Euronet (EEFT) Expands ATM Network in Malaysia With Buyout

Euronet Worldwide, Inc. EEFT recently announced its acquisition of Malaysian Electronic Payment System (“MEPS”) ATM terminals in a bid to expand its reach in the Malaysian market. By integrating this extensive network into its existing operations, Euronet solidifies its position as a major player in the country's non-bank ATM sector. The move underscores the company's commitment to providing secure and reliable cash access to millions of customers, including those in underserved rural areas.

This move bodes well as it enhances EEFT’s Ren payment platform. This acquisition aligns with its broader strategy of expanding its ATM operations globally through strategic acquisitions. By offering comprehensive ATM outsourcing services, the company provides banks and operators with opportunities to enhance business continuity and extend their reach and services to customers. Euronet will benefit from increased revenue opportunities through service charges and transaction fees. Higher transaction volumes and profitability poise the company for growth.

MEPS ATMs were fully transferred to Euronet by Apr 1, 2024. The company expects the rebranding move to be completed by 2025. This move is a win-win situation for all parties involved. While sellers will be able to divest their ATM networks strategically, buyers can expand their presence and customers can benefit from enhanced services.

This move is time opportune as Euronet expects that the number of ATMs outside of Europe could equal those in Europe in the next five to 10 years. Moves such as redeploying underperforming ATMs and acquiring new ATMs are expected to boost the EFT segment’s revenues in the future.

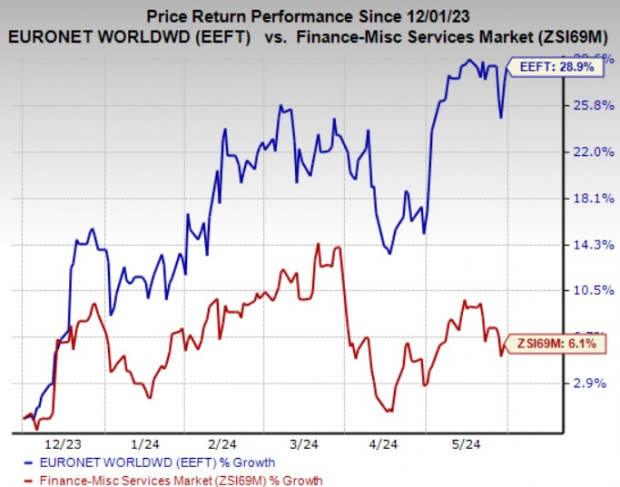

Zacks Rank and Price Performance

Euronet currently carries a Zacks #2 (Buy).

Shares of EEFT have risen 28.9% in the past six months compared with the industry’s 6.1% growth.

Image Source: Zacks Investment Research

Other Stocks to Consider

Other top-ranked stocks in the insurance space are HCI Group, Inc. HCI, Old Republic International Corporation ORI and RLI Corp. RLI. While HCI Group sports a Zacks Rank #1 (Strong Buy), Old Republic and RLI carry a Zacks Rank of 2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

HCI Group’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 139.2%. The Zacks Consensus Estimate for HCI’s 2024 earnings indicates an improvement of 57.6% from the year-ago reported figure, while the same for revenues implies growth of 40.9%. The consensus mark for 2024 earnings has moved 13.1% north in the past 30 days.

Old Republic's earnings outpaced estimates in three of the last four quarters and missed the mark once, delivering an average surprise of 6.6%. The Zacks Consensus Estimate for 2024 earnings implies an improvement of 3.8% from the year-ago reported figure, while the same for revenues indicates growth of 6.8%. The consensus estimate for 2024 earnings has moved 1.1% north in the past 60 days.

RLI’s earnings surpassed estimates in three of the trailing four quarters and missed the mark once, the average surprise being 132.4%. The Zacks Consensus Estimate for RLI’s 2024 earnings indicates an improvement of 18.2% from the year-ago reported figure, while the same for revenues implies growth of 15.3%. The consensus estimate for RLI’s 2024 earnings has moved 1.7% north in the past 30 days.

Shares of HCI Group, Old Republic and RLI have risen 84.5%, 28.4% and 15.9%, respectively, in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

Euronet Worldwide, Inc. (EEFT) : Free Stock Analysis Report

Old Republic International Corporation (ORI) : Free Stock Analysis Report

HCI Group, Inc. (HCI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance