Vodafone (VOD) Considers Selling Tower Assets to Trim Debt Burden

Per a Reuters report, Vodafone Group Public Limited Company VOD is mulling to divest its $2.3 billion stake in India's Indus Towers through stock market block deals next week. The strategic move is part of Vodafone’s broader effort to address its substantial debt load.

The British telecom giant holds a 21.5% stake in Indus Towers via various group entities. As of the most recent closing stock price in Mumbai, this investment is valued at approximately $2.3 billion. However, the exact size of the stake sale might be less than 21.5%, depending on market demand.

The transaction is crucial for Vodafone as it seeks to alleviate its massive $42.2 billion net debt.

The divestiture also aligns with Vodafone's 2022 announcement to sell its then-28% stake in Indus. However, progress has been slow, with only a small portion sold until now. Efforts to sell to rival telecom firms have not been fruitful, making stock market block deals a practical alternative.

Indus Towers, a major player in the global tower industry with around 220,000 towers, counts Bharti Airtel among its shareholders. From an industry perspective, block deals are gaining traction in India's bullish market, highlighted by British American Tobacco's recent $2 billion stake sale in ITC. Indus Towers, which reported a 20% increase in net profit to $221 million for the March 2024 quarter, remains an attractive asset, making this divestiture timely for both Vodafone and potential investors.

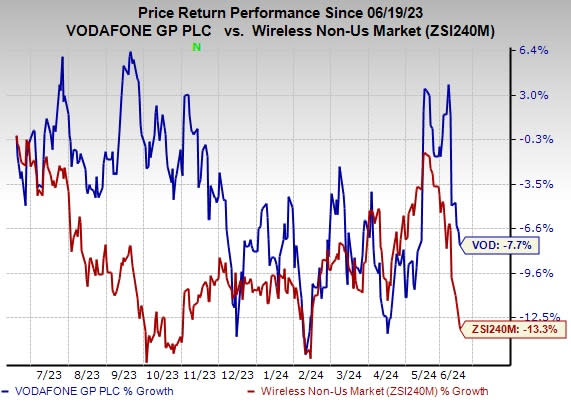

The stock has lost 7.7% over the past year compared with the industry’s decline of 13.3%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Vodafone currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Arista Networks, Inc. ANET, sporting a Zacks Rank #1 at present, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 15.7% and delivered an earnings surprise of 15.4%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed data center segment. Arista is increasingly gaining market traction in 200 and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

NVIDIA Corporation NVDA, currently flaunting a Zacks Rank #1, is another key pick in the broader industry. It is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit or GPU. Over the years, the company’s focus has evolved from PC graphics to AI-based solutions that now support high-performance computing, gaming and virtual reality platforms.

The company’s GPU platforms are playing major roles in developing multi-billion-dollar end-markets like robotics and self-driving vehicles. NVIDIA has a long-term earnings growth expectation of 30.9% and delivered an earnings surprise of 18.4%, on average, in the trailing four quarters.

Motorola Solutions, Inc. MSI, carrying a Zacks Rank #2 (Buy) at present, delivered an earnings surprise of 7.5%, on average, in the trailing four quarters. It has a long-term earnings growth expectation of 9.5%.

Motorola provides services and solutions to government segments and public safety programs, along with large enterprises and wireless infrastructure service providers. It develops and services both analog and digital two-way radio, voice and data communications products, and systems for private networks, wireless broadband systems and end-to-end enterprise mobility solutions to a wide range of enterprise markets.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vodafone Group PLC (VOD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance