Warner Bros. Discovery’s Zaslav Sees M&A ‘Opportunities’ in Next 2-3 Years: ‘There Are a Lot of Players That Are Losing a Lot of Money’

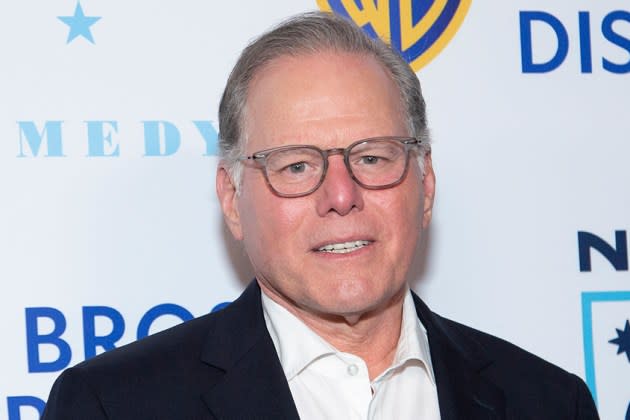

Warner Bros. Discovery, just over two years after closing the merger of WarnerMedia and Discovery, will be “opportunistic” about seeking M&A deals in the next two or three years, president and CEO David Zaslav said.

“I think some companies will be for sale,” Zaslav said, speaking Thursday at the Bernstein 40th Annual Strategic Decisions Conference in New York. “We can be opportunistic but we’re going to be very disciplined.”

More from Variety

Bill Walton, NBA Star, ESPN Commentator and Grateful Dead Superfan, Dies at 71

Warner Bros. Discovery Licenses College Football Playoff Games From ESPN as NBA Talks Continue

NBA Finals Basketball Games to Screen Live on Imax in Hong Kong, Taiwan

“I think there’s likely going to be some consolidation. There are a lot of players. There are a lot of players that are losing a lot of money,” Zaslav said. “One of the reasons why we really fought to drive our free cash flow and pay down our debt is to be in a position — as we roll out globally, as we fight to build our business — that we’re a healthy company.”

Speaking of losing money, Warner Bros. Discovery reported full-year 2023 revenue of $41.3 billion, down 4% on a pro-forma basis, and a net loss of $3.13 billion (versus a net loss of $5.36 billion on a pro-forma basis in 2022). The media conglomerate during the first quarter of 2024 repaid $1.1 billion of debt to end the quarter with $43.2 billion of gross debt.

“Over the next two to three years, I expect that there’s going to be some opportunities,” Zaslav said. “There’ll be some players that want to get out of the business, that will look to consolidate their streaming businesses with others. And so I think we will look to be opportunistic during that time,” he said, adding that he believes there will be 4-5 dominant global streaming platforms as things shake out.

“The global nature of this business is going to require a number of players to decide whether they want to go it alone,” according to Zaslav. He said “consolidation can happen in a lot of different ways,” including through bundling — such as WBD and Disney’s forthcoming Disney+/Hulu/Max bundle — and he also suggested “over the long term some of the smaller players in streaming will end up wanting to be part of a bigger global organization.”

Regarding Paramount Global — which has been in talks about a potential sale to Skydance Media and has been reviewing a joint bid from Sony Pictures-Apollo — Zaslav didn’t address WBD’s recent interest in exploring a merger with the company, but he commented in a lightning-round Q&A about Paramount, “Great storytelling heritage.” Zaslav met briefly late last year with Paramount’s then-CEO Bob Bakish to size up a potential merger but those talks didn’t continue.

Meanwhile, on WBD’s potential loss of NBA rights, Zaslav said the company is continuing to talk with the league about a new deal. Asked to contemplate a future without NBA games, he responded, “We feel very comfortable, and we’ve been very strategically focused on making sure that we have a robust offering of sports for each of our sports channels in the U.S. and around the world.”

“In general, we’re a leader in sports around the world,” he said. “Our job is to be very strategic about what content do we have… and making sure we have what we think creates real shareholder value.” He noted that WBD recently picked up college football rights sublicensed from ESPN. Zaslav said the strategy has been to yield “a very robust [sports] offering for consumers that they can watch on TNT in the U.S. all year round.”

The NBA’s media rights deals with both Disney’s ESPN and Warner Bros. Discovery expire after the 2024-25 season. The league has already worked out deal frameworks with ESPN as well as Amazon Prime Video and NBCUniversal, per multiple reports, while Warner Bros. Discovery believes it has a right to try to match a deal offered by any rival. Warner Bros. Discovery’s Turner and the NBA have been allied since 1989, with the relationship growing so strong that Turner has helped operate the NBA’s cable TV network and manage some of its digital properties.

About the WBD-Disney bundle with Disney+, Hulu and Max, Zaslav said that “if it works” it should reduce churn and provide a better overall customer experience. “Right now it’s a really challenging environment for consumers” to find content, he said. “I think it’s the beginning of this transition from people going to 10 different apps. Eventually, I think there’s going to be four or five,” Zaslav said, adding that he believes Max will be one of those.

“On a very basic level, the more often you watch a product, the more people in the family that watch the product, the lower the churn,” he said. “The idea of Warner Bros. Discovery and Disney together is a very compelling offering. We think that will provide a more nourishing, better consumer experience.”

Warner Bros. Discovery expects two-thirds of its Max subscriber growth going forward to come from international markets, Zaslav said, and the company is “hard bundling” Max with distributors like Canal+ in France.

Zaslav also called out WBD’s joint venture with Disney and Fox Corp. for Venu Sports, an app that will bundle of live channels slated to launch in the fall of 2024. “It’s a different approach. We think it will be very attractive,” he said, but didn’t discuss pricing. It’s aimed at younger sports fans who don’t subscribe to traditional pay-TV services.

As he has in the past, Zaslav touted WBD’s content franchises and argued that “the good news is a lot it has been underused,” citing the Harry Potter TV series greenlit for 10 consecutive seasons and Peter Jackson’s return to making a “Lord of the Rings” movie for Warner Bros. set for 2026 release.

“We have some of these tentpole, IP storytelling content [franchises] that people know everywhere in the world,” the CEO said. “So whether it’s Superman or Batman or Wonder Woman, our whole DC franchise that James Gunn is really driving, or whether it’s ‘Harry Potter’ or ‘Lord of the Rings’ or ‘Game of Thrones,’ we sit with content.”

Best of Variety

Sign up for Variety’s Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.

Yahoo Finance

Yahoo Finance