MarketAxess (MKTX) Unveils New Trading Tool for Tax-Exempt Munis

MarketAxess Holdings Inc. MKTX recently announced the execution of the first portfolio trade for tax-exempt municipal bonds, which took place earlier this month between a large asset manager and a bank. The new portfolio trading for tax-exempt municipal bonds is expected to bring certainty of execution and unparalleled efficiency for traders dealing with municipal bonds.

This move bodes well for MKTX, as by catering to key market demand and enhancing efficiency, it is solidifying its position as a leader in fixed-income securities. This initiative is expected to help with the retention of existing clients and attract new clients. Improved engagement and enhanced loyalty are expected to improve trading volumes and further expand MKTX’s market share. Moreover, MKTX is diversifying its revenue streams with this move.

With this new tool, clients can send lists to a single dealer or multiple parties, negotiate price movements and execute trades discreetly on diversified portfolios of up to 1,500 unique CUSIPs in one transaction. Clients can now experience the same efficiency as their counterparts enjoy in the corporate bond market.

This move builds on the continued success of MKTX, as it recently captured 8.1% of the market share in municipal bonds, up from 5.6% in the prior year. The market share represented $577 million in average daily volumes. This highlights how MKTX is leveraging technology to streamline trading and improve transparency. MKTX is establishing itself as a clear leader by catering to the clients’ demands in the continuously evolving landscape. This new move is expected to shape the future of municipal bond trading.

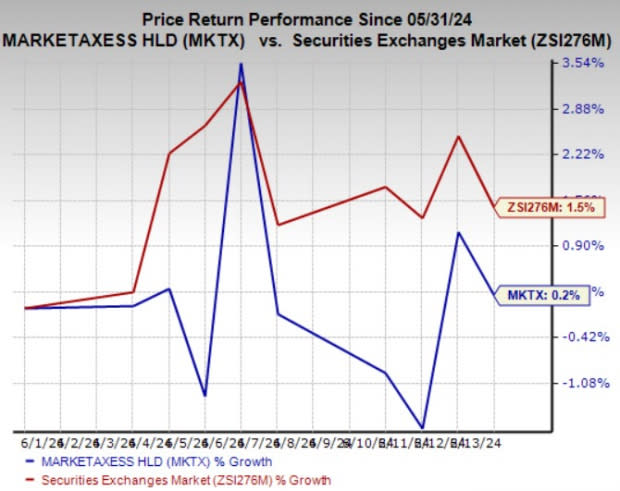

Price Performance

The company’s shares have gained 0.2% month to date compared with the 1.5% rise of the industry it belongs to.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

MarketAxess currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the insurance space are Reinsurance Group of America, Incorporated RGA, Old Republic International Corporation ORI and RLI Corp. RLI. While Reinsurance Group sports a Zacks Rank #1 (Strong Buy), Old Republic and RLI carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Reinsurance Group’s earnings surpassed estimates in each of the last four quarters, the average surprise being 19.45%. The Zacks Consensus Estimate for RGA’s 2024 earnings indicates an improvement of 3.9% from the year-ago reported figure while the same for revenues implies growth of 7.2%. The consensus mark for RGA’s earnings has moved 0.9% north in the past 30 days.

The bottom line of Old Republic outpaced earnings estimates in three of the last four quarters and missed the mark once, the average surprise being 6.6%. The Zacks Consensus Estimate for ORI’s 2024 earnings indicates an improvement of 3.8% from the year-ago reported figure while the same for revenues implies growth of 6.8%. The consensus mark for ORI’s earnings has moved 1.1% north in the past 60 days.

RLI’s earnings surpassed estimates in three of the trailing four quarters and missed the mark once, the average surprise being 132.4%. The Zacks Consensus Estimate for RLI’s 2024 earnings indicates an improvement of 18.2% from the year-ago reported figure while the same for revenues implies growth of 15.3%. The consensus mark for RLI’s earnings has moved 4.3% north in the past 60 days.

Shares of Reinsurance Group, Old Republic and RLI have gained 39.5%, 20.3% and 9.2%, respectively, in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

Reinsurance Group of America, Incorporated (RGA) : Free Stock Analysis Report

MarketAxess Holdings Inc. (MKTX) : Free Stock Analysis Report

Old Republic International Corporation (ORI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance