A Look Back at Household Products Stocks' Q1 Earnings: Church & Dwight (NYSE:CHD) Vs The Rest Of The Pack

Earnings results often indicate what direction a company will take in the months ahead. With Q1 now behind us, let’s have a look at Church & Dwight (NYSE:CHD) and its peers.

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

The 10 household products stocks we track reported a solid Q1; on average, revenues were in line with analyst consensus estimates. while next quarter's revenue guidance was in line with consensus. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and household products stocks have held roughly steady amidst all this, with share prices up 0.9% on average since the previous earnings results.

Church & Dwight (NYSE:CHD)

Best known for its Arm & Hammer baking soda, Church & Dwight (NYSE:CHD) is a household and personal care products company with a vast portfolio that spans laundry detergent to toothbrushes to hair removal creams.

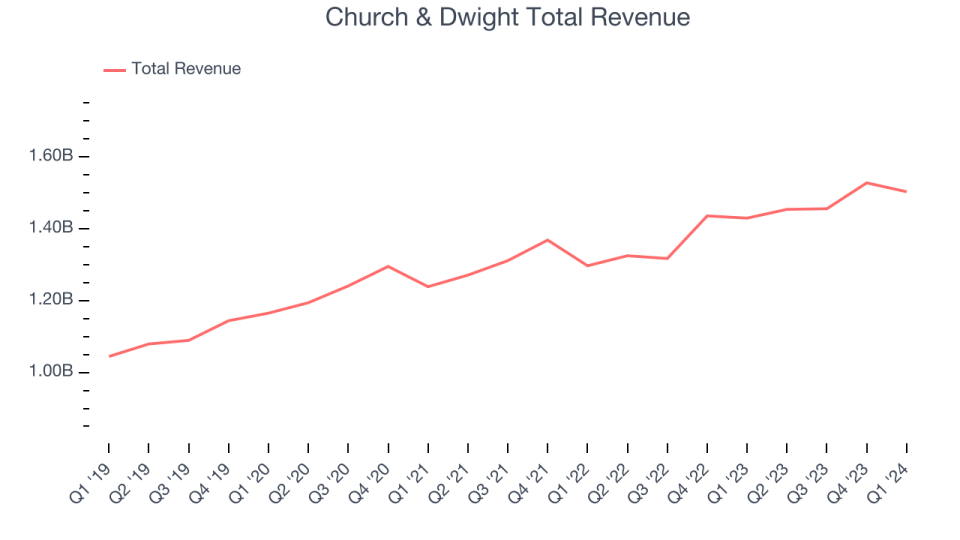

Church & Dwight reported revenues of $1.50 billion, up 5.1% year on year, in line with analysts' expectations. It was a solid quarter for the company, with an impressive beat of analysts' organic revenue growth estimates and a decent beat of analysts' gross margin estimates.

Matthew Farrell, Chief Executive Officer, commented, “The Company is performing extremely well with all three divisions delivering strong growth. I want to thank our global employees for their great efforts each and every day. Our outstanding Q1 results reflect the strength of our brands, the early success of our new products, and our perennial focus on execution. Volume was the primary driver of organic growth, and we expect volume growth to continue for the rest of the year. Marketing as a percent of sales increased 150 bps driving strong consumption and share gains. Global online sales grew to 20.5% of total consumer sales in Q1, a dollar increase of 14.9% compared to Q1 2023. Finally, the combination of strong sales, margin expansion, and efficient working capital management resulted in strong cash flow generation in the first quarter, leading to over $1 billion of cash from operations expected in the full year outlook.

The stock is down 0% since the results and currently trades at $106.24.

Is now the time to buy Church & Dwight? Access our full analysis of the earnings results here, it's free.

Best Q1: Spectrum Brands (NYSE:SPB)

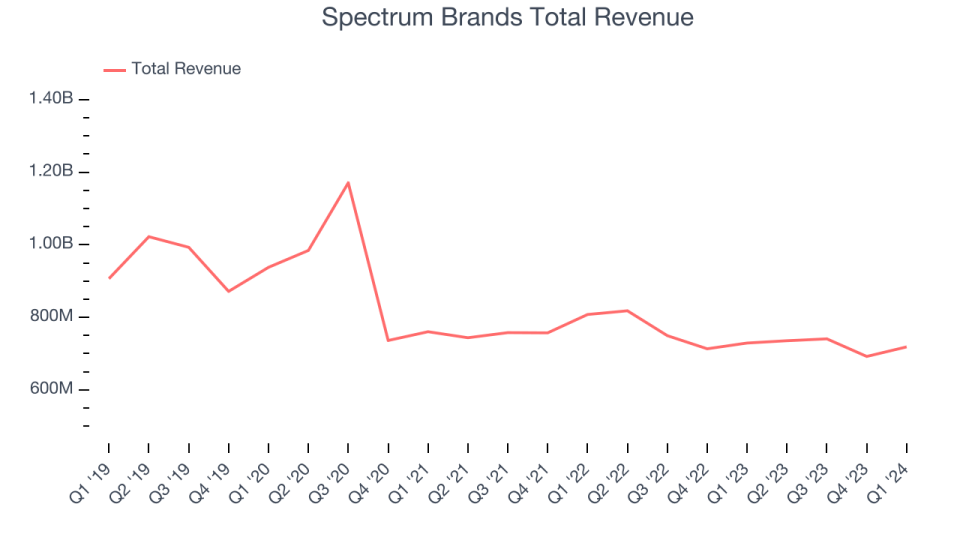

A leader in multiple consumer product categories, Spectrum Brands (NYSE:SPB) is a diversified company with a portfolio of trusted brands spanning home appliances, garden care, personal care, and pet care.

Spectrum Brands reported revenues of $718.5 million, down 1.5% year on year, outperforming analysts' expectations by 1.4%. It was a stunning quarter for the company, with an impressive beat of analysts' earnings estimates and an impressive beat of analysts' gross margin estimates.

The stock is up 9.1% since the results and currently trades at $92.19.

Is now the time to buy Spectrum Brands? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Energizer (NYSE:ENR)

Masterminds behind the viral Energizer Bunny mascot, Energizer (NYSE:ENR) is one of the world's largest manufacturers of batteries.

Energizer reported revenues of $663.3 million, down 3% year on year, falling short of analysts' expectations by 0.1%. It was a weak quarter for the company, with a miss of analysts' organic revenue growth estimates and a miss of analysts' operating margin estimates.

The stock is down 1.6% since the results and currently trades at $28.98.

Read our full analysis of Energizer's results here.

WD-40 (NASDAQ:WDFC)

Short for “Water Displacement perfected on the 40th try”, WD-40 (NASDAQGS:WDFC) is a renowned American consumer goods company known for its iconic and versatile spray, WD-40 Multi-Use Product.

WD-40 reported revenues of $139.1 million, up 6.8% year on year, falling short of analysts' expectations by 0.8%. It was a mixed quarter for the company, with full-year revenue guidance beating analysts' expectations but a miss of analysts' revenue estimates.

WD-40 pulled off the fastest revenue growth and highest full-year guidance raise among its peers. The stock is down 9.5% since the results and currently trades at $231.1.

Read our full, actionable report on WD-40 here, it's free.

Colgate-Palmolive (NYSE:CL)

Formed after the 1928 combination between toothpaste maker Colgate and soap maker Palmolive-Peet, Colgate-Palmolive (NYSE:CL) is a consumer products company that focuses on personal, household, and pet products.

Colgate-Palmolive reported revenues of $5.07 billion, up 6.2% year on year, surpassing analysts' expectations by 2.1%. It was a strong quarter for the company, with an impressive beat of analysts' organic revenue growth estimates and a decent beat of analysts' revenue estimates.

The stock is up 5% since the results and currently trades at $93.73.

Read our full, actionable report on Colgate-Palmolive here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance