Keurig Dr Pepper's (KDP) Strategic Initiatives Look Encouraging

Keurig Dr Pepper Inc. KDP seems well-poised for growth, thanks to its robust business strategies. The company has been gaining from expansion initiatives, innovation, brand strength and pricing actions. It has also been launching various products and expanding distribution across the international markets.

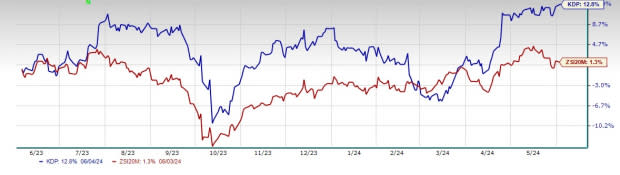

Shares of this energy drinks and alternative beverages’ marketer have gained 12.8% compared with the industry’s 1.3% growth over the past year.

More on Strategies

Continued momentum in the Refreshment Beverages segment has been aiding Keurig Dr Pepper’s performance for a while now. In the first quarter, sales in the U.S. Refreshment Beverages segment rose 4.3% year over year to $2.1 billion, reflecting higher net price realization. Results were driven by higher pricing, persistent elasticities across most categories and contribution from KDP's commenced distribution partnership with Nutrabolt for C4 Energy. Continuation of this trend will continue to aid the top line in the near term.

In addition, management highlighted an evolving enterprise strategy, which focuses on five pillars to deliver sustainable growth. These comprise a road map to guide the company’s employees' actions every day with directives to champion consumer-obsessed brand building, shape its now and next beverage portfolio, amplify the route-to-market advantage, produce fuel for growth and dynamically allocate capital.

Image Source: Zacks Investment Research

Keurig Dr Pepper is experiencing strong market share gains across categories. In the first quarter, across its Canadian coffee business, market share grew for Keurig brewers and for the owned and licensed pod portfolio led by the Van Houtte brand. Management has been investing in the route-to-market capabilities, including the on-premise expansion in Canada, and is focused on strengthening the DSD network in Mexico. In addition, management looks forward to strengthening the company’s international route to market capabilities.

The aforementioned catalysts, along with continued brand strength and significant pricing, have been aiding Keurig Dr Pepper’s performance for a while now. This led to impressive first-quarter 2024 results, wherein the top and bottom lines surpassed the Zacks Consensus Estimate. Both earnings and revenues improved year over year. Net price realization grew 3.1% from the year-ago quarter. Continued strength in the company's brand portfolio and in-market execution, along with elasticity across most categories, aided revenues.

Notably, management projects constant-currency net sales growth in the mid-single-digit range and adjusted earnings per share to rise in high-single-digits in 2024. The view also reflects continued momentum in the U.S. Refreshment Beverages and international segments.

Analysts seem quite optimistic about this Zacks Rank #3 (Hold) company. The Zacks Consensus Estimate for 2024 sales and earnings per share (EPS) is currently pegged at $15.4 billion and $1.91, respectively. These estimates imply corresponding growth of 4% and 6.7% year over year. The consensus mark for 2025 sales and EPS is presently $15.6 billion and $2.05, respectively, indicating increases of 3.6% and 7.1% year over year.

To wrap up, Keurig Dr Pepper seems to be a decent investment bet based on the aforementioned positives.

Stocks to Consider

The Chef’s Warehouse CHEF, which engages in the distribution of specialty food products, currently carries a Zacks Rank #2 (Buy). CHEF has a trailing four-quarter earnings surprise of 23.4%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for The Chef’s Warehouse’s current fiscal year sales and earnings indicates growth of 9.5% and 7.9%, respectively, from the year-ago reported numbers.

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently carries a Zacks Rank of 2. VITL has a trailing four-quarter average earnings surprise of 102.1%.

The consensus estimate for Vital Farms’ current financial-year sales and earnings implies growth of 17.2% and 37.3%, respectively, from the year-ago reported numbers.

Utz Brands Inc. UTZ, which manufactures a diverse portfolio of salty snacks, currently carries a Zacks Rank of 2. UTZ has a trailing four-quarter earnings surprise of 2%, on average.

The Zacks Consensus Estimate for Utz Brands’ current financial-year earnings indicates growth of 24.6% from the year-ago quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Chefs' Warehouse, Inc. (CHEF) : Free Stock Analysis Report

Keurig Dr Pepper, Inc (KDP) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance