Exploring Three SGX Dividend Stocks For Stable Income Opportunities

Amidst a landscape where trend-following strategies are demonstrating resilience across various market conditions, investors in Singapore's SGX might consider the stability offered by dividend stocks. These stocks can serve as a strategic component in portfolios, aiming to provide steady income streams even during volatile phases. A good dividend stock typically features robust fundamentals and a consistent payout history, qualities that are particularly appealing in the current environment where long-term gains and risk management are paramount.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

Civmec (SGX:P9D) | 6.20% | ★★★★★★ |

Singapore Exchange (SGX:S68) | 3.62% | ★★★★★☆ |

Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | 3.33% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 7.02% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.66% | ★★★★★☆ |

BRC Asia (SGX:BEC) | 7.55% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.80% | ★★★★★☆ |

Singapore Airlines (SGX:C6L) | 7.13% | ★★★★★☆ |

YHI International (SGX:BPF) | 6.63% | ★★★★★☆ |

Sing Investments & Finance (SGX:S35) | 6.09% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top SGX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

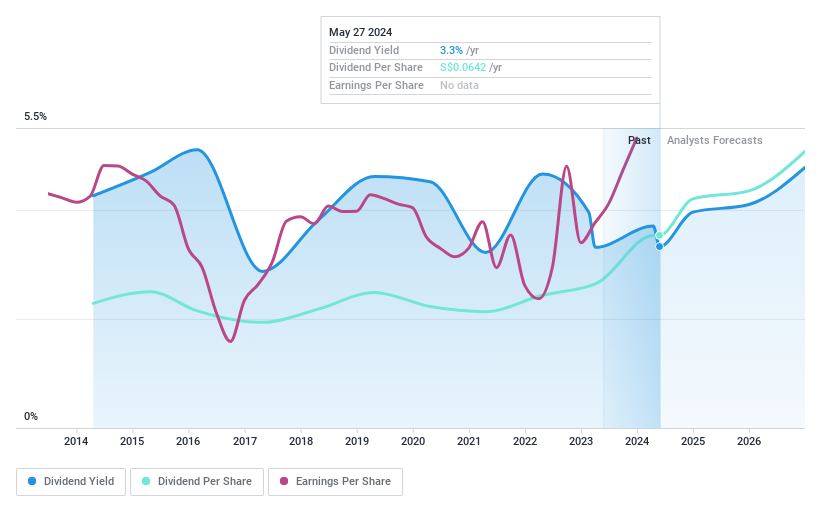

Yangzijiang Shipbuilding (Holdings)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yangzijiang Shipbuilding (Holdings) Ltd. is an investment holding company that specializes in shipbuilding, operating across Greater China, Canada, Japan, Italy, Greece, and other European countries with a market capitalization of SGD 7.62 billion.

Operations: Yangzijiang Shipbuilding (Holdings) Ltd. generates revenue primarily through its shipbuilding segment, which accounted for CN¥22.79 billion, and its shipping operations, which contributed CN¥1.02 billion.

Dividend Yield: 3.3%

Yangzijiang Shipbuilding's recent board restructuring could influence governance and strategic decisions, potentially impacting its dividend policy. The company declared a final dividend of SGD 0.065 per share for FY2023, reflecting a stable payout amid solid financial health evidenced by a low cash payout ratio of 19.1% and earnings coverage at 33.6%. Despite a modest yield of 3.33%, which is below the top quartile in Singapore's market, the consistency in dividend growth over the past decade underpins its reliability as a dividend stock, although it may not appeal to those seeking high yields.

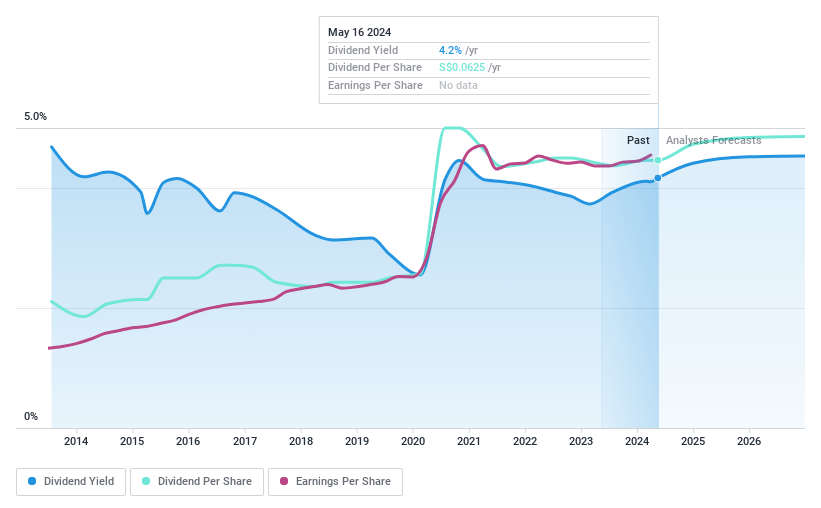

Sheng Siong Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sheng Siong Group Ltd is an investment holding company that operates a chain of supermarket retail stores in Singapore, with a market capitalization of SGD 2.29 billion.

Operations: Sheng Siong Group Ltd generates its revenue primarily through supermarket operations that sell consumer goods, totaling SGD 1.39 billion.

Dividend Yield: 4.1%

Sheng Siong Group recently reported a rise in Q1 2024 sales to SGD 376.19 million and net income to SGD 36.32 million, alongside an increase in EPS. The firm declared a final dividend of SGD 0.032 per share, reflecting its ongoing commitment to shareholder returns despite a history of volatile dividends. Recent executive appointments could steer operational enhancements, potentially influencing future financial stability and dividend sustainability, which is currently supported by a reasonable cash payout ratio of 50.1%.

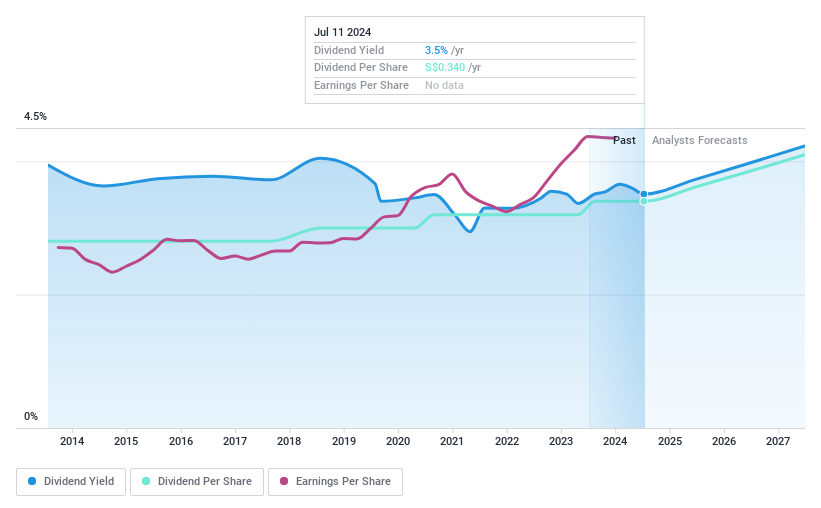

Singapore Exchange

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Singapore Exchange Limited operates as an integrated securities and derivatives exchange with related clearing houses in Singapore, boasting a market capitalization of SGD 10.05 billion.

Operations: Singapore Exchange Limited generates revenues primarily from segment adjustments amounting to SGD 843.68 million and fixed income, currencies, and commodities totaling SGD 371.53 million.

Dividend Yield: 3.6%

Singapore Exchange maintains a steady dividend track record with a 10-year history of consistent and growing payouts, supported by a payout ratio of 63% and cash payout ratio of 79.1%. Despite its dividend yield of 3.62% being lower than the top quartile in Singapore's market, its dividends are well-covered by both earnings and cash flows. Recent corporate activities include participation in industry conferences and internal board restructurings, indicating active management engagement and governance oversight.

Get an in-depth perspective on Singapore Exchange's performance by reading our dividend report here.

Where To Now?

Discover the full array of 21 Top SGX Dividend Stocks right here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:BS6 SGX:OV8 and SGX:S68.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance