5 Stocks With Recent Dividend Hike for a Stable Portfolio

U.S stock markets continue to exhibit a strong performance in 2024. Year to date, the three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — were up 2.6%, 14.3% and 19.3%, respectively. The broad-market index S&P 500 and the tech-heavy Nasdaq Composite have already posted several all-time highs both intraday and closing basis in the first half of this month.

However, we are not out of the woods. On Jun 12, in his post-FOMC meeting statement, Fed Chairman Jerome Powell indicated just one cut of 25 basis points in the Fed fund rate in 2024. This is a significant reduction from three rate cuts for 2024, as hinted in the March FOMC meeting.

Consequently, the terminal rate of the benchmark lending rate increased to 5.1% this year instead of 4.6% projected in March. The Fed kept the existing interest rate range of 5.25-5.5% intact, and, the statement regarding inflation was almost the same.

The post-meeting statement said, “Inflation has eased over the past year but remains elevated.” The only change is that the new statement mentioned, “In recent months, there has been modest further progress toward the Committee’s 2% inflation objective.” The previous statement was “a lack of further progress” on inflation.

Moreover, the Fed’s projection for long-term interest rate (a benchmark that neither boosts nor restricts growth) increased to 2.8% from the 2.6% forecast earlier. It shows that Fed officials are more inclined toward a “higher interest rate for longer.”

Stocks in Focus

At this stage, dividend-paying stocks should be in demand as investors try to safeguard their portfolios. We believe one should consider stocks that have recently raised their dividend payments.

Five such companies are — Hancock Whitney Corp. HWC, UnitedHealth Group Inc. UNH, Eni S.p.A. E, FedEx Corp. FDX and Hamilton Lane Inc. HLNE. Each of our picks carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

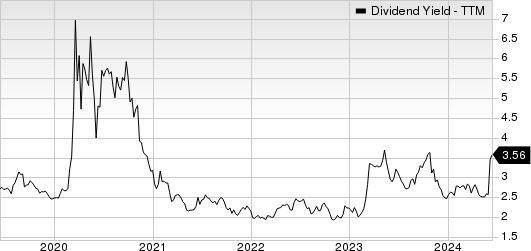

Hancock Whitney has been benefiting from an increase in non-interest income and a higher loan balance. Strategic expansion initiatives and a solid loan balance are likely to aid HWC’s top line. We project total revenues to rise 3.2% in 2024.

Hancock Whitney is likely to meet debt obligations and sustain its capital distribution plans, given a solid liquidity position. Further, high rates will aid HWC’s net interest margin (NIM) expansion. We expect NIM to rise to 3.39% this year.

On Jun 5, 2024, Hancock Whitney declared that its shareholders would receive a dividend of $0.40 per share on Jun 14, 2024. It has a dividend yield of 3.4%. Over the past five years, HWC has increased its dividend two times, and its payout ratio presently stays at 24% of earnings. Check HWC’s dividend history here.

Hancock Whitney Corporation Dividend Yield (TTM)

Hancock Whitney Corporation dividend-yield-ttm | Hancock Whitney Corporation Quote

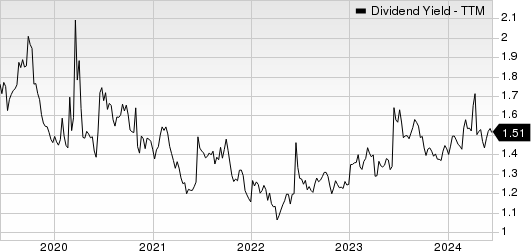

UnitedHealth Group’s top line remains poised for growth on the back of a strong market position, new deals, renewed agreements and expansion of service offerings. UNH’s solid health services segment provides diversification benefits. The Government business of UNH remains well-poised for growth in the future.

UnitedHealth Group’s adjusted net earnings per share are anticipated to be in the $27.5-$28.00 band in 2024, higher than the 2023 reported figure of $25.12. A sturdy balance sheet enables business investments and prudent deployment of capital via share repurchases and dividend payments.

