukraine Ends

Nasdaq Futures Under Pressure as Nvidia Retreats: Markets Wrap

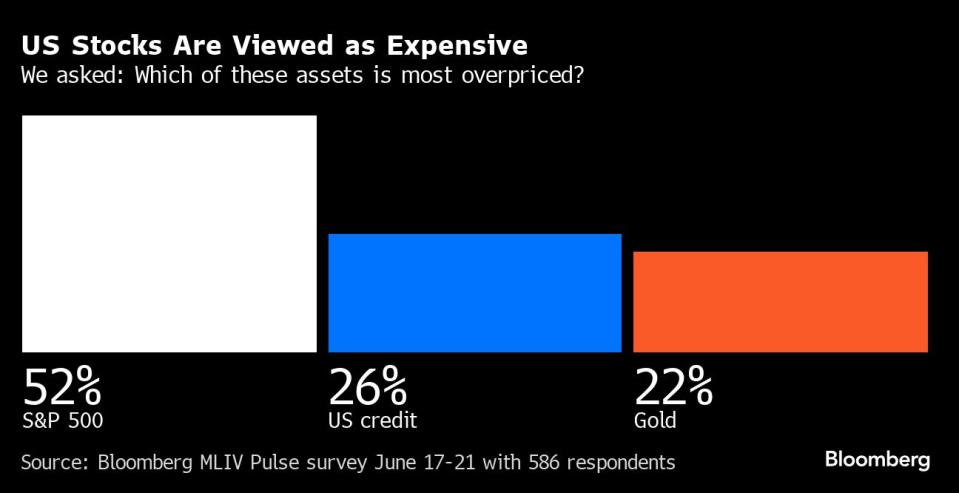

The 2024 rally, which has driven the US equity benchmark to 31 record closing highs, has left the asset class more overpriced than US credit or gold, a majority of the 586 respondents said. After soaring roughly 50% since October 2022, driven by technology shares, the bull market has delivered a greater advance than the median of its predecessors going back to 1957.

Investors aren’t looking to hit the sell button just yet, but signs of skittishness are evident as about half of survey takers say stocks will see the beginning of a correction of at least 10% this year, with 35% saying that will happen in 2025. That overarching sense of caution is also apparent in the options market, where traders have been building hedges against potential losses in tech stocks.

With the economy and earnings still growing, and ample liquidity sloshing around in the financial system, most poll participants see scope for additional gains this year, but only a modest amount. The survey’s median projection is for the S&P 500 to finish 2024 at 5,606, almost 3% above Friday’s close. That’s a cheerier view than Wall Street strategists’ median target, which is for the index to be little changed from current levels at year-end.

About three quarters of participants say they’ll maintain or boost their exposure to the S&P 500 over the next month. It makes sense to ride the bullish wave for the time being, Ned Davis Research’s Ed Clissold and Thanh Nguyen wrote in a June 20 note. They have doubts, however, as the year goes on, given all the questions investors face in the second half, around all-important areas such Federal Reserve policy and the US elections.“Maintain an overweight position in equities for now,” they wrote. “But prepare for more defensive positioning, potentially in the third quarter.”

As a measure of equities’ lofty valuation, Michael O’Rourke at JonesTrading points to the S&P 500’s market capitalization relative to the size of the economy. Since around 1990, that ratio has only been higher when stocks were surging in 2021.

“We are in a bubble and there is an outsized risk that the economy finally slows down in the second half of the year and multiples should contract,” said O’Rourke, the firm’s chief market strategist. “These are very dangerous levels for long-term investors to be buying stocks.”

Artificial intelligence, a key driver of the market’s almost 15% advance this year, is seen as the most likely trigger for a selloff, with 31% of survey respondents on alert for a negative surprise on that front.

Tech stocks in the so-called Magnificent Seven basket — led by AI darling Nvidia Corp. — have dominated profit growth, although in the analysis of Bloomberg Intelligence their influence is likely to wane in the months ahead.

Worries around the economy are also top of mind. Some 27% of poll-takers said stocks could drop as unemployment increases, while almost a quarter pointed to the risk of a surprise pickup in inflation that would keep the Fed on hold for longer.

The jobless rate rose to 4% in May, the highest since early 2022. Goldman Sachs Group Inc. economists warned the job market stands at a potential “inflection point,” where any further softness in demand for workers will hit jobs, not just job openings.

“General economic conditions are confusing,” Kim Forrest, chief investment officer at Bokeh Capital Partners, said via email. “Inflation seems to be subsiding but jobs seem to be slowing down.”

For all the reasons to fret over the months ahead, the survey also contains some potentially rosier signals.

For one thing, participants forecast that oil prices are likely to end 2024 around $80 for WTI futures, right around Friday’s levels.

The lop-sided rally in stocks has also created big distortions in the market. Value stocks, for one, are historically cheap relative to their growth peers and the broader market, and for 40% of survey participants they now look like the biggest bargain in US stocks. That’s followed by small caps and the equal-weighted S&P 500.

“We could see the market move higher by the end of the year, if we skirt by a recession – which I think is highly likely,” said Bokeh Capital’s Forrest. “And it all depends on the outlook for 2025 as we near the end of the year.”

The MLIV Pulse survey was conducted from June 17 to June 21 among Bloomberg News terminal and online readers worldwide who chose to engage with the survey, and included portfolio managers, economists and retail investors. Terminal readers can subscribe to future surveys here.

This story was produced with the assistance of Bloomberg Automation

--With assistance from Vildana Hajric.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance