House prices hit new record as London homes sell for twice UK average

UK property prices hit a new record high in September, as the coronavirus crisis triggered surging demand for new homes.

Figures published on Wednesday confirm prices have broken official records, bearing out what lenders, property websites and estate agents have reported in recent months.

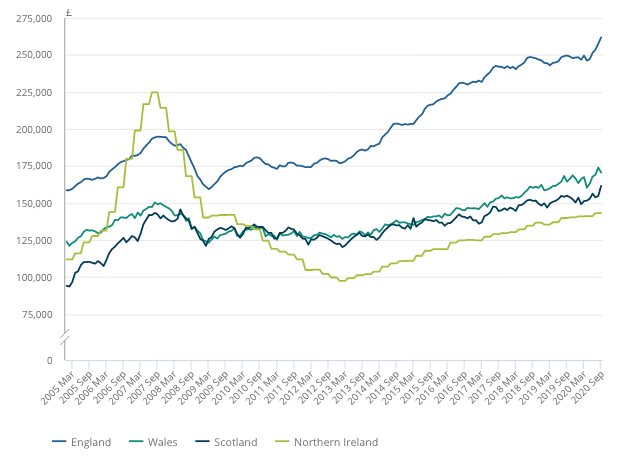

The average UK property sold in September, the latest month available, went for an all-time high of £245,000 ($326,000), according to the Office for National Statistics (ONS).

It marked a 4.7% increase year-on-year, in the fastest annual growth since October 2017. London’s prices also hit a new record high at almost twice the national average and three times average prices in north-east England, with the average transaction in the capital netting sellers £496,000.

The ONS figures are based on official property sale registers and generally lag behind industry figures by several months, reflecting the typical gap between sales being agreed, completed and then recorded by officials.

More recent industry data shows some early signs that momentum may be easing in the sales and price boom seen since the first national lockdown was lifted.

Rightmove (RMV.L) said on Monday the average price of a property coming to market this month was down 0.5% or £1,505 compared to last month. Average mortgage interest rates have also risen, though mortgage approvals in September were still at their highest since 2007.

READ MORE: UK house prices fall 0.5% as sellers ‘more realistic’ in run-up to stamp duty deadline

Experts expect the boom to lose steam once buyers and sellers stop believing they can hit an end-of-March deadline for the temporary stamp duty holiday in England and Northern Ireland. The wider economic downturn is also expected to eventually spill over into a cooler market, though predictions of a housing market slowdown this year have so far proved wide of the mark.

“Google Trends data show that visits to property websites were only 20% above their level a year ago in the last four weeks, a deterioration from the 28% increase in the previous eight weeks,” said Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

“High mortgage rates partly reflect lenders taking advantage of the surge in demand, but they also reflect a re-pricing in response to the deteriorating labour market, which will endure after demand has softened.”

Some estate agents report recent vaccine hopes boosting demand, however.

WATCH: Are low-traffic neighbourhoods a good idea?

Jeremy Leaf, a north London estate agent and a former Royal Institute of Chartered Surveyors (RICS) residential chairman, noted the figures were “a little dated.”

“Since then, activity cooled and was replaced by a more cautious approach, before the prospect of a COVID-19 vaccine reinvigorated the market. Even the prospect of further lockdowns and Christmas distractions are not deterring many from trying to take maximum advantage.”

READ MORE: Can the UK housing and construction boom ride out the winter?

Anna Clare Harper, CEO of asset managers SPI Capital, said a 4.7% price rise “suggests a ‘mini boom,’” but added: “Many feel this will be short lived, given economic circumstances and forecasts.

“However, the ‘fundamental’ drivers of housing demand are strong, and we are in an environment of low interest rates, with reduced rates of new buildings coming onto the market and limited existing stock.”

Watch: Why are house prices rising during a recession?

Yahoo Finance

Yahoo Finance