Unveiling Three ASX Growth Companies With Up To 18% Insider Ownership

The Australian market is showing signs of vitality, with the ASX200 poised for gains following upbeat sessions in the US markets and positive economic indicators hinting at potential interest rate cuts. Amidst this optimistic backdrop, understanding the influence of high insider ownership can be crucial in identifying growth companies that are well-positioned to navigate current market conditions.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Cettire (ASX:CTT) | 28.7% | 26.7% |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Change Financial (ASX:CCA) | 26.6% | 76.4% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Biome Australia (ASX:BIO) | 34.5% | 114.4% |

Liontown Resources (ASX:LTR) | 16.4% | 50.8% |

Argosy Minerals (ASX:AGY) | 14.5% | 129.6% |

Chrysos (ASX:C79) | 21.3% | 63.5% |

Let's dive into some prime choices out of from the screener.

Bell Financial Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bell Financial Group Limited, operating in Australia, offers a range of services including broking, online broking, corporate finance, and financial advisory to various client types with a market capitalization of approximately A$442.63 million.

Operations: The company generates revenue from several key segments: retail (A$103.58 million), institutional (A$50.36 million), products & services (A$48.10 million), and technology & platforms (A$26.20 million).

Insider Ownership: 10.7%

Bell Financial Group, while trading at 22.6% below its estimated fair value, exhibits a promising outlook with earnings expected to grow significantly by 26.9% annually, outpacing the Australian market's forecast of 13%. However, its dividend sustainability is questionable as it is not well covered by earnings or cash flows. The company recently presented at the Bell Potter Emerging Leaders Conference, highlighting its strategic initiatives amidst these financial dynamics.

Emerald Resources

Simply Wall St Growth Rating: ★★★★★☆

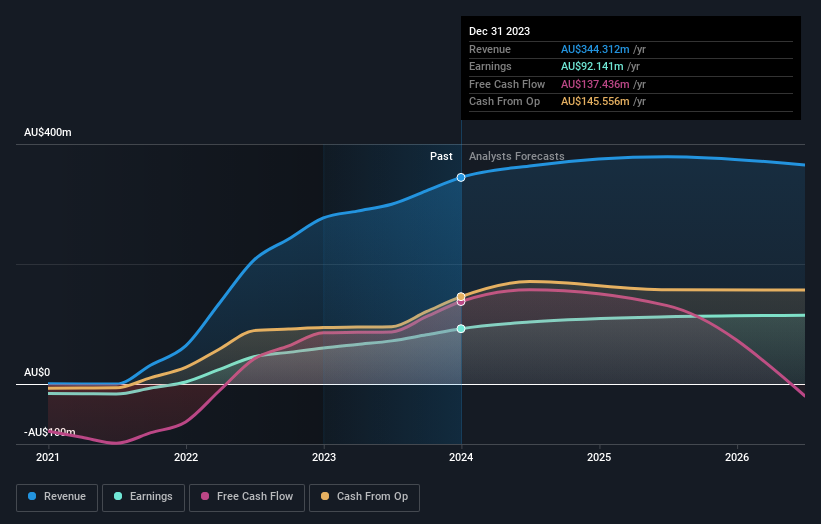

Overview: Emerald Resources NL is a company focused on the exploration and development of mineral reserves in Cambodia and Australia, with a market capitalization of approximately A$2.35 billion.

Operations: The primary revenue segment for the company is derived from mine operations, generating A$339.32 million.

Insider Ownership: 18.5%

Emerald Resources is poised for robust growth, with revenue and earnings forecast to outperform the Australian market's average, growing at 18.6% and 23.2% per year respectively. Despite past shareholder dilution, the company's return on equity is expected to reach a high of 20.7% in three years. However, there has been no significant insider trading activity in the last three months, which may raise questions about internal confidence levels amidst these growth projections.

Flight Centre Travel Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Flight Centre Travel Group Limited operates as a travel retailer serving both leisure and corporate sectors across various regions including Australia, New Zealand, the Americas, Europe, the Middle East, Africa, and Asia, with a market capitalization of approximately A$4.54 billion.

Operations: Flight Centre Travel Group's revenue is primarily derived from its leisure and corporate travel services, generating A$1.28 billion and A$1.06 billion respectively.

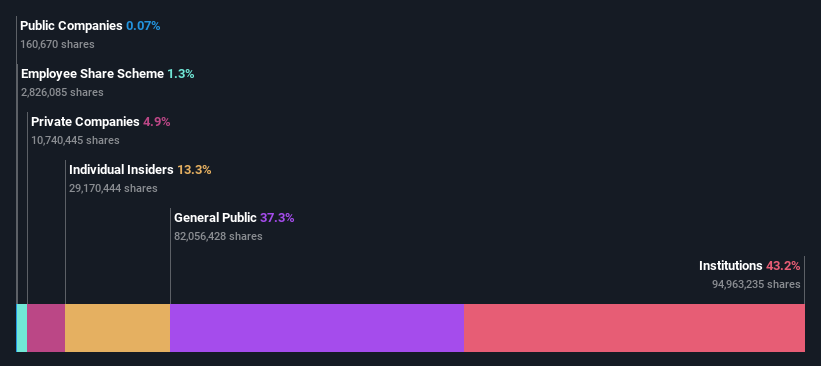

Insider Ownership: 13.3%

Flight Centre Travel Group has transitioned into profitability this year, with earnings expected to grow by 18.81% annually, outpacing the Australian market's forecast of 13%. Trading at 19.7% below its estimated fair value, the company shows promise for value investors. However, revenue growth projections are more modest at 9.7% per year, though still above the market average of 5.2%. Insider trading activity has been neutral recently, with no significant transactions reported in the past three months.

Taking Advantage

Gain an insight into the universe of 89 Fast Growing ASX Companies With High Insider Ownership by clicking here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:BFGASX:EMRASX:FLT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance