Why Aozora Bank's Dividend Falls Short And One Stock That Shines

Investors often turn to dividend stocks for a reliable income stream. However, it's important to assess the sustainability of these dividends. A high payout ratio, as seen with Aozora Bank, can signal potential risk in maintaining future dividends. This article will explore why such stocks might not be ideal for your investment portfolio and highlight a more promising option.

Top 10 Dividend Stocks In Japan

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.74% | ★★★★★★ |

Globeride (TSE:7990) | 3.78% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.56% | ★★★★★★ |

Nihon Tokushu Toryo (TSE:4619) | 3.86% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 6.61% | ★★★★★★ |

KurimotoLtd (TSE:5602) | 5.11% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.05% | ★★★★★★ |

DoshishaLtd (TSE:7483) | 3.47% | ★★★★★★ |

Innotech (TSE:9880) | 3.93% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.38% | ★★★★★☆ |

Click here to see the full list of 376 stocks from our Top Dividend Stocks screener.

Below we spotlight one of our favorites from our exclusive screener and one you might the flick.

Top Pick

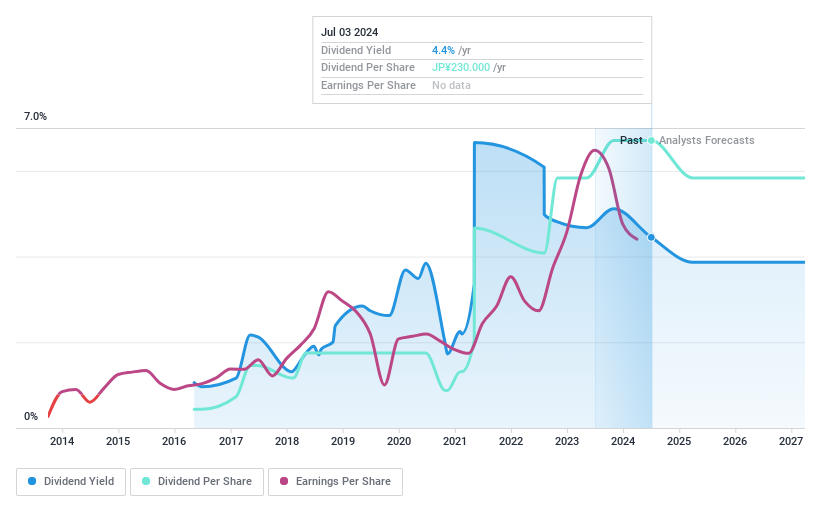

Nippon Yakin Kogyo

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Yakin Kogyo Co., Ltd. is a global manufacturer and seller of stainless steel products, with a market capitalization of approximately ¥65.48 billion.

Operations: The company's primary business is the global manufacturing and sales of stainless steel products.

Dividend Yield: 4.4%

Nippon Yakin Kogyo, with a dividend yield of 4.45%, stands above the Japanese market average of 3.4%. The company's dividends are well-supported by earnings and cash flows, with a payout ratio of 29.4% and a cash payout ratio of 17.3%, indicating sustainability compared to firms with excessive payouts. Despite its relatively short dividend history and some volatility in payments, recent share buybacks totaling ¥1.85 billion underscore a commitment to shareholder returns and capital efficiency.

One To Reconsider

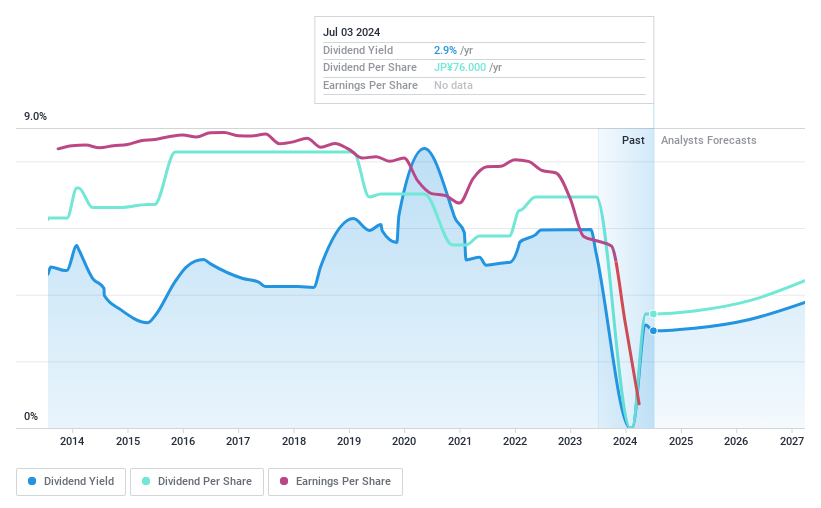

Aozora Bank

Simply Wall St Dividend Rating: ★☆☆☆☆☆

Overview: Aozora Bank, Ltd. operates in Japan and internationally, offering a wide range of banking products and services, with a market capitalization of approximately ¥360.47 billion.

Operations: Aozora Bank's revenue is generated through various segments, with the Structured Finance Group contributing ¥41.57 billion, followed by the International Business Group at ¥19.53 billion, Institutional Banking Group at ¥16.29 billion, and Customer Relations Group providing ¥7.83 billion.

Dividend Yield: 2.9%

Aozora Bank's dividend attractiveness is marred by several issues. The bank's current dividend yield of 2.92% is below the top quartile of Japanese dividend payers which stands at 3.4%. Furthermore, the sustainability of these dividends is questionable; they are not well-covered by earnings and have shown volatility over the past decade, with a significant annual drop exceeding 20% at times. Recent strategic alliances and capital injections, such as those from Daiwa Securities Group, indicate efforts to stabilize and grow but have yet to address underlying profitability concerns directly affecting dividend reliability.

Where To Now?

Click this link to deep-dive into the 376 companies within our Top Dividend Stocks screener.

Have you diversified into one of these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:5480 and TSE:8304.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance