Lam Research Corporation (LRCX)

NasdaqGS - NasdaqGS Real-time price. Currency in USD

Add to watchlist

At close: 04:00PM EDT

After hours:

| Previous close | 1,055.83 |

| Open | 1,065.05 |

| Bid | 1,063.63 x 100 |

| Ask | 1,064.46 x 100 |

| Day's range | 1,052.97 - 1,086.72 |

| 52-week range | 574.42 - 1,101.81 |

| Volume | |

| Avg. volume | 981,109 |

| Market cap | 139.22B |

| Beta (5Y monthly) | 1.47 |

| PE ratio (TTM) | 39.09 |

| EPS (TTM) | 27.24 |

| Earnings date | 24 Jul 2024 - 29 Jul 2024 |

| Forward dividend & yield | 8.00 (0.75%) |

| Ex-dividend date | 18 Jun 2024 |

| 1y target est | 1,019.95 |

Zacks

ZacksLam Research (LRCX) Stock Sinks As Market Gains: What You Should Know

In the closing of the recent trading day, Lam Research (LRCX) stood at $1,054.78, denoting a -0.09% change from the preceding trading day.

Investor's Business Daily

Investor's Business DailyChip Gear Stocks Rise On Micron's Capex Plans

Applied Materials and Lam Research saw their shares rise after memory-chip maker Micron forecast a sizable increase in capital spending.

PR Newswire

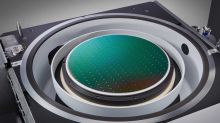

PR NewswireLam Research Highlights its Progress to Create a Better World Through Semiconductor Innovation in 2023 ESG Report

Lam Research Corp. (Nasdaq: LRCX) today released its 2023 Environment, Social, and Governance (ESG) report, detailing accomplishments, and quantified results in these areas as the company continues to unleash the power of innovation for a better world.