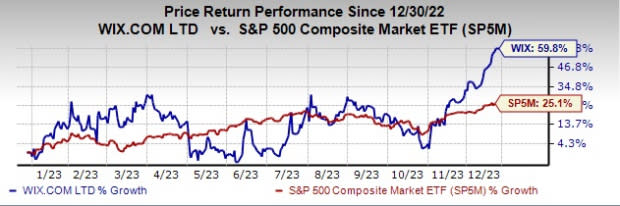

WIX Stock Gains 59.8% YTD: Will the Upward Trend Continue?

Wix.com WIX witnessed healthy momentum this year so far. Shares of the company have gained 59.8% year to date compared with the S&P 500 Composite’s growth of 25.1%.

Wix is a cloud-based web development platform that offers solutions that enable businesses, organizations, professionals and individuals to develop customized websites and application platforms.

Image Source: Zacks Investment Research

Catalysts Behind the Price Surge

Let’s delve deeper to unearth the factors working in favor of this Zacks Rank #3 (Hold) stock.

The company is benefiting from solid momentum in the Creative Subscriptions’ and Business Solutions’ segments. In the third quarter, Creative Subscriptions’ revenues increased 11% year over year, whereas Business Solutions’ revenues rose 22%. Apart from this, continued momentum in annualized recurring revenues from the Creative Subscriptions segment is a major tailwind.

The company’s cloud-based platform is well-positioned to address the growing needs of merchants at a time when social media, cloud computing, mobile devices and data analytics are transforming the e-commerce marketplace. Per an iMarc report, the global e-commerce market is forecasted to witness a CAGR of 27.2% between 2024 and 2032 and reach $183.8 trillion.

The conversion of new users to paid subscriptions, strong customer retention and increasing average revenue per subscription augur well. At the third-quarter end, registered users were 258 million. The company plans to tap the growing demand for artificial intelligence (AI) by launching new products like Conversational AI Chat for businesses and AI Meta Tags Creator. These help users build their online business profile and enhance their website.

The company continues to launch several user-friendly applications and ink strategic collaborations to meet the requirements of a dynamic retail environment, consequently adding to the user base. In December, the company joined forces with the creator of PaidBy — ISX Financial EU Plc — which will allow Wix's UK-based merchants to leverage PaidBy's open banking payment platform. Customers can also make payments directly from their banking application or web portal using PaidBy, which, in turn, improves the checkout process and enhances conversion rates.

Going ahead, the company expects 2023 revenues and free cash flow margin to rise owing to business momentum. The management now anticipates 2023 revenues to grow 12-13% and in the range of $1,558-$1,563 million (earlier view: growth of 11-12% and in the range of $1,543-$1,558 million).

However, the volatile macroeconomic environment and unfavorable foreign currency fluctuations are likely to have acted as headwinds. Stiff competition and rising accumulated deficits are major headwinds.

A Look at Estimates

WIX’s earnings per share (EPS) estimate for 2023 is pegged at $4.18. It incurred a loss of 17 cents per share in 2022. The Zacks Consensus Estimate for 2024 EPS is pegged at $4.67.

The Zacks Consensus Estimate for 2023 EPS has increased to $4.18 from $3.33 in the past 60 days, reflecting analysts’ optimism. The consensus estimate for 2024 EPS has improved to $4.67 from $3.53 over the same time frame.

The company’s revenues for 2023 are projected to rise 12.4% to $1.56 billion. For 2024, the metric is anticipated to climb 11.9% to $1.75 billion.

WIX outpaced estimates in all the trailing four quarters, delivering an earnings surprise of 283.6%, on average.

Stocks to Consider

Some better-ranked stocks in the broader technology space are Pegasystems PEGA, Flex FLEX and Watts Water Technologies WTS. Pegasystems and Flex presently sport a Zacks Rank #1 (Strong Buy), whereas Watts Water Technologies carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Pegasystems’ 2023 EPS has improved 21.2% in the past 60 days to $1.77. PEGA delivered an average earnings surprise of 1,250.2% in the trailing four quarters. Shares of PEGA have soared 51% in the past year.

The Zacks Consensus Estimate for Flex’s fiscal 2024 EPS has increased 3.6% in the past 60 days to $2.56. Flex’s long-term earnings growth rate is 12.4%.

Flex’s earnings outpaced the Zacks Consensus Estimate in each of the last four quarters, the average earnings surprise being 11%. Shares of the company have risen 19.8% in the past year.

The Zacks Consensus Estimate for Watts Water Technologies 2023 EPS has improved 3.9% in the past 60 days to $8.08. Watts Water’s long-term earnings growth rate is 7.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Flex Ltd. (FLEX) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report

Pegasystems Inc. (PEGA) : Free Stock Analysis Report

Wix.com Ltd. (WIX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance