Trader Eyes £8 Million Payday on Half-Point BOE Cut Next Month

(Bloomberg) -- At least one trader is already looking beyond the UK election and betting the Bank of England will deliver an outsized interest-rate cut when its sets monetary policy next month.

Most Read from Bloomberg

Kamala Harris Is Having a Surprise Resurgence as Biden’s Campaign Unravels

Biden’s Fourth of July Shrouded by Pressure to Drop 2024 Bid

Singapore Couples Are Marrying Earlier to Buy Homes, Leading Some to Regret

Newsom Shocks California Politics by Scrapping Crime Measure

A large bet amassed in the options market this week will pay out almost £8 million ($10.2 million) — four times the initial outlay — if policymakers cut borrowing costs by 50 basis points to 4.75% at their meeting in August, data compiled by Bloomberg show.

That would be the biggest reduction since the pandemic, and a far more aggressive move than the market expects, which only sees the BOE bringing its key interest rate to that level by February next year.

Official commentary from the BOE has been sparse since the general election was called in May, with the only clues offered up in the minutes of last month’s policy decision. The accounts hinted that more rate setters may be close to backing a reduction after data showed inflation slowed to their 2% target in May.

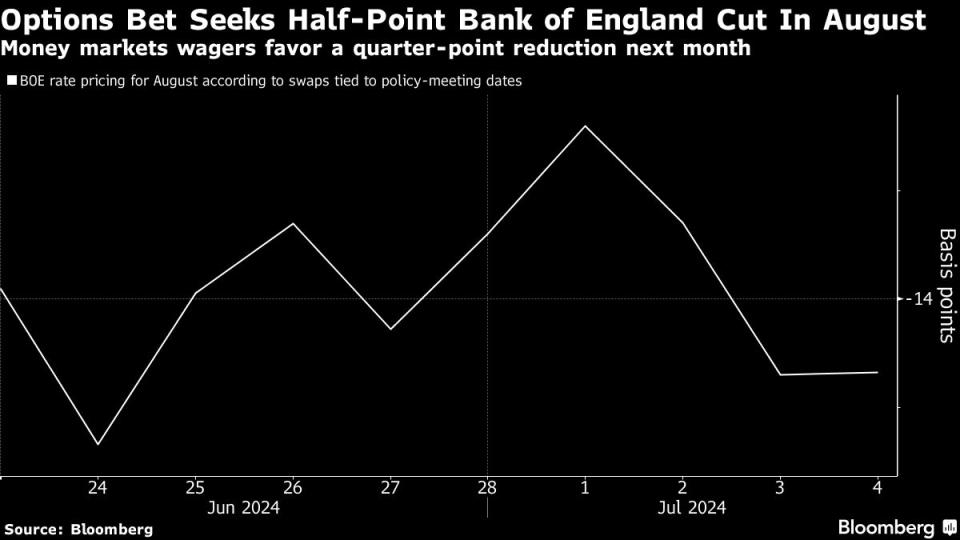

Still, traders are currently on the fence about whether there will even be a cut in August, with implied chances of single quarter-point cut at roughly 60%, according to swaps tied to meeting dates. September is seen as a much more likely start date.

The wager in question is an excess of 60,000 options on futures tied to SONIA — that’s the average that banks pay to borrow from one another overnight, and a proxy for the benchmark interest rate in the region.

Most Read from Bloomberg Businessweek

Dragons and Sex Are Now a $610 Million Business Sweeping Publishing

For Tesla, a Smaller Drop in Sales Is Something to Celebrate

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance