Lloyds falls to loss as it sets aside extra £2.4bn for COVID-19

Lloyds Bank (LLOY.L) has joined the roll-call of banks setting aside billions more to deal with bad loans as a result of the COVID-19 pandemic, earmarking another £2.4bn ($3.1bn) on Thursday.

The bank said it had set aside an extra £2.4bn to cover an expected rise in the number of credit cards, mortgages, and loans going bad as a result of the crisis. Analysts had expected Lloyds to set aside £1.5bn.

“We have seen the UK economy deteriorate since the first quarter,” chief executive António Horta-Osório said on a call with journalists.

The extra provisions in the second quarter mean Lloyds has now set aside £3.8bn in the last six months. The bank said it would likely end up setting aside as much as £5.5bn by the end of the year.

READ MORE: Lloyds Bank profit dives 95% as it sets aside £1.4bn to cover COVID-19

The loss buffers weighed on Lloyds’ performance and pushed it to an unexpected half-year and quarterly loss. The bank made a pre-tax loss of £602m in the first six months of 2020 and lost £676m in the second quarter alone. Analysts had been expecting a pre-tax profit of £42m for the first half.

Income declined 16% to £7.4bn in the first six months of 2020, which was in-line with forecasts. Lloyds blamed a squeeze on interest rates. Return on tangible equity, a key measure of bank performance, fell to just 0.1%, compared with 11.5% last year.

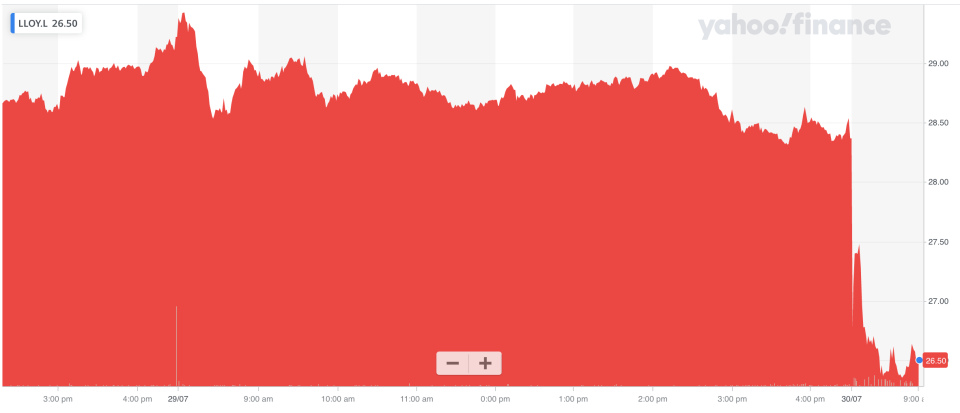

Shares dropped as much as 9% in early trade, hitting an 11-year low. Lloyds was the biggest faller on the FTSE 100.

“The impact of the coronavirus pandemic in the first half of 2020 has been profound on the way we live our lives and on the global economy,” chief executive António Horta-Osório said in a statement.

“We remain fully focused on helping our customers and the UK economy recover, in collaboration with government and our regulators.”

Lloyds has granted 1.1 million repayment holidays to its mortgage and loan customers since the pandemic struck, as well as around 33,000 payment holidays to business customers. It has lent around £9bn to companies under government-backed support schemes.

Lloyds said there were “early signs of recovery” in key markets like consumer spending and mortgages, but warned the outlook was still “uncertain.”

READ MORE: Who will be the next Lloyds CEO?

Banks have been setting aside huge sums to cover an expected surge in bad debt caused by the COVID-19 pandemic. On Wednesday (29 July), Barclays said it was budgeting another £1.6bn to cover loan losses, while Santander set aside €3.1bn and Deutsche Bank increased its provisions by €761m. Earlier this month UBS set aside $272m to cover losses.

Delinquency rates on loans and mortgages have yet to spike in the UK, largely due to payment holidays and government support measures.

Lloyds said its loans “continue to perform well” and said the extra loss provisions were about “building balance sheet resilience.”

Experts expect that to change in the coming months as payment holidays end and government support is withdrawn.

UK GDP collapsed by 25% in just two months as a result of lockdown and the Office for Budget Responsibility (OBR) has said the UK is facing its worst recession in 300 years.

Lloyds assumes UK GDP will fall 10% across 2020, unemployment will spike to 9%, and house prices will fall by 6%. In its worst case scenario, Lloyds modelled a 17% fall in GDP.

Earlier this month Lloyds announced Horta-Osório would be leaving the bank by June next year, kicking off a race to replace him.

“I have no plans at the moment,” Horta-Osório said of his life after Lloyds. “I am completely focused together with the team in helping our customers go through the pandemic.”

Yahoo Finance

Yahoo Finance