Viatris (VTRS) to Divest Some More Businesses, Shares Gain

Viatris VTRS recently announced agreements on planned divestitures targeted for 2023 to simplify the organization. Shares of the company gained 1.93% on Oct 2, 2023, on this news.

The company has received an offer from Cooper Consumer Health to divest its Over-the-Counter (OTC) business, including two manufacturing sites located in Merignac, France and Confienza, Italy and a Research & Development (R&D) site in Monza, Italy, for $2.17 billion. Cooper Consumer Health is a leading European OTC drug manufacturer and distributor.

Viatris has, however, decided to retain its rights for Viagra and Dymista, as well as other select OTC assets within certain markets. The transaction is expected to close in the second quarter of 2024.

Viatris has also entered into definitive agreements to divest its Women's Healthcare business and its Active Pharmaceutical Ingredients (API) business in India.

This API business will be sold to Iquest Enterprises, a privately held pharmaceutical company based in India. The transaction includes three manufacturing sites and an R&D lab in Hyderabad, three manufacturing sites in Vizag and third-party API sales. The company will retain some selective R&D capabilities in API. This transaction is expected to close in the first quarter of 2024.

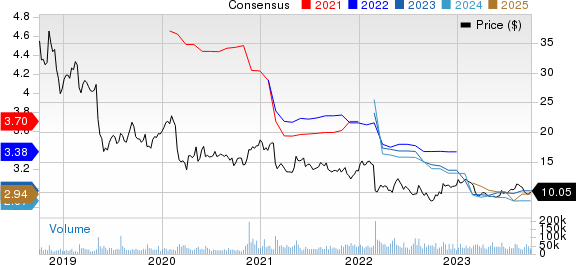

Viatris Inc. Price and Consensus

Viatris Inc. price-consensus-chart | Viatris Inc. Quote

The company will divest its Women's Healthcare business, primarily related to oral and injectable contraceptives, to Insud Pharma, a leading Spanish multinational pharmaceutical company. The transaction includes two manufacturing facilities in India - one in Ahmedabad and one in Sarigam. The transaction is expected to close in the first quarter of 2024.

The divestiture of its API business and Women's Healthcare business will result in gross proceeds of $1.2 billion.

Viatris entered into an agreement to divest its rights to women's healthcare products Duphaston and Femoston to Theramex by the fourth quarter of this year.

Agreements have also been signed to divest commercialization rights in certain non-core markets that were acquired as part of the Upjohn Transaction by the fourth quarter of 2023.

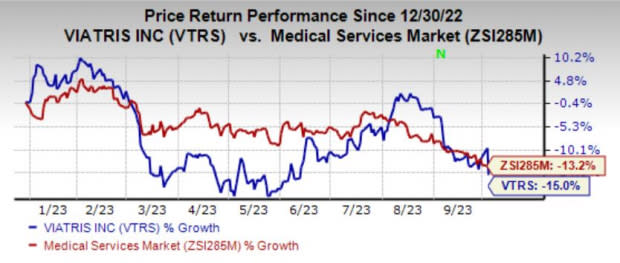

Year-to-date, shares of Viatris have lost 15% compared with the industry’s 13.2% decline.

Image Source: Zacks Investment Research

We remind investors that the company has previously sold its biosimilar portfolio to Biocon Biologics.

The gross proceeds from all these divestitures, including Biocon Biologics, are up to $6.94 billion, or approximately $5.2 billion in estimated aggregate net proceeds.

The proceeds from the divestitures will be mostly used by the company to pay down its debt.

The company expects the streamlined structure will help it focus on the therapeutic areas of ophthalmology, gastroenterology, and dermatology.

These divestitures are part of the company’s two-phase strategy. Phase II of this strategy is expected to begin next year.

Zacks Rank and Stocks to Consider

Viatris currently has a Zacks Rank #3 (Hold).

A few better-ranked stocks in the industry are Eton Pharmaceuticals ETON and Dynavax Technologies DVAX, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Loss estimates for Eton for 2023 have narrowed to 10 cents from 31 cents in the past 60 days, while earnings estimates for 2024 are pegged at 26 cents per share.

Loss estimates for Dynavax for 2023 have narrowed to 23 cents from 56 cents in the past 90 days, while earnings estimates for 2024 are pinned at 3 cents per share.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Eton Pharmaceuticals, Inc. (ETON) : Free Stock Analysis Report

Viatris Inc. (VTRS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance