Sysco (SYY) Benefits From Efficiency Enhancement Amid Challenges

Sysco Corporation SYY has been benefiting from a focus on enhancing efficiency through supply-chain productivity and structural cost-containment efforts. The company’s diversified operations and strength in the food away-from-home channel have been a major upside.

Sysco demonstrated strong discipline and management agility by navigating a softer-than-expected customer environment in the third quarter of fiscal 2024. Despite witnessing slow restaurant traffic and soft volumes, Sysco’s operational efficiency led to robust bottom-line growth. The company remains confident about witnessing improved results for the remainder of fiscal 2024 and into fiscal 2025.

For fiscal 2024, management envisions sales to increase to nearly $79 billion from $76.3 billion recorded in fiscal 2023. Adjusted earnings per share or EPS are expected to rise 5-10% to the $4.20-$4.40 band.

Solid Operational Efficiency

In the third quarter of fiscal 2024, both the gross profit and gross margin improved, reflecting the company’s ability to effectively manage product cost fluctuations through tight margin management, driven by strategic sourcing efforts, disciplined and rational pricing, a higher mix of specialty products and improved penetration rates of Sysco brand products in local markets.

Markedly, Sysco witnessed positive operating leverage for the sixth straight time, driven by a faster expansion in the gross profit compared to operating expenses. Management undertook proactive measures to address both variable and structural operating costs, leading to a raised cost-out goal for fiscal 2024. The company targets cost savings of $120 million now compared with the $100 million expected earlier.

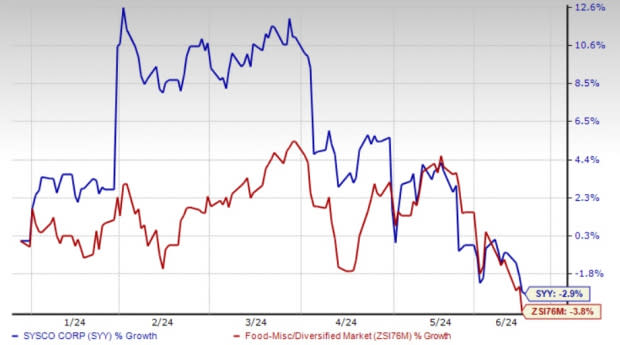

Image Source: Zacks Investment Research

Recipe for Growth on Track

Sysco has been focused on its Recipe for Growth, which is strengthening the company’s capacities across sales and the supply chain. The five strategic pillars include enhancing customers’ experience via digital tools. Further, the company is focused on improving the supply chain to cater to customers efficiently and consistently with better delivery and omnichannel inventory management.

Further, Sysco aims at providing customer-oriented merchandising and marketing solutions to augment sales. The company also targets team-based selling, with an emphasis on important cuisines. Finally, Sysco is focused on cultivating new capacities, channels and segments, along with sponsoring investments via cost-saving initiatives.

Sysco has been carrying out various acquisitions over the years to grow its distribution network and customer base and boost long-term growth. The company acquired Edward Don & Company in early fiscal 2024, which is generating positive synergies. In the first quarter of fiscal 2024, Sysco closed the buyout of BIX Produce to help its specialty produce business (FreshPoint). In February 2022, SYY acquired The Coastal Companies, which also operates under its FreshPoint business. The fast-growing and high-margin specialty space is a priority for Sysco. Well, these acquisitions go in tandem with Sysco’s Recipe for Growth.

Near-Term Hurdles to be Countered?

On its third-quarter fiscal 2024 earnings call, management highlighted that restaurant foot traffic has declined year over year, as observed through credit card transaction data. January restaurant traffic started slow, down in the high single digits year over year due to various factors. February and March saw an improvement, with traffic down to the low single digits, but continued to pose a challenge for distributor case volume growth. Although there was sequential improvement throughout the third quarter, a stronger recovery had been anticipated.

High restaurant menu prices have impacted foot traffic, a concern that needs to be addressed industry-wide to improve affordability for consumers. Apart from this, restaurants continue to face significantly elevated labor costs, while food costs have moderated year over year. Nonetheless, Sysco is committed to supporting its local restaurant customers through several initiatives.

This Zacks Rank #3 (Hold) company’s extensive range of product offerings, together with the proficiency of Sysco’s sales team, the strength of its supply chain and financial stability, positions it well to achieve impressive outcomes in the short run and even more robust results in the long run.

Shares of SYY have fallen 2.9% year to date compared with the industry’s decline of 3.8%.

Solid Food Bets

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently sports a Zacks Rank #1 (Strong Buy). VITL has a trailing four-quarter average earnings surprise of 102.1%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales and earnings indicates growth of 22.5% and 59.3%, respectively, from the year-ago reported numbers.

Utz Brands Inc. UTZ, which manufactures a diverse range of salty snacks, currently carries a Zacks Rank #2 (Buy). UTZ has a trailing four-quarter earnings surprise of 2%, on average.

The consensus estimate for Utz Brands’ current financial-year earnings indicates growth of 26.3% from the year-ago reported numbers.

Conagra Brands CAG, a consumer-packaged goods food company, currently carries a Zacks Rank of 2. The Zacks Consensus Estimate for CAG’s current fiscal-year earnings indicates a decline of 5.1% from the year-ago reported figure.

Conagra Brands has a trailing four-quarter earnings surprise of 6.8%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Conagra Brands (CAG) : Free Stock Analysis Report

Sysco Corporation (SYY) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance