Three Japanese Exchange Growth Companies With High Insider Ownership And Earnings Growth Of 18%

Amid a backdrop of a strengthening Japanese stock market, bolstered by gains in the Nikkei 225 and TOPIX indices, investors continue to seek opportunities in growth-oriented companies. High insider ownership coupled with robust earnings growth can be compelling indicators of potential resilience and commitment to company success in such vibrant market conditions.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.4% | 27% |

Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

Hottolink (TSE:3680) | 27% | 57.4% |

Medley (TSE:4480) | 34% | 28.7% |

Micronics Japan (TSE:6871) | 15.3% | 39.8% |

Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 44.6% |

ExaWizards (TSE:4259) | 21.9% | 91.1% |

Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

AeroEdge (TSE:7409) | 10.7% | 28.5% |

freee K.K (TSE:4478) | 23.9% | 72.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Mercari

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mercari, Inc. operates a marketplace application in Japan and the United States, focusing on the buying and selling of goods, with a market capitalization of approximately ¥364.95 billion.

Operations: The company generates revenue primarily from its marketplace applications active in Japan and the United States.

Insider Ownership: 36%

Earnings Growth Forecast: 18.9% p.a.

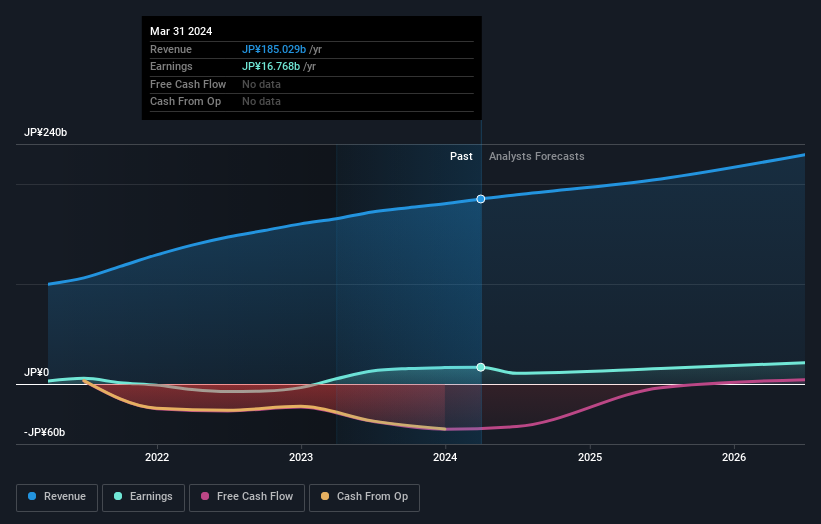

Mercari, a Japanese e-commerce platform, has shown robust growth with earnings increasing by 222.8% over the past year. The company anticipates revenue of JPY 190 billion and an operating profit of JPY 16.5 billion for the fiscal year ending June 2024. Despite its highly volatile share price, Mercari's earnings are expected to grow by 18.88% annually, outpacing the Japanese market's average. Additionally, its forecasted Return on Equity is impressively high at 22.9%, indicating efficient management and profitability potential.

Unlock comprehensive insights into our analysis of Mercari stock in this growth report.

Our expertly prepared valuation report Mercari implies its share price may be too high.

Rakuten Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications sectors serving users globally with a market capitalization of approximately ¥1.86 trillion.

Operations: The company generates revenue through four primary sectors: e-commerce, fintech, digital content, and communications.

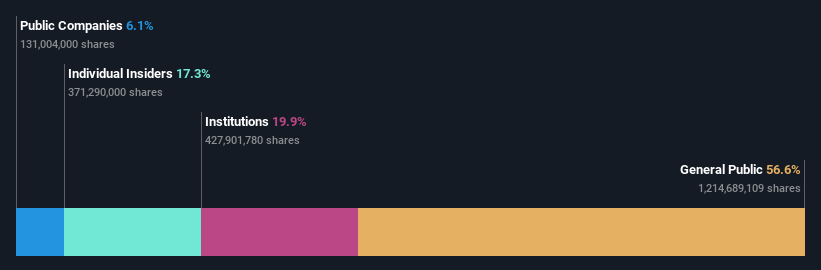

Insider Ownership: 17.3%

Earnings Growth Forecast: 83.1% p.a.

Rakuten Group is poised for significant growth, with revenue expected to expand by 7.8% annually, outstripping the Japanese market's average of 4.2%. The company is on track to become profitable within three years, a testament to its robust operational strategy and market positioning. Despite trading at 79.6% below its estimated fair value and a modest forecasted Return on Equity of 8.9%, Rakuten demonstrates potential through its substantial insider ownership and absence of recent insider selling, underscoring confidence from those closest to the company.

Click to explore a detailed breakdown of our findings in Rakuten Group's earnings growth report.

Our valuation report here indicates Rakuten Group may be undervalued.

BayCurrent Consulting

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BayCurrent Consulting, Inc. offers consulting services across various sectors in Japan and has a market capitalization of approximately ¥526.47 billion.

Operations: The firm generates revenue through consulting services across diverse sectors in Japan.

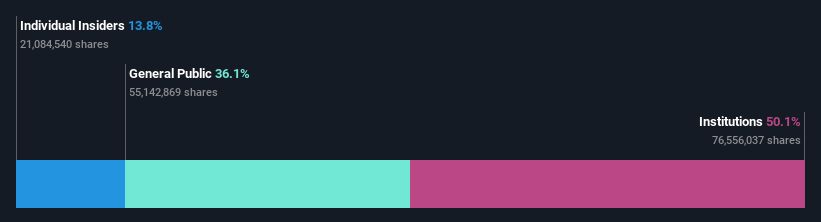

Insider Ownership: 13.9%

Earnings Growth Forecast: 18.4% p.a.

BayCurrent Consulting's recent share buyback, completing the repurchase of shares for ¥3.60 billion, underscores its commitment to shareholder value and capital efficiency. Despite a highly volatile share price over the past three months, BayCurrent has demonstrated solid growth with earnings increasing by 17.2% last year and forecasted to grow at 18.36% annually. The company's revenue growth is also expected to outpace the Japanese market substantially at 18.3% per year, reflecting strong operational performance and market positioning.

Seize The Opportunity

Dive into all 98 of the Fast Growing Japanese Companies With High Insider Ownership we have identified here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:4385TSE:4755 and TSE:6532

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance