Is the US dollar's dominance at risk?

The eroding dominance of the world's number one currency

Christian Ohde/Alamy

For decades, the mighty US dollar has reigned supreme as the world's reserve currency, main unit of account, and leading medium of exchange. The go-to for international transactions, it's safe to say that the greenback has seemed untouchable – until now.

Led by China and Russia, the BRICS nations are making a concerted effort to knock the dollar off its throne and are even planning to launch a rival gold-backed currency. Other possible challengers include the euro, which has long been touted as a replacement, as well as cryptocurrencies.

Read on to discover how the dollar took over the world, the threats it now faces, and why a major global push to dedollarise could spell catastrophe for America's economy.

All dollar amounts in US dollars, unless otherwise stated.

The dollar overtakes the pound as global top dog

FPG/Getty Images

While America became the world's biggest economy in the late 19th century, the US dollar didn't command top dog status until the end of World War I, when it surpassed the pound sterling as the pre-eminent international currency (as reported by the Atlantic Council).

Amid the Wall Street Crash of 1929 and the resulting Great Depression, the UK's currency temporarily regained the top spot, only to lose it permanently after World War II.

The Bretton Woods Agreement of 1944 created an international currency exchange system pegged to the US dollar and backed by gold. Following the war, the US became the world's banker, distributing huge loans to decimated countries in Europe and beyond.

The dollar's continued global dominance

T. Del Amo/ClassicStock /Getty Images

The dollar's hegemony continued even after President Nixon ditched the gold standard in 1971. During the decade that followed, oil and other commodities began to be priced in dollars, cementing the currency's supremacy. By the late 1970s, 85% of the world's foreign currency reserves were held in dollars.

The Japanese yen and German deutsche mark stole some of the reserve currency pie during the 1980s and 1990s, and the euro has emerged as the world's second most widely held reserve currency following its introduction in 1999.

However, the dollar remains the world's premier reserve currency by a long shot, dominating everything from trade to foreign exchange.

The dollar's foreign reserve and trade supremacy

chameleonsEye/Shutterstock

The dollar's share of central bank foreign reserves stands at 58% according to the Atlantic Council's Dollar Dominance Monitor.

That figure has hovered consistently at around 60% since the late 1990s, while the runner-up euro has a share of just 20%, which has also remained consistent since the currency's introduction. By way of comparison, the yen and pound sterling make up 5% apiece, while the Chinese renminbi's share is just 3%.

In terms of trade, the dollar is leader of the pack by a wide margin, with a 54% share in export invoicing. The euro's is 30%, while the yen, pound sterling, and renminbi make up just 4% each.

The dollar's forex dominance

Chris McGrath/Getty Images

The dollar is especially dominant when it comes to foreign exchange transactions, with the monetary lingua franca (common language) part of a whopping 88% of all FX transactions globally. This figure is only a shade lower than it was in the late 1980s. At 31%, the euro comes a pretty distant second in this respect.

Buttressed by the world's biggest economy and a number of other factors, including its stability, liquidity, and ease of conversion, the dollar accounts for 69% of global currency usage, as revealed by a recent analysis from asset management firm Vanguard.

By contrast, the euro's proportion is 23.1%, the yen's 7.3%, the pound sterling's 6.4%, and the renminbi's just 3%.

Past efforts to take on the dollar

INTERFOTO/Alamy

Given the dollar's massive global clout, toppling the currency from its lofty pedestal is a formidable challenge.

The deutsche mark and yen both failed to make a significant dent during the 1980s and 1990s, while the euro remains firmly in the greenback's shadow, despite being widely tipped to take the dollar's crown back in the 2000s. After the Saddam Hussein regime in Iraq started pricing oil in euros, there was even speculation the world's oil exporters would stop denominating the commodity in dollars, which some commentators predicted would crash the US economy.

In fact, pundits have been heralding the end of the dollar's dominance for decades. But the voices have amplified over the past couple of years in light of a barrage of new threats to the all-powerful greenback...

China's dedollarisation drive turbo-charged by the war in Ukraine

Kathy deWitt/Alamy

China started calling for a new global reserve currency in the 2000s and is now on a major drive to dedollarise, turbo-charging its mission to ditch the dollar over the past couple of years in particular.

The catalyst has been Russia's illegal invasion of Ukraine. The levying of tough Western sanctions on the Putin regime, which have included the freezing of $300 billion (£237bn) of Russia's foreign currency reserves and kicking Russian banks off the SWIFT payments messaging system, came as "an unwelcome surprise" for the powers that be in Beijing, according to Nikkei.

One thing's for certain: the "weaponisation" of the US dollar served as a serious wake-up call for the Chinese government.

China's vulnerable dollar foreign currency reserves

Gang Liu/Shutterstock

China's central bank (pictured) holds the largest foreign currency reserves in the world, at $3.2 trillion (£2.5tn).

A considerable proportion of this is made up of US dollars. If Beijing were to fall foul of Washington in a drastic way – for example, if it launched an invasion of Taiwan – there's every chance the US would prevent China from accessing its greenbacks.

With this in mind, the People's Republic and a number of other nations who don't have the best relations with America have embarked on a derisking push, which involves dumping the dollar in any way they can.

China's gold-buying spree

K.unshu/Shutterstock

As part of the push, China has been busily buying up gold, burning through its dollar reserves to do so.

The quintessential safe-haven investment, gold tends to increase in value during times of strife. Crucially, it can be stored domestically, making it immune from international sanctions.

Last year, the People's Republic bought a record 735 tonnes of the precious metal, more than any other country. According to numismatic expert Jan Nieuwenhuijs, two-thirds of the haul was purchased covertly.

China's gold holdings as a percentage of its total foreign reserves now officially stand at 4.9%, its highest figure ever. However, that number is still comparatively modest – the US's figure is closer to 75%, according to Investopedia.

Central banks swapping dollars for gold and China's SWIFT rival

Ralf Liebhold/Shutterstock

Countries aligned with the People's Republic, which the IMF has nicknamed the "China bloc", are also on a gold shopping spree in order to minimise their exposure to the dollar.

During the first quarter of this year, central banks bought up 290 tonnes of the prized metal, smashing all previous records and propelling the price of gold to dizzying new heights.

The sanctions on Russia have also prompted China to double down on its development of an alternative to the US-dominated SWIFT payment messaging system. It launched its own version, the Cross-Border Interbank Payment System (CIPS), in 2015.

CIPS now reportedly covers more than 4,500 banking institutions in 182 countries, though it has a very long way to go to even come near to matching SWIFT's transaction volumes and enormous reach.

Russia's moves to dedollarise

GREG BAKER/AFP via Getty Images

China's close ally, Russia, which has an even stronger incentive to dedollarise, has also set up a SWIFT alternative. Both countries are replacing the dollar in trade transactions and are urging other nations to do the same.

In April 2024, Russian Foreign Minister Sergey Lavrov (pictured) boasted that more than 90% of settlements between China and Russia are now being carried out in yuan or roubles. China has also arranged yuan trading and currency swap deals with other countries, including Saudi Arabia.

Saudi Arabia's dedollarisation proposal

Travelpixs/Shutterstock

Saudi Arabia has even floated the idea of pricing its oil exports in non-dollar currencies. As Professor Robert Wade of the LSE has pointed out, however, this seems to be part of a "bargaining strategy" with the US rather than an effort to erode the dollar's dominance.

Interestingly, Professor Wade highlights the "exorbitant burden" and "exorbitant privilege" of the US dollar as the world's de facto currency.

Coined by Professor Michael Pettis, a globally renowned expert on China's economy, the term refers to the downsides of dollar dominance, including the argument it fuels America's colossal deficit.

The renminbi as an alternative to the dollar?

Casper1774 Studio/Shutterstock

While China has been pushing the use of the renminbi as an alternative reserve currency, its current share of the global total is less than 3%, marking its lowest level in three years.

This is likely due to China's spluttering economy and strict capital controls, combined with concerns over its geopolitical alliances and increasing militarism, according to Reuters.

Professor Wade suggests that China may hesitate to promote the renminbi as the leading international currency given the "exorbitant burden" this would incur. It's little wonder that China is getting behind a collective BRICS currency instead...

The proposed gold-backed BRICS currency

Per-Anders Pettersson/Getty Images

BRICS is the bloc of emerging economies made up of Brazil, Russia, India, China, and South Africa. Egypt, Ethiopia, Iran, Saudi Arabia, and the UAE were also admitted to BRICS at the beginning of the year.

Spearheaded by Russia, the organisation is planning to launch its own international currency, backed by sanctions-immune gold.

The idea is for the currency to start out as a unit of account in transactions between BRICS countries, before later becoming a store of value and means of exchange, much like the dollar.

The flop IMF alternative promoted by China, Russia and more

STEFANI REYNOLDS/AFP via Getty Images

In the past, China and Russia have suggested replacing the dollar with the IMF's Special Drawing Rights (SDRs), as have the likes of France and Germany.

Created in 1969, these assets were initially tied to gold but are now based on a basket of five currencies: the euro, renminbi, yen, and pound sterling, in addition to the dollar. However, the supporting countries haven't been able to make SDRs happen.

A widely used gold-backed BRICS currency would be a dream come true for bloc members such as Russia and Iran, as they're currently sanctioned to the hilt.

China could invade Taiwan without worrying about the US completely cutting it off from global trade and the currency would also be a boon for two newer members, Ethiopia and Egypt, who are both currently plagued by dollar shortages. Brazil is also keen.

Could the BRICS currency supplant the dollar?

lucky_xtian/Shutterstock

What's more, Brazil has teamed up with Argentina to develop the sur, a new common currency for Latin America. But does the planned BRICS currency – referred to as the "R5" in honour of the five core members' currencies (renminbi, ruble, rupee, real, and rand) – or Latin American sur present realistic challenges to the dollar's dominance?

A number of experts are far from convinced. Fierce rivalry and division among BRICS nations, especially between China and India, could very well scupper the creation of the bloc's currency and Jim O'Neill, the former Goldman Sachs economist who first coined the term "BRIC", has branded it a "ridiculous" idea.

The sur has attracted similar levels of criticism, with advisory firm Oxford Economics deriding it as "irrelevant and also unfeasible".

India's unsuccessful efforts to dedollarise

JOAT/Shutterstock

Other efforts to dedollarise have fallen flat. India’s Oil and Gas Minister Hardeep Singh Puri admitted last year that dedollarisation was a long way off for India. The country is taking steps to reduce its reliance on the greenback, though it isn't having much luck.

India has been trying to pay for its oil imports in rupees for quite some time now. But no export nation has been willing to accept the currency, which shows just how much of an uphill struggle it is for countries to break away from using the dollar.

The euro's failure to challenge the dollar

olrat/Shutterstock

As we've mentioned, the euro has failed to challenge the dollar as the dominant global currency. Experts have put this down to a range of factors, including the lack of a common eurozone sovereign bond market.

Germany has floated the idea of a new EU-based payments system, although little effort is being made to enhance the euro's global role.

The EU is closely aligned with the US and its interests. Unlike the BRICS countries, which are dealing with Western sanctions, dollar shortages, and other greenback-related headwinds, it doesn't have a pressing need to replace the dollar.

Other potential contenders

Sergio J Lievano/Shutterstock

The Australian dollar, Swiss franc, and Canadian dollar are all being used more internationally but as the American Enterprise Institute (AEI) has noted, their respective financial systems and markets are simply too small. This minimises these currencies' potential impact on the US dollar's dominance.

No traditional national or collective currency appears to have what it takes to usurp the greenback. However, digital currencies have been touted by some as viable alternatives...

The threat to the US dollar posed by digital currencies

Panther Media GmbH/Alamy

Digital currency has three main varieties: cryptocurrency, stablecoins, and central bank digital currency (CBDC).

It's highly unlikely crypto could ever challenge the dollar: it's unregulated and subject to wild fluctuations in value, making it extremely undesirable for use as a global currency.

Stablecoins have a set value, though this is typically pegged to the dollar. According to the AEI, increased use of stablecoins may actually boost demand for dollars rather than decrease it.

Stablecoins and CBDCs

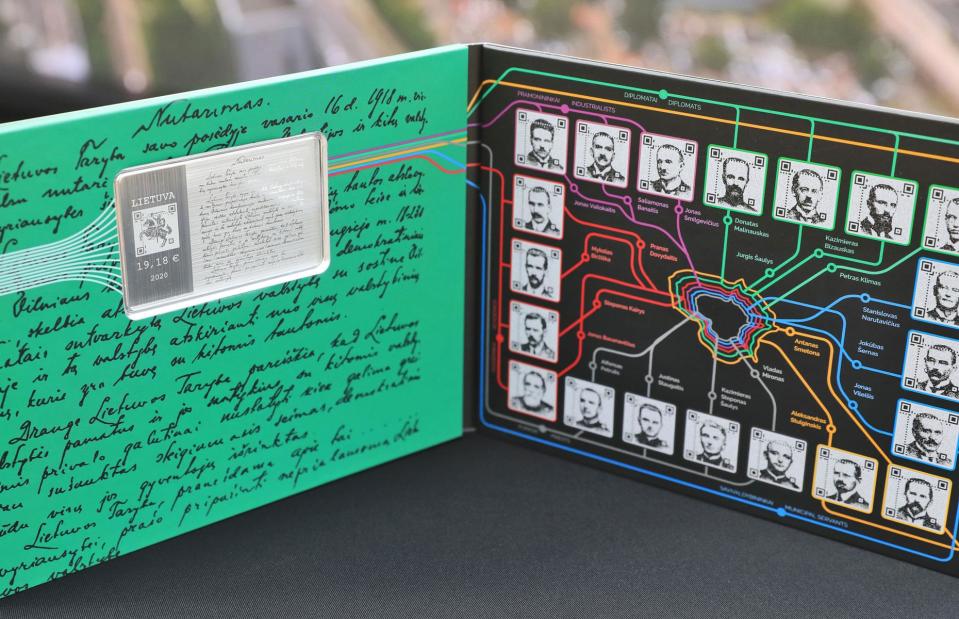

PETRAS MALUKAS/AFP via Getty Images

That said, the Foreign Policy Research Institute has warned that stablecoins could be used by hostile countries to evade US sanctions and undermine global confidence in the dollar because they circulate outside the oversight and supervision of the US financial system.

CBDCs could present an even bigger threat to the US dollar. According to the Atlantic Council, over 130 central banks representing 98% of the world's GDP have started programmes to develop their own digital currencies. These could gain traction as reserve currencies and alternative means of exchange in trade and other transactions, to the detriment of the dollar.

But like the other possible contenders, they face an uphill struggle. Shown here is the eurozone's first digital coin, which was issued by Lithuania's central bank in 2020.

The dollar's 'huge incumbency advantages'

nyker/Shutterstock

The dollar is so entrenched as the number one global currency that taking it on is little short of a Herculean task.

The dollar has what the LSE's Professor Wade calls "huge incumbency advantages". Institutions like Wall Street and American tech giants such as Alphabet, Amazon, and Apple are major players in the global economy, and immense economies of scale and infrastructure have been built up that make the dollar the most efficient currency to exchange on an international level.

Challenging the dollar's status as the world's reserve currency is incredibly difficult, too. The size and stability of the US economy, combined with other factors such as America's robust rule of law, all add up to underpin the dollar's dominance in this area. No other currency ticks as many boxes for the world's central banks.

A failing US economy could spell the demise of the dollar's dominance

corlaffra/Shutterstock

Be that as it may, the dollar still isn't invincible.

Writing for the AEI, erstwhile US Treasury economist Mark Sobel and Steven Kamin, a former director of the Fed's Division of International Finance, warn that a "severe deterioration" of the US fiscal, financial, and economic situation would knock the dollar off the global top spot.

According to Sobel and Kamin, this isn't outside of the realm of possibility, especially given "the political polarisation of the country, the dysfunction of the US Congress and the disinterest of politicians of all stripes in curbing the widening US budget deficit".

The worst-case scenario

Christian Ohde/Alamy

Nonetheless, the authors argue that the loss of dollar dominance wouldn't significantly affect the US economy if it were to come about as a result of other factors, such as the rise of a rival global reserve currency.

But other commentators beg to differ. They include analyst Michael Roch of the Lowry Institute, Australia's leading think tank. In a piece he wrote for the organisation's blog last August, the economic researcher argued that the dedollarisation trend could very well take off in a game-changing way.

Roch suggests it could spell catastrophe for the American economy, with central banks in BRICS nations and other economies dumping their dollar reserves and turning their backs on the currency forever.

Potential hyperinflation in the US

Illustronaut/Alamy

Shockingly, the Lowry Institute expert warns a mass dumping of the dollar would lead to levels of hyperinflation in the US that would probably make the price rises of the past couple of years seem tame. A spike in interest rates and falling asset prices would also be likely.

If this scenario were to happen, the average American would be considerably poorer. It's worth underlining that this is one of the more extreme viewpoints and the general consensus is that the dollar will remain the leader of the pack for the foreseeable future.

The dollar's amazing staying power

Oleg Elkov/Shutterstock

While the use of the greenback on an international basis may experience a decline, the chances of a rival stealing the dollar's thunder and overtaking it as the world's most popular reserve currency, main unit of account, and leading medium of exchange are decidedly slim, for the next few decades at least.

No other currency, whether existing or proposed, has the attributes the dollar possesses. Forces may be conspiring to take down the dollar, though their efforts are likely to be largely futile.

Now find out more about China's astonishing gold-buying spree

Yahoo Finance

Yahoo Finance