Top 3 Value Picks On The Indian Exchange For July 2024

The Indian stock market has shown robust growth, increasing by 1.4% over the last week and surging 44% over the past 12 months, with earnings projected to grow by 16% annually. In this thriving environment, identifying undervalued stocks that have potential for significant appreciation becomes particularly compelling.

Top 10 Undervalued Stocks Based On Cash Flows In India

Name | Current Price | Fair Value (Est) | Discount (Est) |

Updater Services (NSEI:UDS) | ₹307.20 | ₹540.00 | 43.1% |

IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹433.40 | ₹636.71 | 31.9% |

Rajesh Exports (NSEI:RAJESHEXPO) | ₹287.75 | ₹497.18 | 42.1% |

Strides Pharma Science (NSEI:STAR) | ₹955.80 | ₹1664.05 | 42.6% |

Vedanta (NSEI:VEDL) | ₹463.90 | ₹734.79 | 36.9% |

Mahindra Logistics (NSEI:MAHLOG) | ₹537.50 | ₹906.10 | 40.7% |

Delhivery (NSEI:DELHIVERY) | ₹399.40 | ₹742.34 | 46.2% |

PVR INOX (NSEI:PVRINOX) | ₹1461.00 | ₹2548.38 | 42.7% |

TV18 Broadcast (NSEI:TV18BRDCST) | ₹45.56 | ₹71.63 | 36.4% |

Godrej Properties (NSEI:GODREJPROP) | ₹3330.65 | ₹5743.83 | 42% |

Here we highlight a subset of our preferred stocks from the screener

Godrej Properties

Overview: Godrej Properties Limited operates in real estate construction and development across India, with a market capitalization of approximately ₹926.11 billion.

Operations: The company generates revenue primarily from real estate construction and development, totaling ₹29.95 billion, with a smaller segment in hospitality contributing ₹0.41 billion.

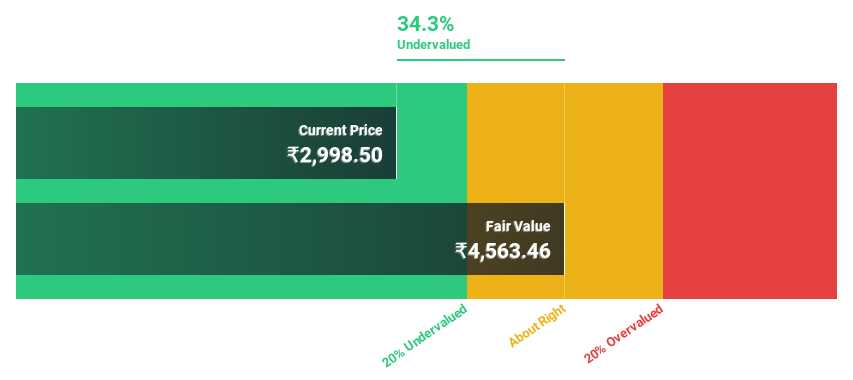

Estimated Discount To Fair Value: 42%

Godrej Properties, with its shares priced at ₹3330.65, significantly under our fair value estimate of ₹5743.83, appears undervalued based on discounted cash flow analysis. Despite challenges in covering debt with operating cash flow, the company's earnings are expected to grow substantially by 35.7% annually over the next three years, outpacing the Indian market's average. Recent financials show a robust increase in net income and sales for FY24, indicating strong operational performance and potential for continued growth in shareholder value.

Strides Pharma Science

Overview: Strides Pharma Science Limited is a pharmaceutical company engaged in the development, manufacturing, and sale of pharmaceutical products across diverse regions including Africa, Australia, North America, Europe, Asia, and India with a market capitalization of ₹87.85 billion.

Operations: The pharmaceutical business, excluding the bio-pharmaceutical segment, generates revenue of ₹40.51 billion.

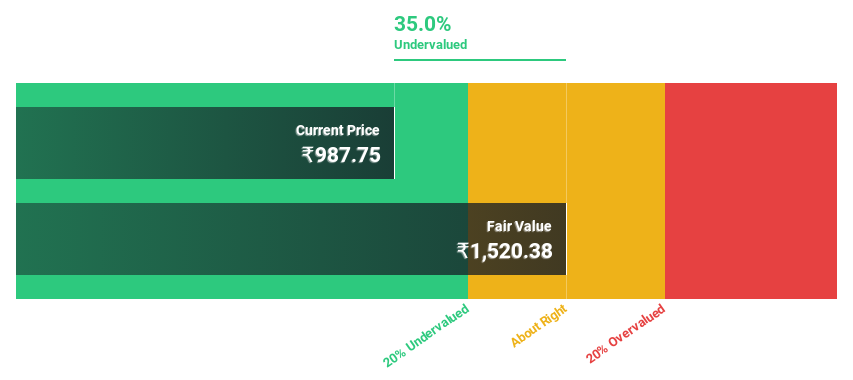

Estimated Discount To Fair Value: 42.6%

Strides Pharma Science, currently trading at ₹941.85, is significantly below the estimated fair value of ₹1664.05, suggesting undervaluation based on cash flows. The company's recent executive reshuffling aims to strengthen its leadership in profitable and sustainable operations. With an expected revenue growth of 11.2% annually—surpassing the Indian market's 9.6%—and a forecast to turn profitable within three years, Strides shows promising financial health despite a low dividend coverage of 0.27%.

Vedanta

Overview: Vedanta Limited is a diversified natural resources company involved in the exploration, extraction, and processing of minerals and oil and gas, operating in India, Europe, China, the United States, Mexico, and other international markets with a market capitalization of approximately ₹1.72 trillion.

Operations: Vedanta's revenue is derived from Aluminium (₹48.37 billion), Copper (₹19.73 billion), Zinc - India (₹27.93 billion), Zinc - International (₹3.56 billion), Iron Ore (₷9.07 billion), Oil and Gas (₹17.84 billion), and Power (6.15 billion).

Estimated Discount To Fair Value: 36.9%

Vedanta Limited, priced at ₹463.9, is trading significantly below its estimated fair value of ₹734.79, indicating potential undervaluation based on cash flows. Despite a high level of debt and profit margins dropping from 7.2% to 3% over the past year, Vedanta's earnings are expected to grow robustly by 42.8% annually. Recent strategic moves include plans to raise INR 40 billion through a stake sale and efforts to reduce debt by divesting non-core assets, aligning with its financial strategy despite operational challenges like regulatory penalties and subdued commodity markets.

Summing It All Up

Discover the full array of 16 Undervalued Indian Stocks Based On Cash Flows right here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:GODREJPROP NSEI:STAR and NSEI:VEDL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance