Three Growth Companies On Chinese Exchange With Revenue Growth As High As 28%

Amidst a backdrop of fluctuating global markets, China's economic landscape presents unique opportunities, particularly in sectors experiencing robust revenue growth. In this context, companies with high insider ownership can signal strong confidence in future prospects, aligning well with investors looking for growth amidst current market conditions.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) | 22% | 54.9% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 24.5% |

Ningbo Deye Technology Group (SHSE:605117) | 24.8% | 28.4% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

Fujian Wanchen Biotechnology Group (SZSE:300972) | 15.3% | 75.9% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

Offcn Education Technology (SZSE:002607) | 26.1% | 65.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

Shanghai Aohua Photoelectricity Endoscope

Simply Wall St Growth Rating: ★★★★★☆

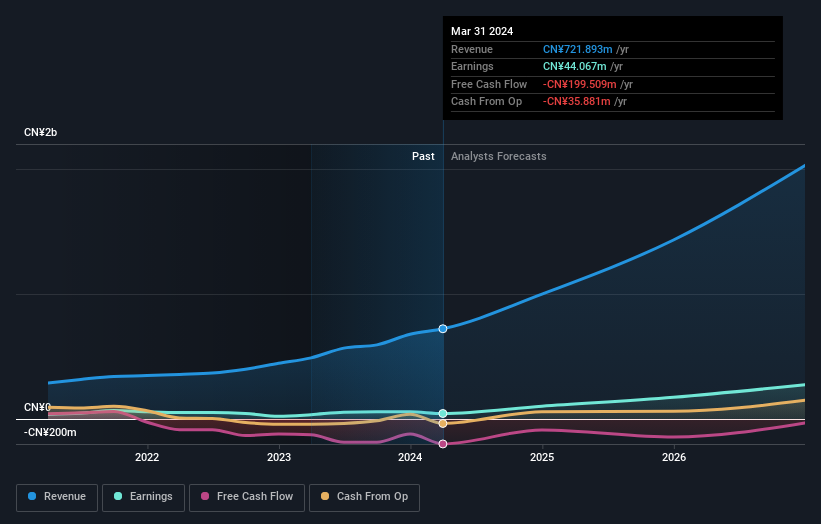

Overview: Shanghai Aohua Photoelectricity Endoscope Co., Ltd. is a medical device company that specializes in the research, development, manufacturing, and sales of electronic endoscopic equipment and consumables both domestically and internationally, with a market capitalization of approximately CN¥6.99 billion.

Operations: The company generates revenue primarily through the sale of diagnostic kits and equipment, totaling CN¥721.89 million.

Insider Ownership: 32.2%

Revenue Growth Forecast: 27.4% p.a.

Shanghai Aohua Photoelectricity Endoscope Co., Ltd. reported a substantial increase in sales to CNY 169.3 million from CNY 125.49 million year-over-year, although net income dropped to CNY 2.76 million from CNY 16.55 million, reflecting challenges despite growth in revenue. Analysts forecast robust future growth with earnings expected to rise by a significant margin annually, outpacing the Chinese market average significantly. However, the company's Return on Equity is projected to remain low at 11.9% in three years, indicating potential concerns about profitability and shareholder returns despite high insider ownership and optimistic revenue projections.

Beijing Sun-Novo Pharmaceutical Research

Simply Wall St Growth Rating: ★★★★★★

Overview: Beijing Sun-Novo Pharmaceutical Research Co., Ltd. is a contract research organization based in China, focusing on the development of pharmaceutical drugs, with a market capitalization of approximately CN¥5.49 billion.

Operations: The company generates revenue primarily through its contract research services for drug development in China.

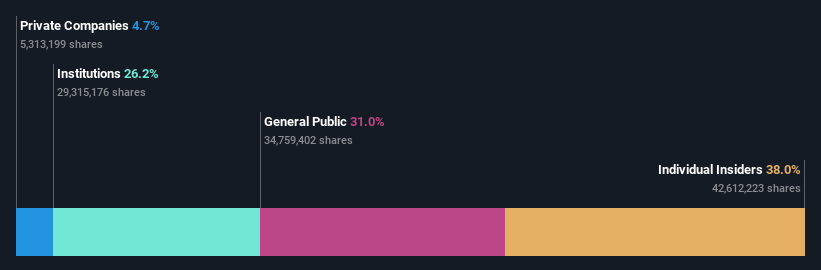

Insider Ownership: 38%

Revenue Growth Forecast: 28.1% p.a.

Beijing Sun-Novo Pharmaceutical Research Co., Ltd. is positioned favorably within its industry, with a Price-To-Earnings ratio of 26.2x, below the Chinese market average of 29.5x. The company has demonstrated strong financial performance with a significant year-over-year earnings growth of 22.6% and robust forecasts indicating an annual profit increase of 27.9%. Additionally, revenue is expected to expand by 28.1% annually, outstripping the market forecast of 13.9%. Despite these positive indicators, the company's recent Annual General Meeting did not highlight any new strategic initiatives that might impact future growth trajectories significantly.

Chengdu Guibao Science & TechnologyLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chengdu Guibao Science & Technology Co., Ltd. is a company that specializes in the development and manufacturing of silicone materials, with a market capitalization of approximately CN¥5.28 billion.

Operations: The business primarily generates revenue from the development and manufacturing of silicone materials.

Insider Ownership: 35.5%

Revenue Growth Forecast: 24.7% p.a.

Chengdu Guibao Science & Technology Ltd., despite a recent dip in quarterly revenue and net income, remains a compelling case within the high insider ownership segment in China. The company's revenue is projected to grow at 24.7% annually, outpacing the Chinese market forecast of 13.9%. Similarly, earnings are expected to increase by 27.3% per year, exceeding market growth projections. However, concerns linger over its volatile share price and inconsistent dividend history, which may deter some investors seeking stability.

Where To Now?

Access the full spectrum of 397 Fast Growing Chinese Companies With High Insider Ownership by clicking on this link.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:688212SHSE:688621 SZSE:300019

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance