Coronavirus: Second wave fears spark drive volatility for stocks

Trade in stocks continued to be volatile around the world on Monday, amid fears about a resurgence in COVID-19 infections.

Stock markets on both sides of the Atlantic opened with drops of 2% or more on Monday. Analysts said the sharp sell-off was driven by fears about rising COVID-19 cases worldwide.

“Equity markets start the week under pressure on weaker than expected Chinese retail sales and industrial production, [and] continued evidence of a second wave of COVID-19 in some parts of emerging markets and the sunbelt in the United States, either through mismanagement, as in Brazil, or as the economy re-opens,” said Sebastien Galy, a senior macro strategist at Norwegian bank Nordea.

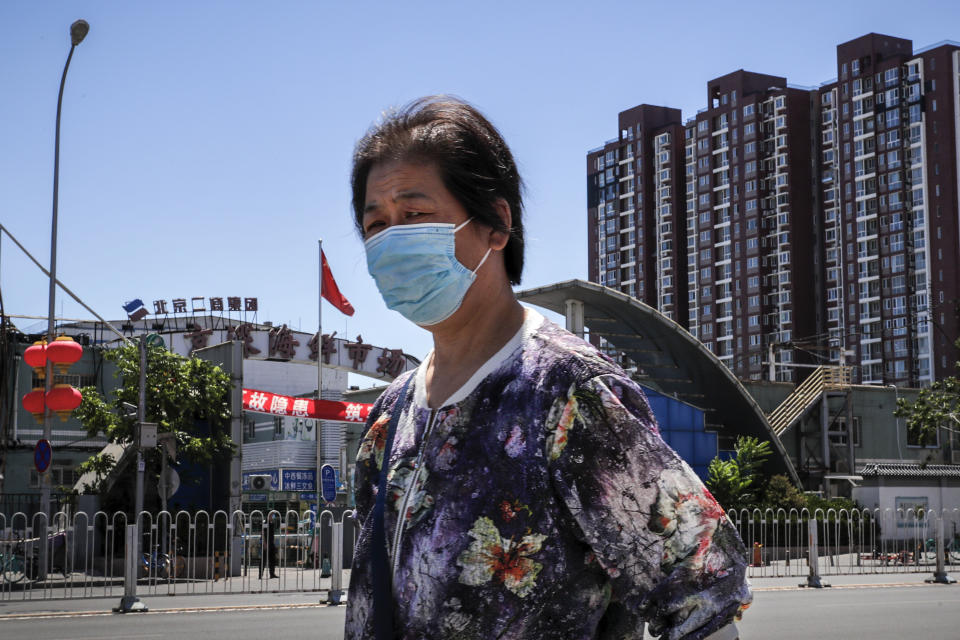

California, Texas, Florida and Arizona continue to battle serious outbreaks in the US. A new outbreak was also detected in Beijing over the weekend, said to have originated in a food market. China has introduced localised restrictions in response.

Still, the stocks sell-off in Europe and the US moderated as the session wore on. European stock markets ended the day in the best position they had been all session. The FTSE 100 (^FTSE) closed down just 0.6%, while the DAX (^GDAXI) was 0.3% lower and the CAC 40 (^FCHI) fell 0.4%.

Losses had also moderated on Wall Street by the time trade ended in Europe. At 5.30pm, the S&P 500 (^GSPC) was down just 0.2%, the Dow (^DJI) was off just 0.4% and the Nasdaq (^IXIC) had turned positive for the day, with a gain of 0.2%.

“There were Sunday headlines of China seeing the largest increase in new cases since April and a very localised lockdown around a market in Beijing,” strategist Jim Reid and his team at Deutsche Bank wrote in a note to clients on Monday morning. “However, at 57 new cases reported in a country of 1.4 billion people, we have to put this into some perspective.

“This rounded up the 1-day new case growth to 0.1% after 62 days of 0.0% growth. A further 49 cases have been reported overnight with Beijing shutting down housing districts in and around the market in focus.”

READ MORE: House prices jump in England as estate agents overwhelmed

Asian markets closed lower on Monday. Japan’s Nikkei (^N225) lost 3.4% and the Hong Kong Hang Seng (^HSI) fell 2.1%. On mainland China, the Shanghai Composite (000001.SS) dropped 1% and the Shenzen Component (399001.SZ) fell 0.5%.

Monday’s choppy session follows a similarly volatile day on Friday and a steep sell-off on Thursday last week.

Globally there are now 7.9 million cases of COVID-19 and the 7-day moving average in daily new cases has hit an all-time high, according to the World Health Organisation (WHO)’s latest situation report.

Yahoo Finance

Yahoo Finance