Top Three Growth Companies With High Insider Ownership In May 2024

As global markets exhibit resilience, with major U.S. indices like the Dow Jones Industrial Average and S&P 500 reaching new highs, investor sentiment is buoyed by moderating inflation and favorable economic data. In this context, growth companies with high insider ownership are particularly compelling, as they often signal strong confidence from those who know the company best—its insiders—in its future prospects.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Gaming Innovation Group (OB:GIG) | 22.8% | 36.2% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 49.9% |

Elliptic Laboratories (OB:ELABS) | 31.4% | 124.6% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Nordic Halibut (OB:NOHAL) | 29.9% | 90.7% |

Vow (OB:VOW) | 31.8% | 99.4% |

EHang Holdings (NasdaqGM:EH) | 33% | 98.1% |

La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.6% |

Adocia (ENXTPA:ADOC) | 12.8% | 104.5% |

OSE Immunotherapeutics (ENXTPA:OSE) | 24.9% | 92.9% |

We'll examine a selection from our screener results.

Raia Drogasil

Simply Wall St Growth Rating: ★★★★★☆

Overview: Raia Drogasil S.A., a prominent retailer in Brazil, specializes in selling medicines, personal care, and beauty products, with a market capitalization of R$47.34 billion.

Operations: The company generates R$35.14 billion from the retail sale of medicines, cosmetics, and hygiene products.

Insider Ownership: 20.9%

Revenue Growth Forecast: 12.8% p.a.

Raia Drogasil has demonstrated robust financial performance, with a recent report showing first-quarter sales rising to BRL 9.1 billion from BRL 7.93 billion year-over-year, although net income slightly decreased. The company's earnings are forecasted to grow by 26.8% annually, outpacing the Brazilian market's average. With high insider ownership typically signaling confidence in the company's trajectory, Raia Drogasil is poised for growth, supported by strong revenue and profit forecasts and a solid return on equity projection of 27.6%.

Merdeka Battery Materials

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PT Merdeka Battery Materials Tbk operates in the mining and processing of nickel, cobalt, and other minerals, with a market capitalization of approximately IDR 65.34 billion.

Operations: The company generates revenue primarily from two segments: mining, which brought in $83.61 million, and manufacturing, contributing $1.31 billion.

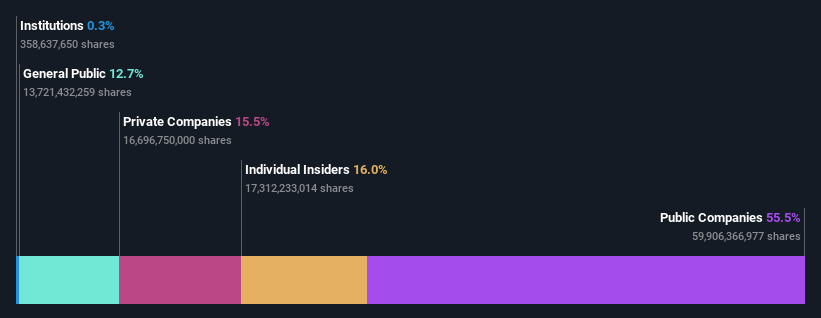

Insider Ownership: 16%

Revenue Growth Forecast: 19.9% p.a.

Merdeka Battery Materials, despite a volatile share price, shows potential with its earnings expected to grow significantly at 81.3% per year, outpacing the ID market's 30.3%. However, challenges persist as its profit margins have declined from last year's 4.8% to just 0.5%, and revenue growth projections are modest at 19.9% annually. Recent financial activities include sizable fixed-income offerings totaling IDR 1.5 billion in bonds due between 2025 and 2027, indicating a strategic push for capital amidst fluctuating earnings.

Chifeng Jilong Gold MiningLtd

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chifeng Jilong Gold Mining Co., Ltd. is a gold and non-ferrous metal mining company with a market capitalization of approximately CN¥29.66 billion.

Operations: The company generates revenue primarily from gold and non-ferrous metal mining.

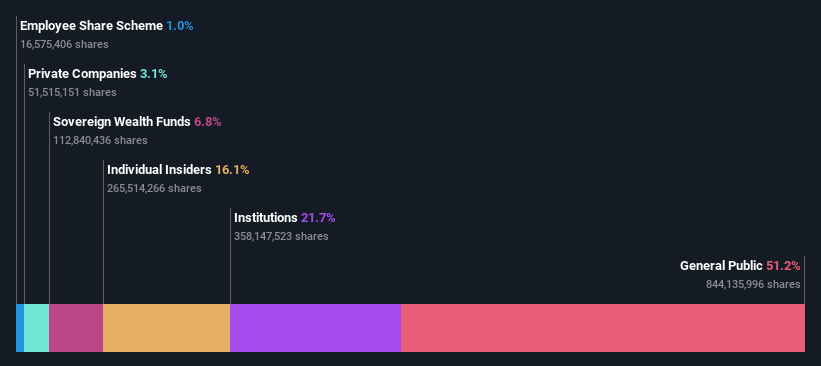

Insider Ownership: 16.1%

Revenue Growth Forecast: 15.5% p.a.

Chifeng Jilong Gold Mining Co., Ltd. has demonstrated robust growth with a significant earnings increase of 163.8% over the past year, and revenue also rising from CNY 1,586.75 million to CNY 1,853.84 million in Q1 2024. The company's earnings are expected to grow by 25.39% annually, outpacing the CN market's forecasted growth rate of 23.3%. Despite this strong performance, its Return on Equity is projected to be low at 18.6% in three years' time, suggesting potential challenges in maintaining profitability levels relative to shareholder equity.

Turning Ideas Into Actions

Embark on your investment journey to our 1489 Fast Growing Companies With High Insider Ownership selection here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include BOVESPA:RADL3 IDX:MBMA and SHSE:600988.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance