What to watch: Oil climbs ahead of OPEC+ meeting, US jobless claims, and Diageo axes buyback

Here are the top business, market, and economic stories you should be watching today in the UK, Europe, and abroad:

Oil rises ahead of OPEC+ meeting

Oil futures rose on Thursday morning, ahead of a virtual meeting of the OPEC+ group later today

The OPEC+ group, which includes core OPEC members and Russia, are due to meet later today to discuss a potential cut to output. It comes amid a price war between Saudi Arabia and Russia that began last month and has sent oil crashing to near 20-year lows.

An announcement on the group’s decision is expected at 4pm UK time.

Oil was rising ahead of the meeting. Crude oil (CL=F) was trading up 5.4% to $26.45 per barrel and Brent (BZ=F) was 3.2% higher at $33.89.

“Crude oil prices have continued to move higher ahead of today’s OPEC+ meeting, with expectations fairly high that a cut will be agreed, either today, or tomorrow at the G20 meeting,” said Michael Hewson, chief market analyst at CMC Markets.

The rise boosted oil producers. BP (BP.L) was 2% higher and Shell (RDSB.L) climbed by 2.5%.

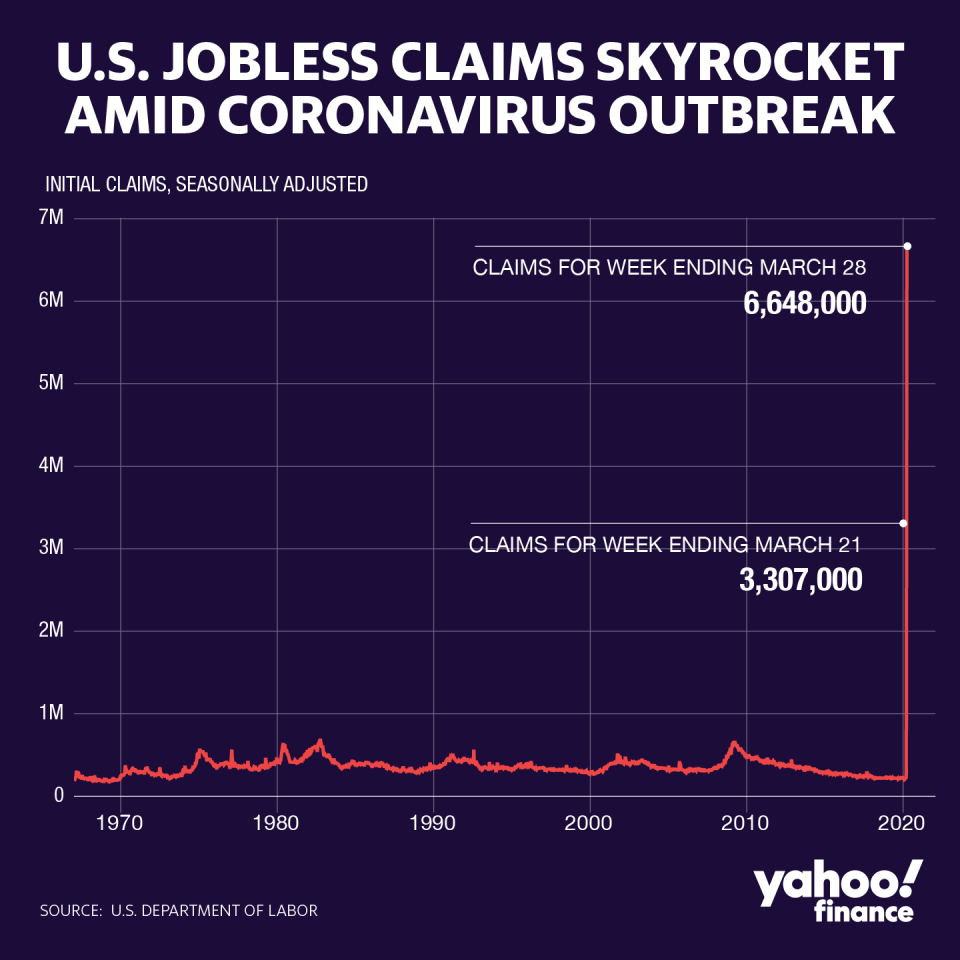

US jobless claims in focus

Weekly US unemployment figures are due at 12.30pm UK time, with analysts expecting another sharp rise in the number of Americans out of work.

Last Thursday, the US Department of Labor said 6.6 million Americans had registered as jobless in the prior week. Analysts think the number of new claims will fall back slightly but still remain in the millions — something unheard of in modern times.

Morgan Stanley expects 5.6 million Americans registered for unemployment last week, while Barclays put its estimate at 5.5 million. Consensus estimates put the figure at around 5.2 million.

Despite the sky-high numbers, US futures were pointing to a higher open. S&P 500 (ES=F) futures were up 0.7%, Dow Jones Industrial futures (YM=F) were up 1%, and Nasdaq (NQ=F) futures rose 0.5%.

“The sharp rise in unemployment levels across the world is a clear and present concern for some in the markets, who take the not unreasonable view that markets are underestimating the economic damage that is about to be unleashed on the US and the global economy,” said CMC’s Hewson.

European stocks climb

European stocks rose on Thursday 9 April, as investors continued to focus on signs of a turning point in the coronavirus pandemic and the Bank of England moved to directly support UK government spending.

The FTSE 100 (^FTSE) rose 2.3% in London at the open on the last trading day before the long Easter weekend.

Investor attention was focused on a surprise announcement by the Bank of England that it was extending an overdraft-like facility with the UK government, suggesting it will directly finance some state spending. The overdraft facility has not been used significantly since the 2008 financial crisis.

The pound was flat against the euro to €1.1410 (GBPEUR=X) and up 0.1% against the dollar to $1.2403 (GBPUSD=X) shortly after the announcement.

Read more: Bank of England to finance additional UK government spending

Elsewhere in Europe, France’s CAC 40 (^FCHI) climbed 1.5% and Germany’s DAX (^GDAXI) opened up 1.5%.

Analysts said investors were still focused on signs that the global coronavirus pandemic could be reaching its peak, suggesting economies may start to come out of lockdown in the coming weeks.

Diageo axes payouts

Johnnie Walker and Guinness-owner Diageo (DGE.L) has warned that the speed of the shutdown in large parts of the world is hitting its business even harder than it expected.

Diageo said sales in key markets like the US and Europe were slumping due to government-ordered shutdown of restaurants and bars.

As a result, the company withdrew its financial guidance for the year and has paused share buyback plans. Diageo said it would not be buying back any more shares this year as part of a £4.5bn programme announced last summer.

“During this challenging time, our top priority is to safeguard the health and well-being of our people, while taking necessary action to protect our business,” chief executive Ivan Menezes said in a statement.

“I am confident in Diageo's long-term strategy and our ability to move quickly in this difficult environment. We will continue to execute with discipline and invest prudently to ensure we are strongly positioned for a recovery in consumer demand.”

UK economy shrank before full force of coronavirus crisis hit

The UK economy shrank by 0.1% in February, indicating that it was already in a weak position before the full force of the coronavirus crisis razed the country’s businesses.

While the contraction reflects the spillover effects of coronavirus-related slowdowns elsewhere, the new data relates to the month before March’s UK-wide lockdown, which is expected to push the UK into its worst recession in decades.

The Office for National Statistics (ONS) said on Thursday that the country’s economic output grew by just 0.1% in the three months to the end of February, suggesting that the economy almost flatlined.

The month-on-month contraction of 0.1% was also lower than the 0.1% growth that had been expected by analysts, and raises questions about the fundamentals of the UK economy.

£28bn of UK dividends cancelled due to coronavirus

Almost half of UK-listed companies have cancelled their dividends this year, according to new research, as companies look to conserve cash to ride out the coronavirus pandemic.

Fund administrator Link Group said on Thursday that £28.2bn-worth ($35bn) of dividends have been cancelled since the start of the year. 45% of UK-listed companies have axed payouts to investors, with the vast majority of cancellations coming in the last four weeks.

By value, the axed dividends amount to 34.5% of the expected payout between April and December 2020.

The wave of cancellations come as companies look to conserve cash in the face of slumping consumer demand and plummeting economic growth due to the COVID-19 pandemic.

Yahoo Finance

Yahoo Finance