On Jun 5, 2024, UnitedHealth Group declared that its shareholders would receive a dividend of $2.10 per share on Jun 25, 2024. It has a dividend yield of 1.7%. Over the past five years, UNH has increased its dividend six times, and its payout ratio presently stays at 29% of earnings. Check UNH’s dividend history here.

UnitedHealth Group Incorporated Dividend Yield (TTM)

UnitedHealth Group Incorporated dividend-yield-ttm | UnitedHealth Group Incorporated Quote

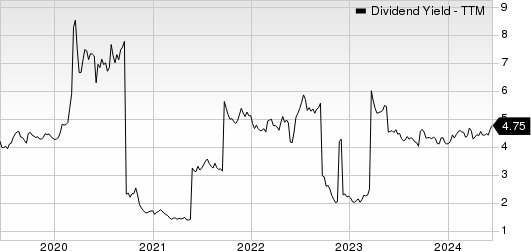

Eni’s long-term growth will be driven by its increased focus on expanding upstream operations. Eni is set to increase its natural gas production, as this will play a vital role in its journey toward decarbonization.

Eni has successfully diversified into renewable energy sources through its subsidiary, Plenitude, which has achieved significant growth. Moreover, E has consistently maintained a higher dividend yield compared to its sub-industry peers, reflecting its strong commitment to returning capital to shareholders.

On Jun 5, 2024, Eni declared that its shareholders would receive a dividend of $0.372 per share on Oct 7, 2024. It has a dividend yield of 4.8%. Over the past five years, E has increased its dividend nine times, and its payout ratio presently stays at 32% of earnings. Check E’s dividend history here.

Eni SpA Dividend Yield (TTM)

Eni SpA dividend-yield-ttm | Eni SpA Quote

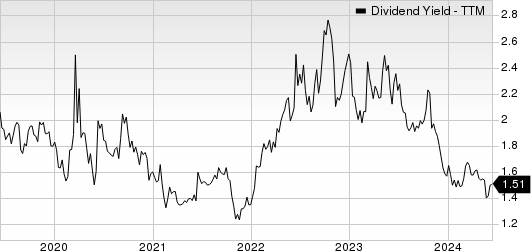

FedEx is realigning its costs under a companywide initiative called DRIVE. These initiatives are likely to result in annual cost savings of $4 billion by 2025. However, related benefits are already driving bottom-line expansion and liquidity. FDX continues paying dividends and buying back shares. FDX expects to repurchase $2.5 billion of common stock and pay $1.3 billion in dividends during fiscal 2024.

On Jun 10, 2024, FedEx declared that its shareholders would receive a dividend of $1.38 per share on Jul 9, 2024. It has a dividend yield of 2.2%. Over the past five years, FDX has increased its dividend four times, and its payout ratio presently stays at 29% of earnings. Check FDX’s dividend history here.

FedEx Corporation Dividend Yield (TTM)

FedEx Corporation dividend-yield-ttm | FedEx Corporation Quote

Hamilton Lane is a private equity firm specializing in early venture, emerging growth, turnaround, middle market, mature, mid-venture, bridge, buyout, distressed/vulture, loan, and mezzanine in growth capital companies.

HLNE prefers to invest in energy, industrials, consumer discretionary, health care, real estate, information technology, utilities, and consumer services. HLNE prefers to invest in Africa/Middle East, Asia/Pacific, Europe, Latin America and the Caribbean, the United States and Canada.

On Jun 12, 2024, Hamilton Lane declared that its shareholders would receive a dividend of $0.49 per share on Jul 5, 2024. It has a dividend yield of 1.6%. Over the past five years, HLNE has increased its dividend five times, and its payout ratio presently stays at 45% of earnings. Check HLNE’s dividend history here.

Hamilton Lane Inc. Dividend Yield (TTM)

Hamilton Lane Inc. dividend-yield-ttm | Hamilton Lane Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Eni SpA (E) : Free Stock Analysis Report

FedEx Corporation (FDX) : Free Stock Analysis Report

Hamilton Lane Inc. (HLNE) : Free Stock Analysis Report

Hancock Whitney Corporation (HWC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance