Three-quarters of benefits cuts announced since 2015 yet to hit home

Three-quarters of benefits cuts imposed since 2015 have yet to take effect, meaning the worst is yet to come for millions of people.

Billions of pounds in “savings” earmarked from changes to the welfare system have not yet filtered down to households.

The respected Institute of Fiscal Studies think-tank said tax rises of £30bn would be needed each year by the mid-2020s to retain public spending levels and balance the books.

And an extra £11bn would be required to cover social care, health and pension costs for the ageing population, it said.

IFS director Paul Johnson said of the looming impact of welfare cuts: “Given scale of benefit cuts, as you’d expect, poorer half of households will be hit hard.

“This contrasts with what happened up to 2015. Then policy hit the lower half, but less hard than over this period. It also hit the richest pretty hard.”

MORE: Brexit divorce bill will hit at least £37.1bn – and we’ll be paying until 2064

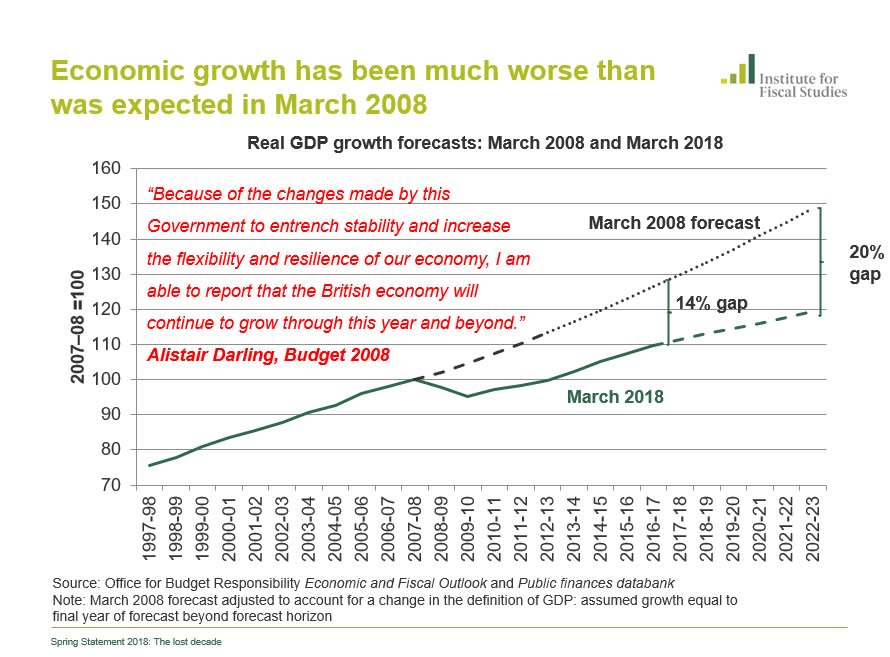

In its detailed analysis of Philip Hammond’s Spring Statement, the IFS said the UK was still suffering the hangover of the 2008 financial crisis, which had led to the worst decade of growth since “at least” the Second World War.

The chancellor sought to dispel the “doom and gloom” surrounding the economy during his address to the Commons on Tuesday.

Telling MPs he felt “positively Tigger-like”, Hammond said there was light at the end of the tunnel as debt was forecast to come down, borrowing was less than expected and GDP was set to grow over the next five years.

MORE: Look after the pennies: why copper coins should go – and why they should stay

However, the growth figures bumble along at well below 2% – putting the UK right the near the bottom the G20.

In its briefing, the IFS also warned the challenge to public spending was acute. It said: “The squeeze on day-to-day spending on public services is set to continue: £12bn would be required by 2022-23 to prevent any further cut to real per-capita spending.”

“Overall, regardless of whether or not the deficit is eliminated by mid-2020s the UK public finances face substantial pressures with many significant and politically difficult long-term fiscal challenges ahead that need addressing.”

Yahoo Finance

Yahoo Finance