How the zero-based budgeting method could boost your savings

Budgeting is a key way of taking control of your finances, and there are plenty of different methods to try out.

Search for “budgeting techniques” on social media and you will find plenty of tactics, such as the 50/30/20 rule or the 1p challenge – but there is another route to giving each penny a purpose.

Known as zero-based budgeting, this method is similar to running a business, where you account for every penny that comes in and goes out of your current account.

Alex King, founder of financial education platform Generation Money, said: “Zero-based budgeting as a concept originates from accounting techniques used to justify business expenditures each new financial year.

“Instead of applying a percentage increase to a department’s budget, zero-based budgeting requires that every existing and new expense be individually justified. It is considered a more rigorous, albeit time-consuming, method of controlling expenses.”

Here, Telegraph Money explains how zero-based budgeting works and how it could boost your saving and spending.

What is zero-based budgeting?

The zero-based budgeting technique takes account of all your earnings each month and gives every bit of income and expenditure a category, so you know how much to put towards spending such as energy, transport, food, entertainment and hopefully savings.

Ifedapo Francis Awolowo, senior lecturer in financial and management accounting at Sheffield Business School, said: “It is a fresh approach to spending wisely.”

The primary appeal of zero-based budgeting is that every pound and penny is accounted for.

Unlike other methods, such as the popular 50/30/20 rule that splits your spending between needs, wants and savings, zero-based budgeting has wider categories.

Rachel Kerrone, personal finance expert at Starling Bank, said: “Zero-based budgeting provides a detailed breakdown of your spending.

“It allows you to dedicate specific amounts of money to specific categories, without a single penny being left aside.”

Louise Hill, chief executive of pocket money app GoHenry, said zero-based budgeting can help people think more carefully about what they are buying and decide if it’s worth the expense, while also helping parents teach their kids about saving and budgeting.

She said: “It’s a good way to get people to consider their needs vs wants, reduce impulse buys on unnecessary things and establish healthier financial habits.”

How zero-based budgeting works

First you need to work out how much income you have.

This is easy if you are paid a regular salary as you can see the figure on your payslip. A self-employed person would need to monitor how much income they are getting each month and what they are withdrawing while accounting for tax.

Once you know your income, the hard work begins.

You need to allocate a specific spending category to each pound you earn.

Mr King suggested starting with your mortgage or rent as well as main household bills, food costs and any debts you may be repaying.

He added: “Then, you move on to discretionary spending such as non-grocery shopping, dining out and entertainment. After deciding on these allocations, you can designate the remaining funds to savings and investments.”

The allocations can be made on a piece of paper or spreadsheet. Alternatively, some banks such as Starling offer tools that let you ringfence money into different categories such as energy, shopping or savings.

Ms Kerrone added: “When your budget is complete, your income minus expenses and savings should equal zero.

“This allows you to see exactly how much you spend and where, which in turn allows you to see where you have opportunities to cut back on unnecessary spending or where you can save or allocate more money than you previously thought.”

How to work out a zero-based budget?

Your zero-based budget will depend on your earnings.

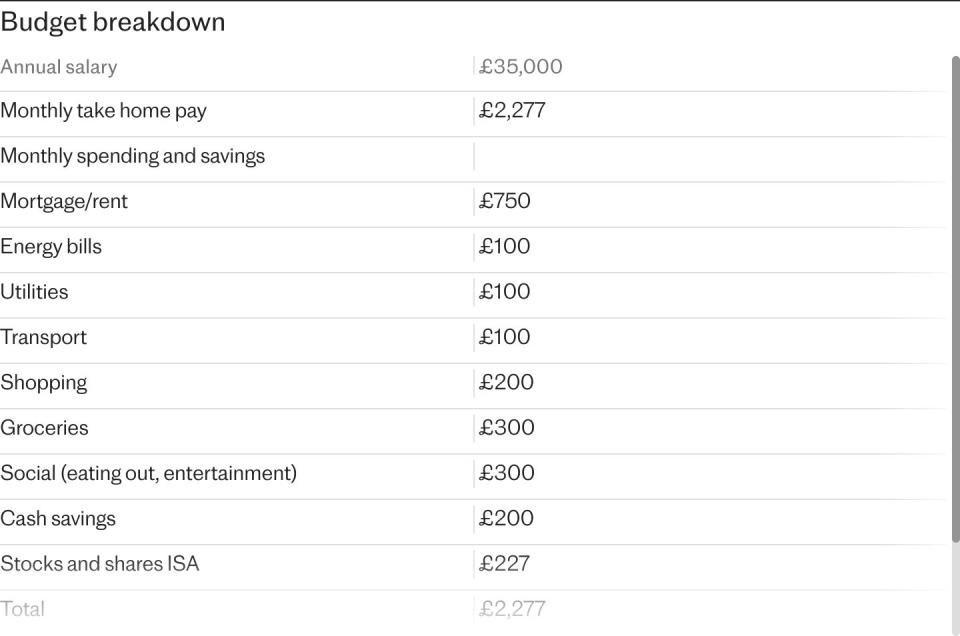

For example, if you earn the average UK salary of £35,000 you will have £2,277 of post-tax take-home pay to work with each month.

That assumes you aren’t using other company benefits such as pension contributions, or paying off a student loan.

Calculations by Generation Money show that from the £2,277, £750 could go towards your mortgage or rent, £100 each to energy bills, utilities and transport, £300 each on groceries and entertainment and £200 on shopping.

That leaves £200 for cash savings and £227 to put in a stocks and shares Isa each month.

There may be other categories to consider such as childcare if you are a parent.

You can also double your budget if you use the technique with your partner or spouse.

Pros of zero-based budgeting

The main benefit of zero-based budgeting is that it helps you meticulously track your expenses.

Brian Byrnes, head of personal finance at savings app Moneybox, said “Without actually knowing where your money is going, it can be hard to make accurate and confident budgeting decisions.

“With zero-based budgeting, every pound and penny that leaves your account is accounted for and is a conscious decision.”

It can help see how much you have leftover each month or where cutbacks are needed, while helping prioritise your savings and investments.

Ms Kerrone added: “If you’re someone who regularly gets to the end of the month and finds that you don’t have enough money for your rent or other essentials, allocating your income into a range of categories will help to stay on track.

“On the other hand, if you often find yourself having quite a lot left over at the end of the month, why not put this aside from the start of the month and build a rainy day or holiday fund.”

Cons of zero-based budgeting

Zero-based budgeting only really works if you have a fixed income.

It may be more tricky for a self-employed person where your earnings may fluctuate, unless you are willing to change your calculations each month.

Mr King suggests having a “balancing” category item can help, such as allocating any remaining budget to an Isa, even if it varies.

There are also likely to be unexpected expenses that come up, such as if you need to fix a leak at home or your car breaks down.

Ms Hill added: “It’s impossible to predict the price of everything in advance or account for sudden price hikes for example, so people should be mindful of that when using this approach.

“Always having a rainy-day fund in place, regardless of whatever budgeting method you use, is the best way to provide a safety net for unexpected expenses.”

It also depends on how committed you are to the technique. Setting up a spreadsheet or spending plan is one thing, but actually controlling your spending and sticking to a budget still requires plenty of willpower.

Mr Byrnes added: “Some may find the meticulous nature of zero-based budgeting too time consuming and obsessive, and require more flexibility. It’s important that saving and budgeting becomes a positive experience, so trying and testing different methods might be key.”

Yahoo Finance

Yahoo Finance