Top Swiss Dividend Stocks To Consider In July 2024

Swiss stocks recently experienced a downturn, influenced by broader European market trends and uncertainty regarding future interest rate decisions from the Fed and ECB. Amid these fluctuations, dividend stocks remain a point of interest for investors seeking potential stability and steady returns in a volatile market environment.

Top 10 Dividend Stocks In Switzerland

Name | Dividend Yield | Dividend Rating |

Vontobel Holding (SWX:VONN) | 5.57% | ★★★★★★ |

Cembra Money Bank (SWX:CMBN) | 5.19% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.54% | ★★★★★★ |

St. Galler Kantonalbank (SWX:SGKN) | 4.43% | ★★★★★★ |

Novartis (SWX:NOVN) | 3.36% | ★★★★★☆ |

Roche Holding (SWX:ROG) | 3.86% | ★★★★★☆ |

Julius Bär Gruppe (SWX:BAER) | 5.08% | ★★★★★☆ |

Holcim (SWX:HOLN) | 3.57% | ★★★★★☆ |

Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.74% | ★★★★★☆ |

Helvetia Holding (SWX:HELN) | 5.18% | ★★★★★☆ |

Click here to see the full list of 26 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

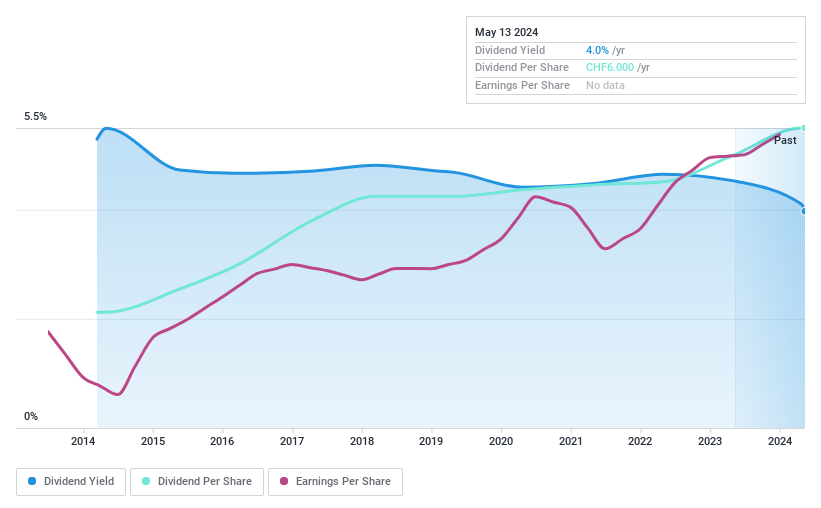

Compagnie Financière Tradition

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Compagnie Financière Tradition SA is a global interdealer broker dealing in financial and non-financial products, with a market capitalization of approximately CHF 1.10 billion.

Operations: Compagnie Financière Tradition SA generates its revenue from three key geographical segments: Americas (CHF 350.89 million), Asia-Pacific (CHF 271.44 million), and Europe, Middle East, and Africa (CHF 431.78 million).

Dividend Yield: 4.1%

Compagnie Financière Tradition offers a stable dividend yield of 4.12%, supported by a decade of consistent growth and reliability in payouts. The dividends are well-covered, with a payout ratio of 47.2% and cash payout ratio at 40.8%, indicating strong earnings and cash flow support despite its share price volatility over the past three months. Recent financials show an upward trend, with revenue reaching CHF 983.3 million and net income at CHF 94.42 million for the year ended December 31, 2023.

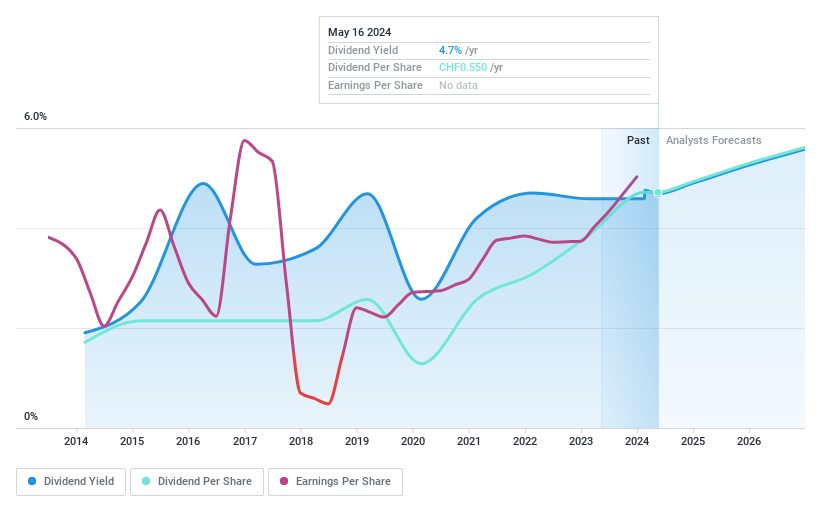

EFG International

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EFG International AG operates in private banking, wealth management, and asset management services with a market capitalization of approximately CHF 4.06 billion.

Operations: EFG International AG generates revenue through various regional and functional segments, with notable contributions from Switzerland & Italy (CHF 450.20 million), the United Kingdom (CHF 177.40 million), Asia Pacific (CHF 165.30 million), Continental Europe & Middle East (CHF 249.70 million), Americas (CHF 133.20 million), Investment and Wealth Solutions (CHF 122.40 million), and Global Markets & Treasury (CHF 83 million).

Dividend Yield: 4.1%

EFG International exhibits a mixed dividend profile, marked by a volatile and unreliable dividend history over the past decade. Despite this, dividends have grown and are modestly covered by earnings with a current payout ratio of 58.5%. The company's financial health is pressured by a high bad loans ratio at 2.5% and insufficient allowance for bad loans at 5%. Recently, EFG extended its buyback plan until the end of July 2024, potentially impacting future dividend sustainability.

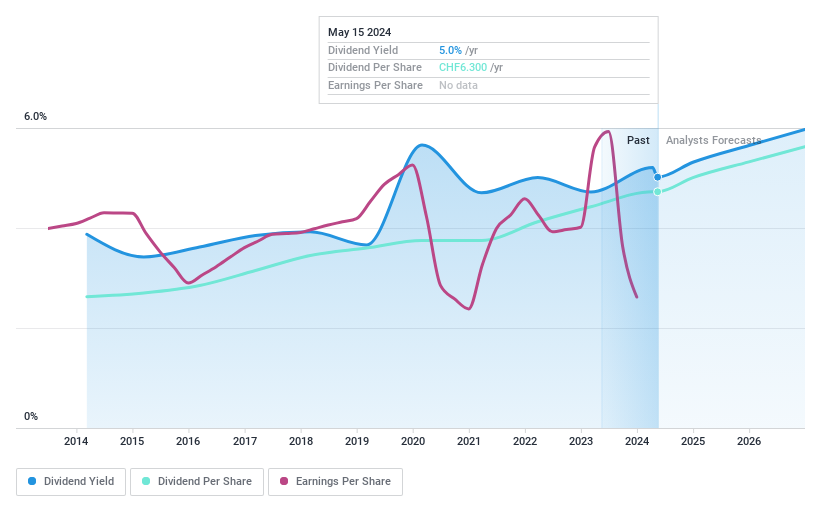

Helvetia Holding

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Helvetia Holding AG operates in the life and non-life insurance and reinsurance sectors across Switzerland, Germany, Austria, Spain, Italy, France, and other international markets with a market capitalization of approximately CHF 6.52 billion.

Operations: Helvetia Holding AG generates CHF 1.81 billion from its life insurance segment and CHF 7.09 billion from its non-life insurance operations.

Dividend Yield: 5.2%

Helvetia Holding AG recently proposed a dividend increase to CHF 6.3, reflecting a nearly 7% hike, effective from May 28, 2024. Despite a lower net income of CHF 283.2 million in 2023 compared to the previous year and earnings per share decreasing from CHF 8.03 to CHF 5.24, the company maintains a cash payout ratio of 36.5%, suggesting dividends are well covered by cash flows yet not by earnings with a high payout ratio of 120.3%. Helvetia's dividend yield stands at an attractive top-tier level in the Swiss market at over five percent but faces challenges with reduced profit margins and underwhelming earnings coverage.

Seize The Opportunity

Access the full spectrum of 26 Top Dividend Stocks by clicking on this link.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:CFT SWX:EFGN and SWX:HELN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance