Unveiling Three Chinese Growth Companies With High Insider Ownership On The Shanghai Exchange

Amidst a backdrop of fluctuating global markets, China's Shanghai Exchange has demonstrated resilience, though it faces challenges from deflationary pressures and consumer caution. In such an environment, companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business. Exploring growth companies within this context not only aligns with current economic undercurrents but also offers potential stability and insight into firms deeply rooted in their strategic vision and execution.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) | 22% | 54.9% |

Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 24.8% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Ningbo Deye Technology Group (SHSE:605117) | 24.8% | 28.5% |

Fujian Wanchen Biotechnology Group (SZSE:300972) | 14.9% | 75.9% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

Here we highlight a subset of our preferred stocks from the screener.

QuantumCTek

Simply Wall St Growth Rating: ★★★★★☆

Overview: QuantumCTek Co., Ltd. specializes in producing information and communication technology security products and services enabled by quantum information technology, operating in China with a market capitalization of CN¥14.13 billion.

Operations: The company generates revenue primarily from the production of information and communication technology security products and services utilizing quantum information technology.

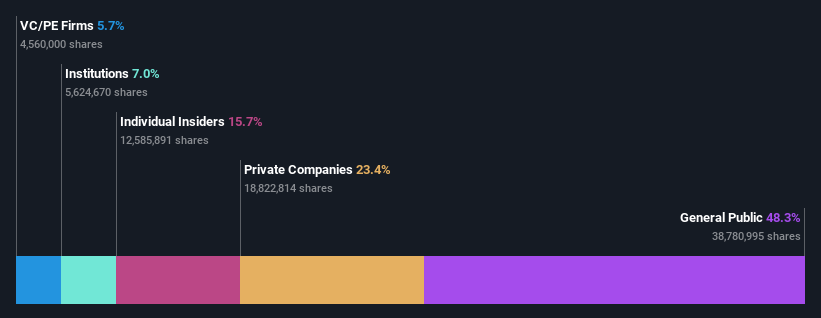

Insider Ownership: 15.7%

Earnings Growth Forecast: 141.8% p.a.

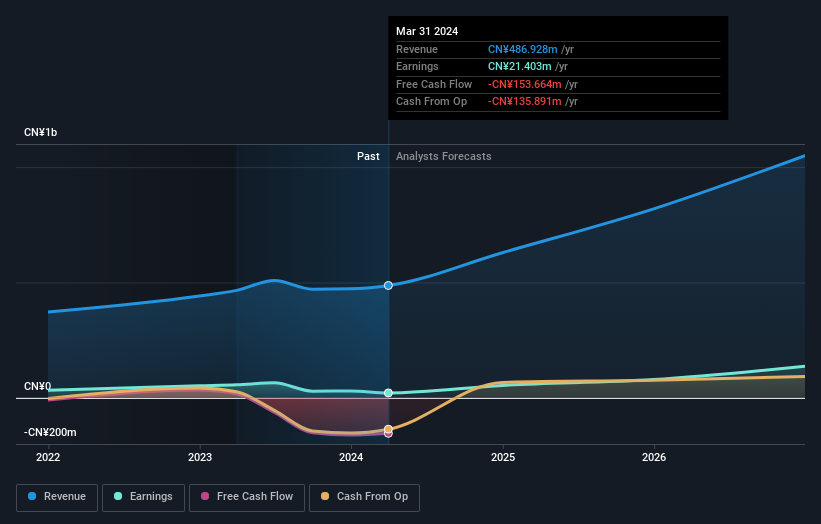

QuantumCTek, a Chinese growth company with significant insider ownership, has recently faced challenges with a substantial net loss reported in Q1 2024 (CNY 41.47 million) compared to the previous year. Despite these setbacks, the company is forecasted to become profitable within three years and expects revenue growth at an impressive rate of 47.8% per year, outpacing the market's average. However, investors should note the highly volatile share price in recent months and no significant insider trading activity reported over the past three months.

Maxic Technology

Simply Wall St Growth Rating: ★★★★★☆

Overview: Maxic Technology, Inc. specializes in designing and selling both analog and mixed-signal integrated circuits (ICs), operating both in China and globally, with a market capitalization of approximately CN¥3.39 billion.

Operations: The company primarily generates its income from the design and sale of analog and mixed-signal integrated circuits.

Insider Ownership: 24.4%

Earnings Growth Forecast: 55.3% p.a.

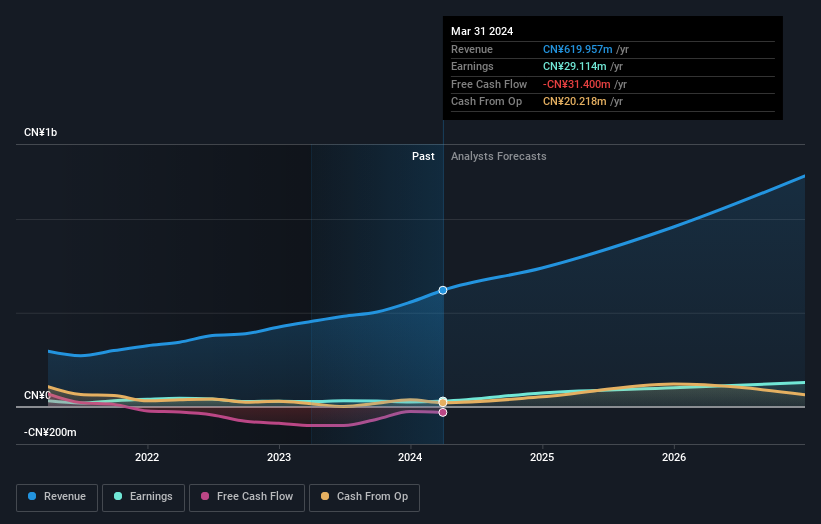

Maxic Technology, a Chinese growth company with high insider ownership, is poised for robust expansion with earnings expected to grow significantly over the next three years. Despite a recent net loss in Q1 2024 and lower profit margins compared to last year, revenue growth forecasts remain strong at 27.3% annually, outstripping the market average. However, potential investors should be cautious of its highly volatile share price and low forecasted return on equity in three years (4.2%).

Boji Medical TechnologyLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: Boji Medical Technology Ltd, operating under ticker SZSE:300404, specializes in offering contract research services for the development and production of drugs and medical devices, serving pharmaceutical companies both in China and globally, with a market capitalization of approximately CN¥3.21 billion.

Operations: The company generates its revenue by providing contract research services for the development and production of drugs and medical devices to pharmaceutical firms worldwide.

Insider Ownership: 37.7%

Earnings Growth Forecast: 41.9% p.a.

Boji Medical TechnologyLtd, a Chinese growth company with substantial insider ownership, is expected to see significant earnings growth of 41.87% annually over the next three years, outpacing both its past performance and market averages. Despite challenges such as shareholder dilution and low forecasted return on equity (9.3%), the firm's revenue growth remains robust at 25.1% annually. Recent dividends and consistent profit affirmations underscore its financial stability amidst these dynamics.

Make It Happen

Reveal the 362 hidden gems among our Fast Growing Chinese Companies With High Insider Ownership screener with a single click here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:688027SHSE:688458 and SZSE:300404

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance